The great dollar short is backfiring on global investors

MG News | October 10, 2025 at 10:06 AM GMT+05:00

October 10, 2025 (MLN): Betting

against the dollar has been the dominant trade this year in the $9.6

trillion-a-day foreign exchange market, but the wager is starting to stumble.

The world’s primary reserve currency is around a two-month

high even as the US government shutdown drags on, and traders in Asia and

Europe say hedge funds are adding options bets that the rebound versus most

major peers will extend into year-end, according to Bloomberg.

Overseas developments have been a key driver, with the euro

and the yen falling abruptly this month. At the same time, comments from

Federal Reserve officials urging caution around further interest-rate cuts have

boosted the dollar’s appeal.

The longer the strength persists, the more painful it is for

those sticking with calls for the greenback to take another leg lower. Among

the bears: Goldman Sachs Group Inc., JPMorgan Chase & Co. and Morgan

Stanley.

The trend, if it continues, could reverberate across the

global economy, for example making it harder for other central banks to ease

monetary policy, pushing up the cost of commodities and increasing the burden

of foreign borrowings in the currency.

A rapid rebound could derail some of the year’s most favored

trades, knocking bullish expectations for emerging-market equities and bonds in

the final quarter and also weighing on the shares of American exporters.

Count Ed Al-Hussainy at Columbia Threadneedle among dollar

pessimists who have flipped their view. The portfolio manager went short at the

end of 2024 when the greenback was still rallying as part of the so-called

Trump trade after the US election.

Over the past month and a half he’s trimmed that stance by

reducing exposure to emerging markets. For him it boils down to markets leaning

too heavily toward Fed rate cuts given the resilience of the American economy, noted

Bloomberg.

“We have become a lot more positive on the dollar,” he said.

“The markets have priced in a very aggressive series of cuts, and it’s going to

be difficult to execute them without a lot more labor-market pain.”

The Bloomberg Dollar Spot Index is now up roughly 2% since

mid-year, after its steepest first-half slide in decades. In early 2025, after

President Donald Trump held off on applying across-the-board tariffs once he

took office, the greenback slid in part on the view that inflation would be

tame enough for the Fed to resume lowering rates.

The slump deepened with his rollout of sweeping levies in

April, which fueled worries that foreign investors would sour on the US amid

the trade war. There was also speculation that the president favored a weaker

dollar, which would help US exporters, on top of his pressure on the Fed to

slash rates, all of which amplified the bearish wave.

As it turned out, however, international investors haven’t

shunned the US, although there are signs they’ve been buying derivatives to

protect against dollar losses. The lure of US equities, led by megacap

technology shares, has been too great. And overseas demand at Treasury auctions

has been mostly solid.

The latest Commodity Futures Trading Commission data show

that hedge funds, asset managers and commodity trading advisers were still

short the greenback as of late September. Even though the positions are well

below the peak reached at mid-year, that still leaves considerable scope for

pain should the dollar continue to appreciate.

Hedge funds ramping up bullish option trades on the dollar into year-end are expressing that view against most Group-of-10 currencies, according to Mukund Daga, global head of currency options at Barclays Bank Plc.

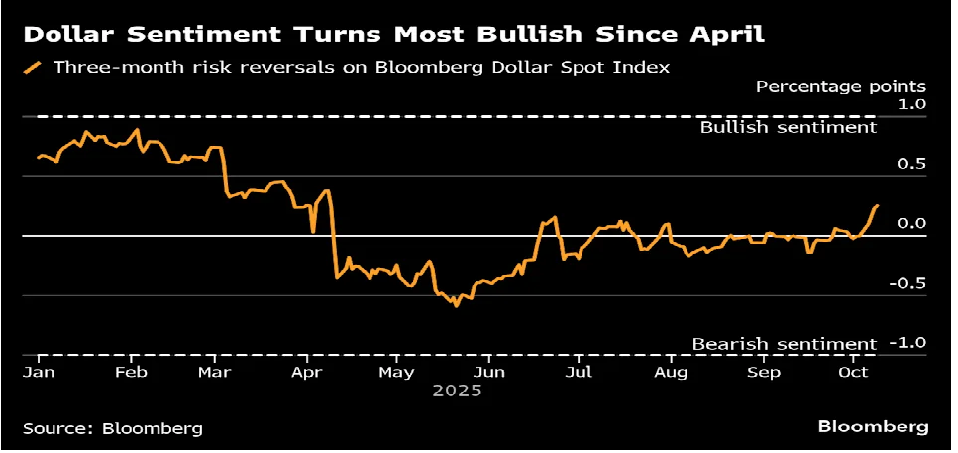

There are also signs that options traders are paying more to hedge against the risk of a dollar rally than a decline. A measure of the difference in demand for bullish versus bearish bets shows traders are the most optimistic on the greenback since April. The appetite for dollar-bullish structures has exceeded that for bearish ones every day this week, Depository Trust & Clearing Corp. data show.

Traders are pricing in roughly two quarter-point cuts by

year-end and more next year. Yet recent commentary including the minutes of the central bank’s

September meeting and remarks from policymakers suggests the trajectory is far

from assured. While there are signs the job market is cooling, inflation

remains sticky.

“Markets are now pricing in a full Federal Reserve cutting

cycle,” said Mona Mahajan, head of investment strategy at Edward Jones. “They

weren’t before, and that helps explain why the dollar has weakened so much, but

some mean reversion is to be expected.”

“The growing momentum for the greenback is spurring a fresh

squeeze for overstretched dollar bears. There seems to be still plenty of money

hanging on to bearish dollar positions in the hope that the “sell America”

narrative from early 2025 makes a return. If that’s so then further dollar

squeezes are on the cards.” a strategist at Bloomberg stated.

A big complication for currency prognosticators is that the

government shutdown has delayed crucial employment figures, though the Bureau

of Labor Statistics is said to have recalled staff to prepare a key inflation

report. Evidence that labor-market weakness is building could revive the

short-dollar trade, and some of the biggest banks on Wall Street still see more

dollar losses in the coming months.

Another wrinkle for the dollar could be the so-called

debasement trade, as growing fiscal concerns around the biggest economies lead

some investors to seek the perceived safety of Bitcoin and precious metals

instead of major currencies.

A large part of the dollar downdraft earlier this year came

from the view that a brightening outlook for non-US markets would lure

investors. But politics in France and Japan have muddied that narrative.

Exchange rates measure relative values, and sentiment toward

the yen has soured with the prospect of the likely ascendancy to Japan’s

premiership of Sanae Takaichi, the new chief of the nation’s ruling party. Her

policies are seen as fueling inflation and debt-funded stimulus, a scenario

that pushed the yen to the weakest since February.

In France, meanwhile, President Emmanuel Macron’s government

remains in crisis, a fresh weight on the common currency, which has dropped to

the lowest since August.

Given the situation in France and expectations of looser

fiscal and monetary policy in Japan, the rally in the dollar against those two

currencies may have legs, said Carol Kong, a strategist at Commonwealth Bank of

Australia.

Related News

| Name | Price/Vol | %Chg/NChg |

|---|---|---|

| KSE100 | 167,085.58 225.68M | 0.48% 802.03 |

| ALLSHR | 101,220.72 685.91M | 0.47% 477.65 |

| KSE30 | 50,772.02 134.57M | 0.57% 290.16 |

| KMI30 | 239,923.35 145.03M | 0.77% 1831.31 |

| KMIALLSHR | 66,042.80 345.76M | 0.65% 425.34 |

| BKTi | 45,106.39 29.18M | 0.06% 24.91 |

| OGTi | 33,583.05 26.44M | 1.52% 502.39 |

| Symbol | Bid/Ask | High/Low |

|---|

| Name | Last | High/Low | Chg/%Chg |

|---|---|---|---|

| BITCOIN FUTURES | 89,425.00 | 92,995.00 88,405.00 | -3415.00 -3.68% |

| BRENT CRUDE | 63.86 | 64.09 63.06 | 0.60 0.95% |

| RICHARDS BAY COAL MONTHLY | 91.00 | 0.00 0.00 | 0.10 0.11% |

| ROTTERDAM COAL MONTHLY | 97.25 | 97.25 97.25 | 0.05 0.05% |

| USD RBD PALM OLEIN | 1,016.00 | 1,016.00 1,016.00 | 0.00 0.00% |

| CRUDE OIL - WTI | 60.14 | 60.50 59.42 | 0.47 0.79% |

| SUGAR #11 WORLD | 14.82 | 15.02 14.73 | -0.06 -0.40% |

Chart of the Day

Latest News

Top 5 things to watch in this week

Pakistan Stock Movers

| Name | Last | Chg/%Chg |

|---|

| Name | Last | Chg/%Chg |

|---|

Savings Mobilized by National Savings Schemes

Savings Mobilized by National Savings Schemes