Weekly Market Roundup

MG News | January 24, 2026 at 11:34 PM GMT+05:00

January 24, 2026 (MLN): The Pakistan Stock

Exchange (PSX) wrapped up the outgoing week on a strong bullish note, with the

benchmark KSE-100 Index surging 4,068.00 points, or 2.20% WoW,

to close at 189,166.83, compared to 185,098.83 at the end of the

previous week.

The KSE-100 climbed beyond 189,000, lifted by upbeat

earnings, dividend expectations, and favorable monetary policy cues. Buying

momentum in major stocks, led by FFC, pushed the index to record levels and

boosted weekly gains._20260124182842272_3e1a3d.jpeg)

Market Capitalization

In terms of market capitalization, total market cap in rupee

terms climbed to Rs5.59 trillion, up from Rs5.43tr last week.

This translates into an increase of approximately Rs153.6bn,

or 2.83% WoW, significantly outperforming the benchmark’s percentage

gain due to heavy-weight stock participation.

In dollar terms, market capitalization rose to $19.97bn

from $19.41bn, showing an increase of $554.8m, or 2.86% WoW._20260124182825833_14b4c6.jpeg)

Consequently, USD returns for the week stood at 2.23%,

compared to 0.40% last week, indicated a notable improvement in

foreign-adjusted equity returns amid currency stability._20260124182817631_ab3fd5.jpeg)

On the macroeconomic front, bank deposit returns increased

to 5.05%

in December 2025, pushing the real deposit rate into positive territory at

1.52%, while lending rates fell to 11.32%, narrowing the banking spread to

627bps and signaling improving conditions for savers

Foreign investors’ profit and dividend repatriation rose

27% YoY to $1.56bn in 6MFY26, driven mainly by higher FDI-related outflows,

with financial and power sectors leading, while the UK and China remained the

top destinations for profit remittances.

Pakistan recorded a net FDI divestment of $134.7m

in December 2025, reversed an inflow last year, as outflows surged despite

moderate inflows, while cumulative FDI fell sharply to $808.1m in 6MFY26 versus

$1.42bn in SPLY.

Pakistan posted a current account deficit of $244m

in December 2025, reversed last month’s surplus, as rising imports and a

widening trade gap outweighed a 16.5% increase in workers’ remittances, with

the 6MFY26 deficit reaching $1.17bn.

Pakistan’s REER fell to 103.73 in December 2025, showed a weaker rupee in real terms, while NEER slipped to 37.97 despite a slight rupee gain to Rs280.12/$.

The Pakistani rupee posted a marginal appreciation

during the week, strengthening to Rs279.86 per USD on January 23, 2026,

compared to Rs279.95 a week earlier.

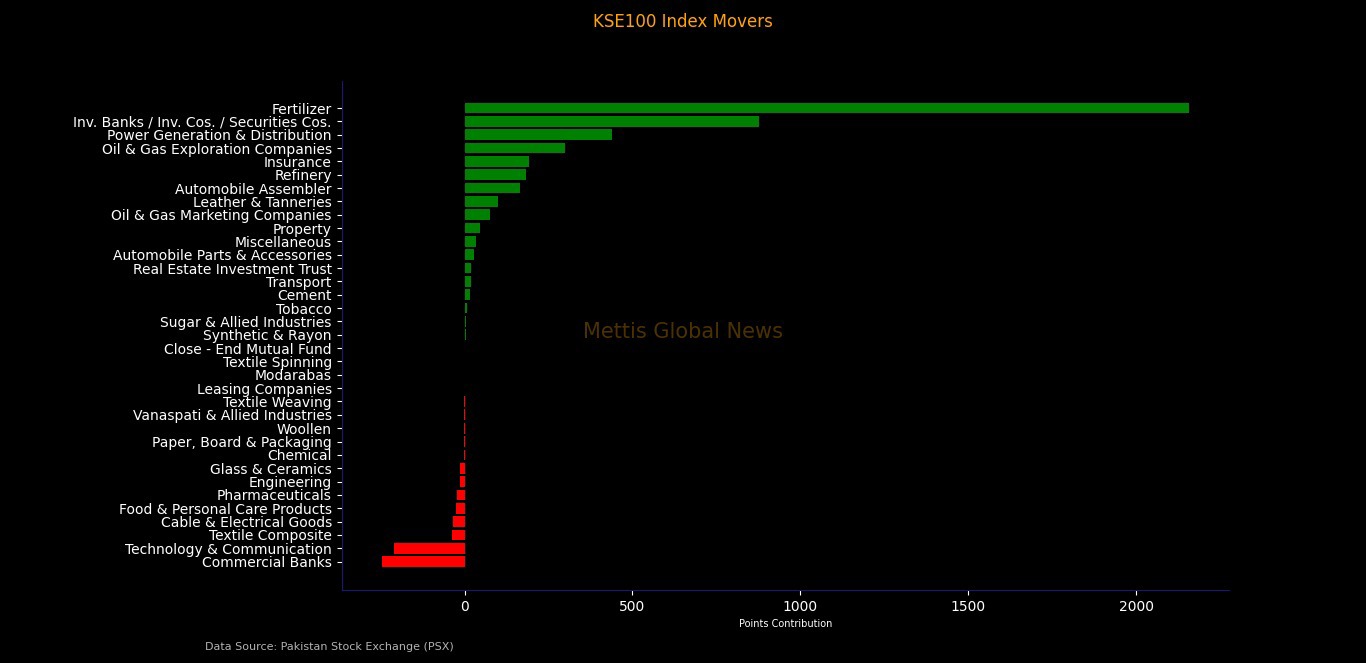

Index Movers

Sector-wise performance was broadly positive, with Fertilizer

stocks emerging as the dominant driver of index gains, contributing a

substantial 2,157 points, supported by strong upside in major fertilizer

names.

This was followed by Investment Banks / Investment

Companies / Securities Companies, which added 877 points, while Power

Generation & Distribution contributed 440 points.

Other notable positive contributors included Oil &

Gas Exploration Companies (+299 points), Insurance (+193 points), Refinery

(+182 points), and Automobile Assemblers (+166 points).

Additional support came from Oil & Gas Marketing

Companies (+77 points), Property (+47 points), Cement (+16

points), and Transport (+18 points).

On the downside, Commercial Banks emerged as the

largest drag on the index, shaving off 246 points, followed by Technology

& Communication (-209 points).

Other lagging sectors included Textile Composite, Cable

& Electrical Goods, Food & Personal Care Products, and Pharmaceuticals,

which collectively capped broader upside.

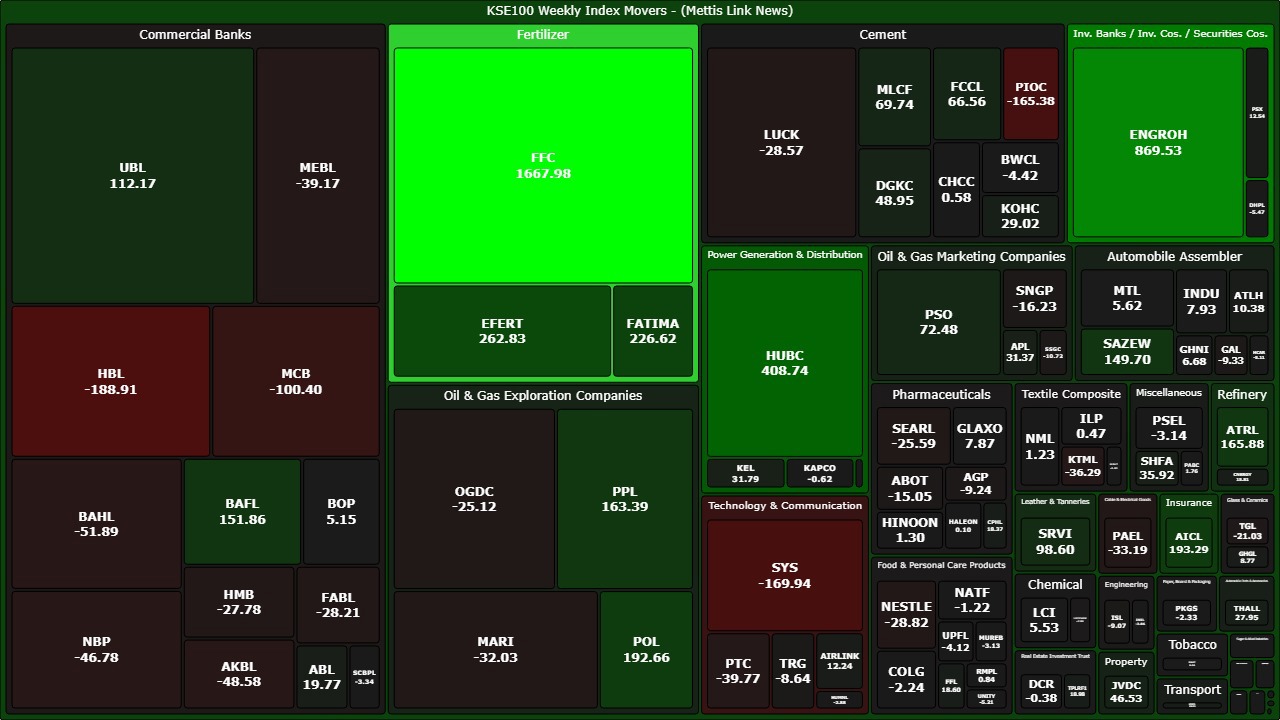

Scrip-wise, Fauji Fertilizer Company (FFC) emerged as

the single largest contributor to the KSE-100 Index, adding 1,668 points,

followed by ENGRO Holdings (ENGROH) with 870 points.

Other major gainers included Hub Power Company (HUBC)

(+409 points), EFERT (+263 points), FATIMA Fertilizer (+227

points), Adamjee Insurance (AICL) (+193 points), POL (+193

points), Attock Refinery (ATRL) (+166 points), and PPL (+163

points).

Among banks, Bank Alfalah (BAFL) and United Bank

Limited (UBL) provided selective support, while SAZEW stood out

among auto assemblers.

On the downside, selling pressure was concentrated in

heavyweight banking and technology names. MCB Bank emerged as the

largest laggard, shaving off 100 points, followed by HBL (-189

points), Systems Limited (SYS) (-170 points), PIOC (-165 points),

and NBP (-47 points).

Additional pressure came from AKBL, BAHL, MEBL,

PTC, TRG, LUCK, MARI, OGDC, and PAEL,

which collectively limited further upside in the index.

Additional pressure was observed in AKBL

(-48.6 points), BAHL (-51.9 points), MEBL (-39.2 points), PTC

(-39.8 points), TRG (-8.6 points), LUCK (-28.6 points), MARI

(-32.0 points), OGDC (-25.1 points), and PAEL (-33.2 points), capping

further upside in the benchmark.

FIPI / LIPI Flows

From an investor flow perspective, foreign investors

remained net sellers, with cumulative FIPI outflows of $21.05m

during the week.

The selling was primarily driven by foreign corporates,

which recorded net selling of $22.63m, while foreign individuals

posted marginal outflows of $0.05m.

This was partially offset by overseas Pakistanis, who

emerged as net buyers with inflows of $1.64m.

In contrast, local investors absorbed the entire foreign

selling, as LIPI recorded net buying of $21.05m.

Buying was led by mutual funds with net inflows of $22.08m,

followed by individual investors ($11.52m), banks/DFIs ($6.38m),

and insurance companies ($1.32m).

This was partially offset by net selling from companies,

broker proprietary trading, and other organizations._20260124183302264_e5e166.jpeg)

Copyright Mettis Link News

Related News

| Name | Price/Vol | %Chg/NChg |

|---|---|---|

| KSE100 | 189,166.83 407.93M | 0.79% 1478.66 |

| ALLSHR | 112,809.65 875.49M | 0.16% 181.96 |

| KSE30 | 58,207.71 147.51M | 1.27% 729.47 |

| KMI30 | 269,497.03 190.79M | 1.15% 3053.85 |

| KMIALLSHR | 72,828.34 555.24M | 0.32% 235.69 |

| BKTi | 53,520.37 33.89M | -0.06% -32.37 |

| OGTi | 38,886.75 10.61M | -1.00% -393.22 |

| Symbol | Bid/Ask | High/Low |

|---|

| Name | Last | High/Low | Chg/%Chg |

|---|---|---|---|

| BITCOIN FUTURES | 89,340.00 | 91,290.00 88,550.00 | -105.00 -0.12% |

| BRENT CRUDE | 66.29 | 66.30 64.29 | 2.23 3.48% |

| RICHARDS BAY COAL MONTHLY | 86.75 | 0.00 0.00 | -3.00 -3.34% |

| ROTTERDAM COAL MONTHLY | 98.50 | 0.00 0.00 | -0.30 -0.30% |

| USD RBD PALM OLEIN | 1,027.50 | 1,027.50 1,027.50 | 0.00 0.00% |

| CRUDE OIL - WTI | 61.28 | 61.36 59.52 | 1.92 3.23% |

| SUGAR #11 WORLD | 14.73 | 14.98 14.72 | -0.23 -1.54% |

Chart of the Day

Latest News

Top 5 things to watch in this week

Pakistan Stock Movers

| Name | Last | Chg/%Chg |

|---|

| Name | Last | Chg/%Chg |

|---|

Lending and Deposit Rates

Lending and Deposit Rates