Weekly Market Roundup

_20251012104404175_2b5e84.jpeg?width=950&height=450&format=Webp)

MG News | October 12, 2025 at 03:48 PM GMT+05:00

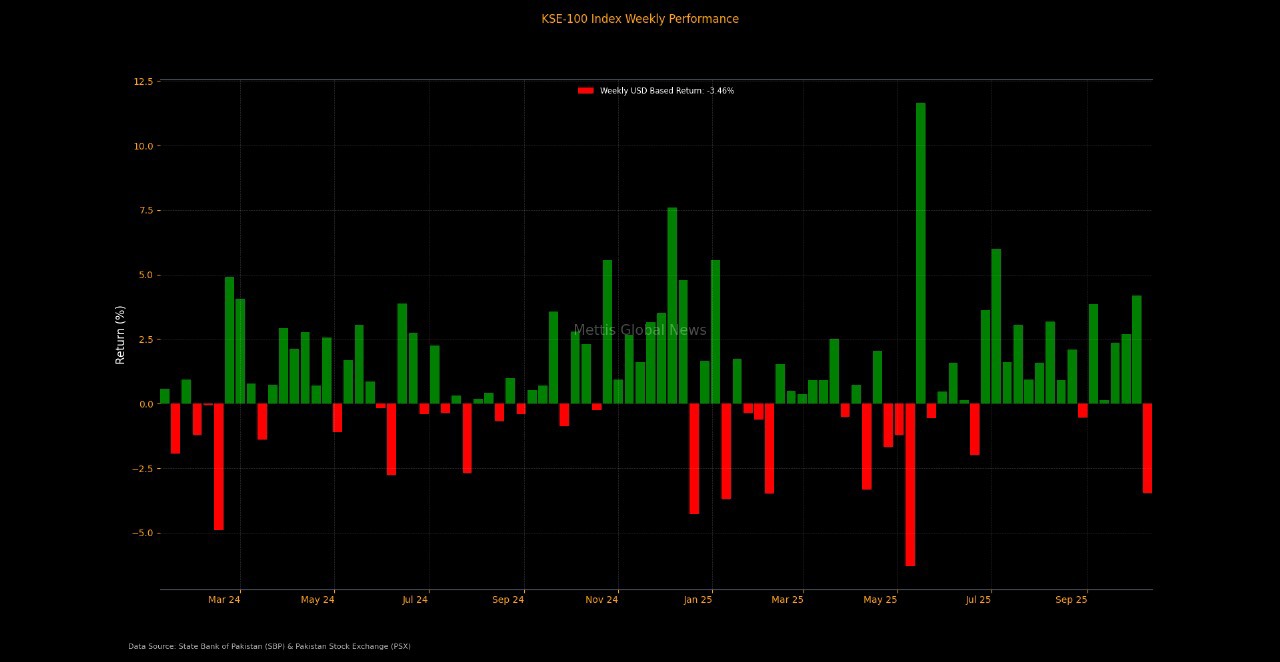

October 12, 2025 (MLN): The Pakistan Stock Exchange (PSX) endured a turbulent week,

with the benchmark KSE-100 Index tumbling by 5,892 points (-3.49% WoW)

to close at 163,098.

The market came under heavy selling pressure, driven

by profit-taking after recent highs.

Sentiment was further dampened by escalating cross-border

tensions with Afghanistan, along with a backdrop of domestic and global

uncertainties, which kept investors on the sidelines.

Investors preferred to lock in gains following recent market highs, while the geopolitical unease, coupled with global risk-off sentiment, accelerated the sell-off.

The pressure intensified across heavyweight sectors,

particularly banks, oil & gas explorers, cements, and power, leading

to broad-based weakness. _20251012104041911_465178.jpeg)

The market capitalisation contracted to Rs4.86 trillion ($17.30 billion) this week, compared to Rs5.04tr ($17.95 billion) in the previous week, wiping out nearly Rs186bn in value.

The sharp decline reflected broad-based selling across key index-heavy sectors, as investors opted to realize profits amid a weakening risk appetite.

_20251012104131168_ba9e25.jpeg)

In USD terms, the market recorded a 3.45% weekly decline, effectively reversing last week’s 4.18% gain.

The slide also coincided

with heightened foreign outflows, a cautious stance from local institutions,

and geopolitical unease that kept overall market sentiment subdued.

On the economic front, the 114th Meeting of the National Accounts Committee (NAC) brought a rare positive note, reporting GDP growth of 3.04% for FY25, above the earlier estimate of 2.68%.

Meanwhile, central government debt declined by 1.0% MoM to Rs77.5 trillion (+10.1% YoY) as of August 2025, signalling improved fiscal management.

On the external front, remittances jumped 11% YoY to $3.18bn in September 2025, while cumulative inflows for 1QFY26 surged 8% YoY to $9.6bn.

Pakistan’s FX reserves continued to inch up, reaching $19.81bn (+$13.7mn WoW), with SBP reserves at $14.42bn (+$20mn WoW).

The PKR also held its ground, appreciating 0.03% WoW to 281.17 per USD.

Adding to the week’s developments, two pivotal MoUs were signed to advance the ownership and collaboration framework of K-Electric, marking progress on one of the country’s most-watched corporate transitions.

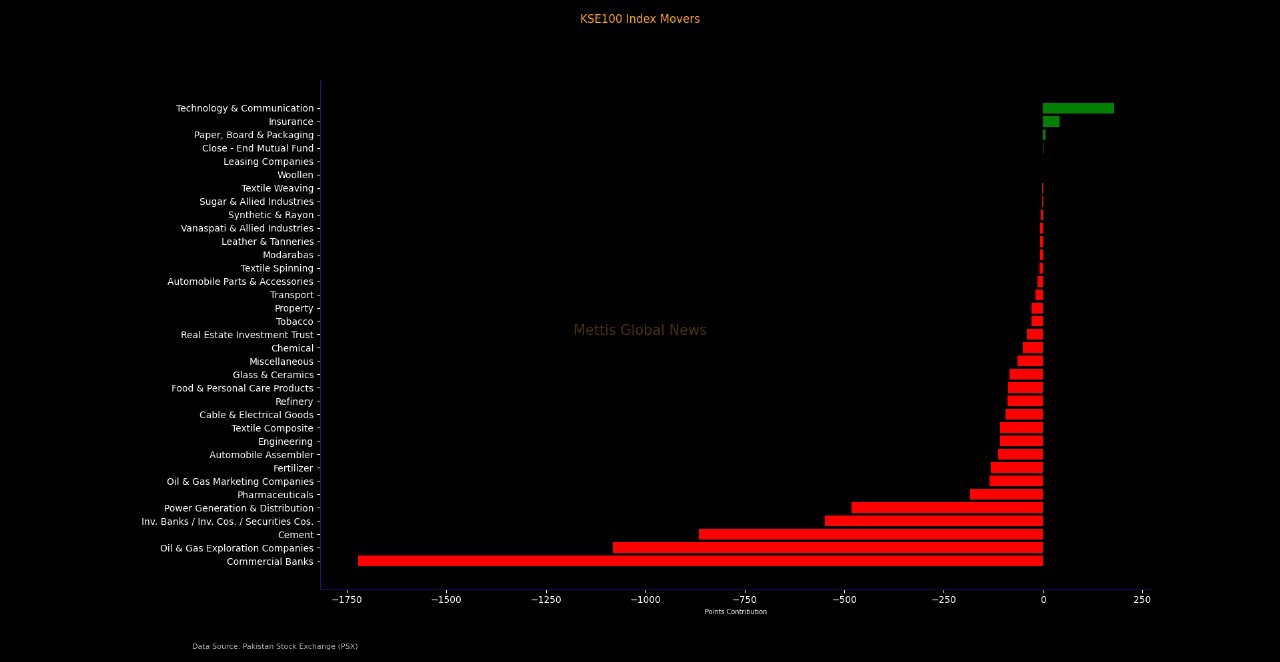

Index Movers

Selling pressure remained broad-based throughout the week, led by heavy losses in the Commercial Banks, Oil and Gas Exploration Companies, and Cement sectors.

The banking sector alone wiped 1,722.36 points off the index, driven by intense profit-taking, though it remained the volume leader with more than 679 million shares traded.

The oil and

gas exploration sector followed with a loss of 1,081.17 points on a

trading volume of 59 million shares, as volatility in global crude

prices dampened investor sentiment.

The Cement sector contributed a decline of 866.08 points on 79 million shares, pressured by concerns over higher input costs and sluggish construction activity.

Meanwhile, Investment Banks and

Companies shed 548.40 points with 20 million shares traded,

while Power Generation and Distribution lost 482.21 points on a

hefty volume of 793 million shares.

Other sectors, such as Pharmaceuticals, Oil

Marketing Companies, and Fertilizers, also remained under pressure,

losing 183.20 points, 135.07 points, and 131.49 points,

respectively.

Among individual stocks, the major drags on the index included United Bank Limited (UBL) which alone erased 819.64 points, followed by Engro Corporation (ENGROH) with 539.40 points, and Hub Power Company (HUBC) with 477.34 points.

Other key losers were Lucky Cement (LUCK) with 379.87 points, Mari Petroleum (MARI) with 375.34 points, Oil and Gas Development Company (OGDC) with 301.75 points, and Pakistan Petroleum Limited (PPL) with 280.93 points.

Losses

were also noted in NBP, MEBL, BAHL, BAFL, FCCL,

POL, and FABL, which collectively contributed further downside

pressure._20251012104055535_6b1c30.jpeg)

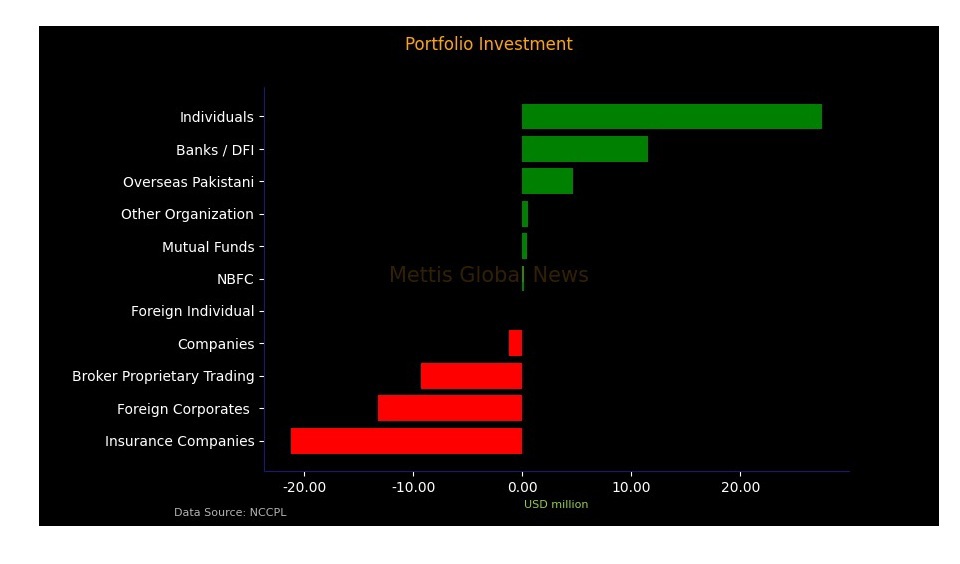

FIPI/LIPI

Foreign investors continued to offload holdings during the week, recording a net sell of $8.54 million.

The selling was largely

driven by foreign corporates, who dumped $13.2 million worth of

equities, partially offset by minor buying from foreign individuals and overseas

Pakistanis, the latter making net purchases of $4.67 million.

Local participants, however, absorbed the foreign outflow. Individual investors remained the most active buyers, with a net inflow of $27.54 million, followed by banks and DFIs adding $11.55 million.

Mutual

funds and NBFCs also turned slight net buyers, contributing $0.49

million and $0.18 million, respectively.

On the other hand, insurance companies offloaded $21.23 million, and broker proprietary trading desks sold $9.29 million, while companies reduced exposure by $1.24 million.

Nonetheless,

the strong retail and institutional participation from local investors nearly

matched the foreign outflow, resulting in a net local inflow of $8.54

million.

Related News

| Name | Price/Vol | %Chg/NChg |

|---|---|---|

| KSE100 | 163,018.66 138.30M | 0.05% 81.72 |

| ALLSHR | 98,973.80 403.59M | 0.17% 164.66 |

| KSE30 | 49,460.79 51.40M | 0.03% 14.97 |

| KMI30 | 233,011.03 39.62M | 0.13% 295.18 |

| KMIALLSHR | 64,476.20 200.81M | 0.14% 88.53 |

| BKTi | 44,076.19 19.45M | 0.29% 129.30 |

| OGTi | 32,306.98 7.87M | 0.17% 56.15 |

| Symbol | Bid/Ask | High/Low |

|---|

| Name | Last | High/Low | Chg/%Chg |

|---|---|---|---|

| BITCOIN FUTURES | 84,015.00 | 88,150.00 81,485.00 | -2425.00 -2.81% |

| BRENT CRUDE | 62.34 | 63.02 62.26 | -1.04 -1.64% |

| RICHARDS BAY COAL MONTHLY | 85.00 | 0.00 0.00 | 0.25 0.30% |

| ROTTERDAM COAL MONTHLY | 96.25 | 0.00 0.00 | 0.00 0.00% |

| USD RBD PALM OLEIN | 1,082.50 | 1,082.50 1,082.50 | 0.00 0.00% |

| CRUDE OIL - WTI | 57.88 | 58.80 57.81 | -1.12 -1.90% |

| SUGAR #11 WORLD | 14.68 | 14.80 14.58 | 0.02 0.14% |

Chart of the Day

Latest News

Top 5 things to watch in this week

Pakistan Stock Movers

| Name | Last | Chg/%Chg |

|---|

| Name | Last | Chg/%Chg |

|---|

Large Scale Manufacturing (LSM)

Large Scale Manufacturing (LSM)