Weekly SPI decreases by 0.03%

_20251003092603298_af0c50_20251010094012153_327c07.webp?width=950&height=450&format=Webp)

MG News | December 12, 2025 at 01:45 PM GMT+05:00

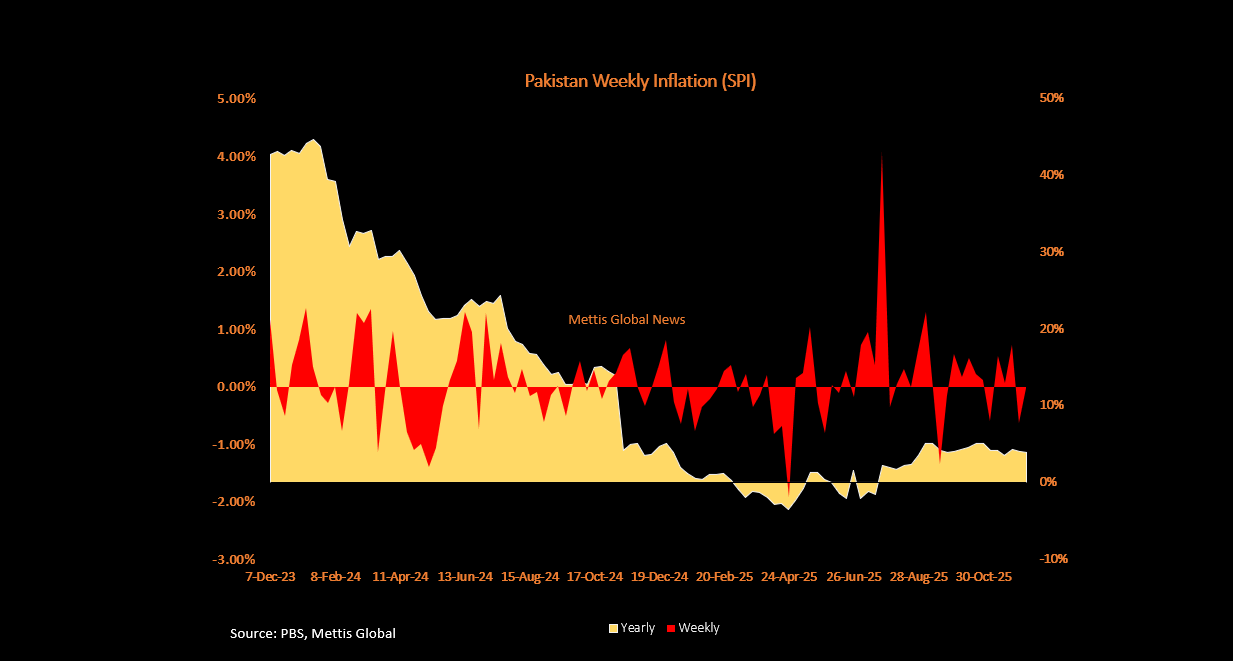

December 12, 2025 (MLN): Pakistan’s short-term inflation, measured through the Sensitive Price Indicator (SPI), recorded a marginal decline of 0.03% for the week ended December 11, 2025, while the year-on-year Sensitive Price Index (SPI) rose by 3.90%.

The weekly drop is driven mainly by sharp reductions in key perishable food items. The data was released by the Pakistan Bureau of Statistics (PBS).

According to PBS, the SPI, covering 51 essential items across 17 urban centres, showed mixed price movements during the week, with 23.53% items becoming costlier, 19.61% items cheaper, while a majority (56.86%) remained unchanged.

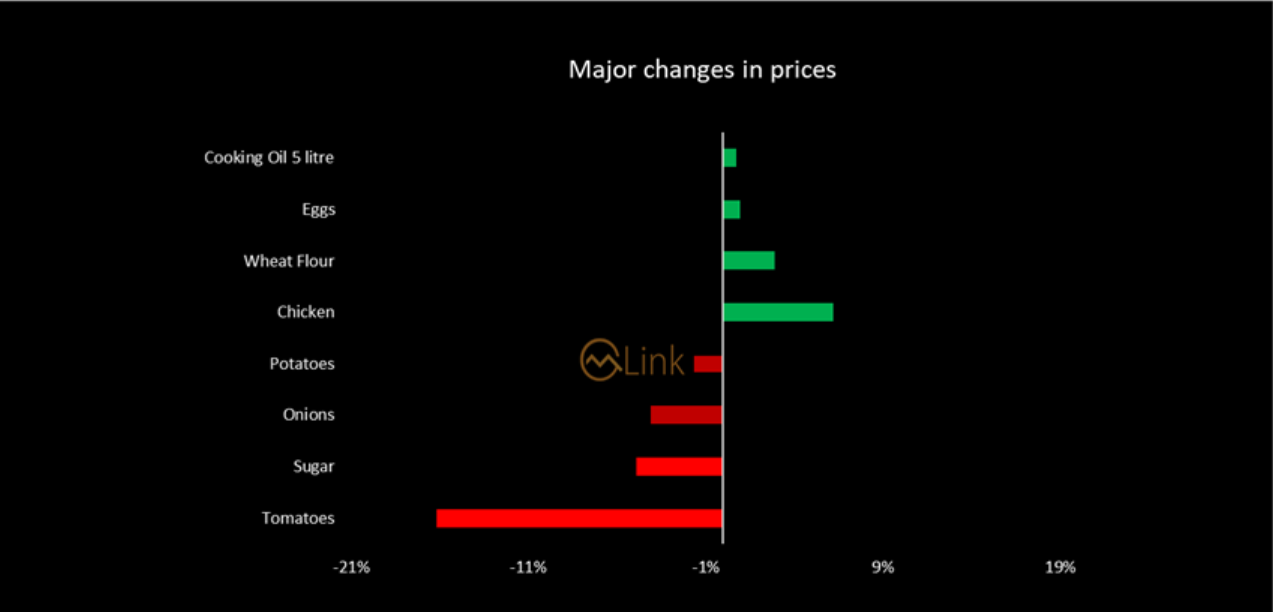

The sharpest weekly decline came from tomatoes, which dropped 16.18%, followed by sugar (-4.91%), onions (-4.08%), potatoes (-1.71%), and bananas (-1.01%).

Prices of pulses such as gram and masoor also eased slightly, along with gur and LPG prices.

In contrast, several staple items saw notable price spikes. Chicken surged 6.19%, maintaining its upward trend, while wheat flour rose 2.88%.

Prices of eggs, cooking oil, vegetable ghee, tea, powdered milk, and pulse moong also increased during the week. Among non-food items, washing soap and firewood inched up marginally.

The highest annual increases were recorded in sugar, which surged 30.28%, followed closely by gas charges for the first quarter at 29.85%. Wheat flour prices rose 21.59%, while gur increased by 14.96%.

Other notable price hikes included beef (13.42%), firewood (12.86%), powdered milk (9.46%), chicken (8.62%), diesel (8.42%), lawn printed fabric (8.29%), cooking oil (7.92%), and bananas (7.79%).

In contrast, several items experienced significant year-on-year declines. Potato prices fell sharply by 42.59%, tomatoes by 40.75%, garlic by 37.46%, onions by 30.23%, and pulse gram by 28.95%.

Tea prices, electricity charges, and salt powder also showed notable reductions during the same period.

The impact of weekly inflation varied across income groups. All expenditure quintiles, except the highest, saw a slight decrease in their weekly SPI.

The lowest-income group (Q1) experienced a decline of 0.26%, followed by Q2 at -0.17%, Q3 at -0.09%, and Q4 at -0.04%.

The highest-income group (Q5) saw a marginal increase of 0.02%. Overall, the combined SPI decreased slightly by 0.03%, indicating that the burden of weekly inflation eased slightly for lower-income groups, largely due to falling vegetable prices.

Over the past 10 weeks, the combined SPI has shown fluctuations. Notable increases were recorded on November 27 (+0.73%) and October 16 (+0.49%).

While declines were observed on November 6 (-0.59%) and December 4 (-0.64%). The latest reading of 335.73 points reflects a modest softening from the previous week.

Copyright Mettis Link News

Related News

| Name | Price/Vol | %Chg/NChg |

|---|---|---|

| KSE100 | 154,421.43 202.93M | -0.92% -1437.05 |

| ALLSHR | 92,487.78 401.80M | -0.96% -898.05 |

| KSE30 | 47,322.74 112.52M | -1.11% -528.79 |

| KMI30 | 221,927.00 101.40M | -0.80% -1792.09 |

| KMIALLSHR | 59,889.41 199.88M | -1.08% -652.12 |

| BKTi | 44,127.70 34.85M | -1.99% -894.82 |

| OGTi | 31,715.42 8.74M | -2.31% -748.93 |

| Symbol | Bid/Ask | High/Low |

|---|

| Name | Last | High/Low | Chg/%Chg |

|---|---|---|---|

| BITCOIN FUTURES | 71,840.00 | 72,250.00 70,200.00 | 1195.00 1.69% |

| BRENT CRUDE | 100.40 | 101.74 99.51 | -0.06 -0.06% |

| RICHARDS BAY COAL MONTHLY | 99.40 | 0.00 0.00 | -10.80 -9.80% |

| ROTTERDAM COAL MONTHLY | 124.50 | 124.60 123.85 | 3.10 2.55% |

| USD RBD PALM OLEIN | 1,083.50 | 1,083.50 1,083.50 | 0.00 0.00% |

| CRUDE OIL - WTI | 95.51 | 98.09 94.66 | -0.22 -0.23% |

| SUGAR #11 WORLD | 14.43 | 14.49 14.12 | 0.18 1.26% |

Chart of the Day

Latest News

Top 5 things to watch in this week

Pakistan Stock Movers

| Name | Last | Chg/%Chg |

|---|

| Name | Last | Chg/%Chg |

|---|

_20260101112329999_0153db_20260209062258909_9180ec.webp?width=280&height=140&format=Webp)

Auto Numbers

Auto Numbers