PSX Intra Day: Feeling Positive

MG News | October 10, 2025 at 11:41 AM GMT+05:00

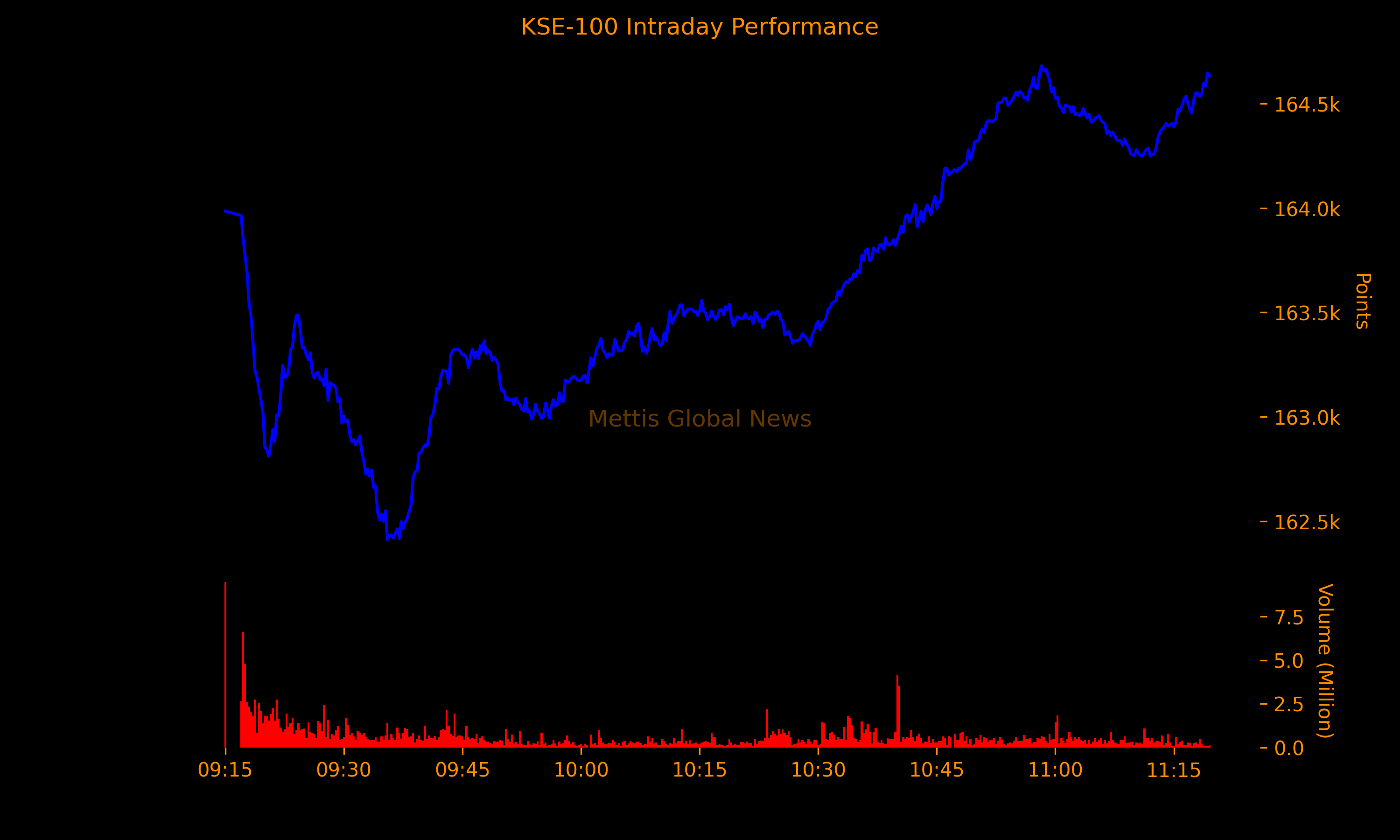

October 10, 2025 (MLN): The benchmark KSE-100 Index holds Friday's intra trading session at 164,611.81, showing an intraday high of 164,681.55 (+69.74) and a low of 162,411.25 (-2,200.56) points as of 11:26 am.

The total volume of the KSE-100 Index was 309.34 million shares.

The intraday swings largely reflect profit-taking by investors following recent gains, coupled with mixed market sentiment amid ongoing macroeconomic and political uncertainties

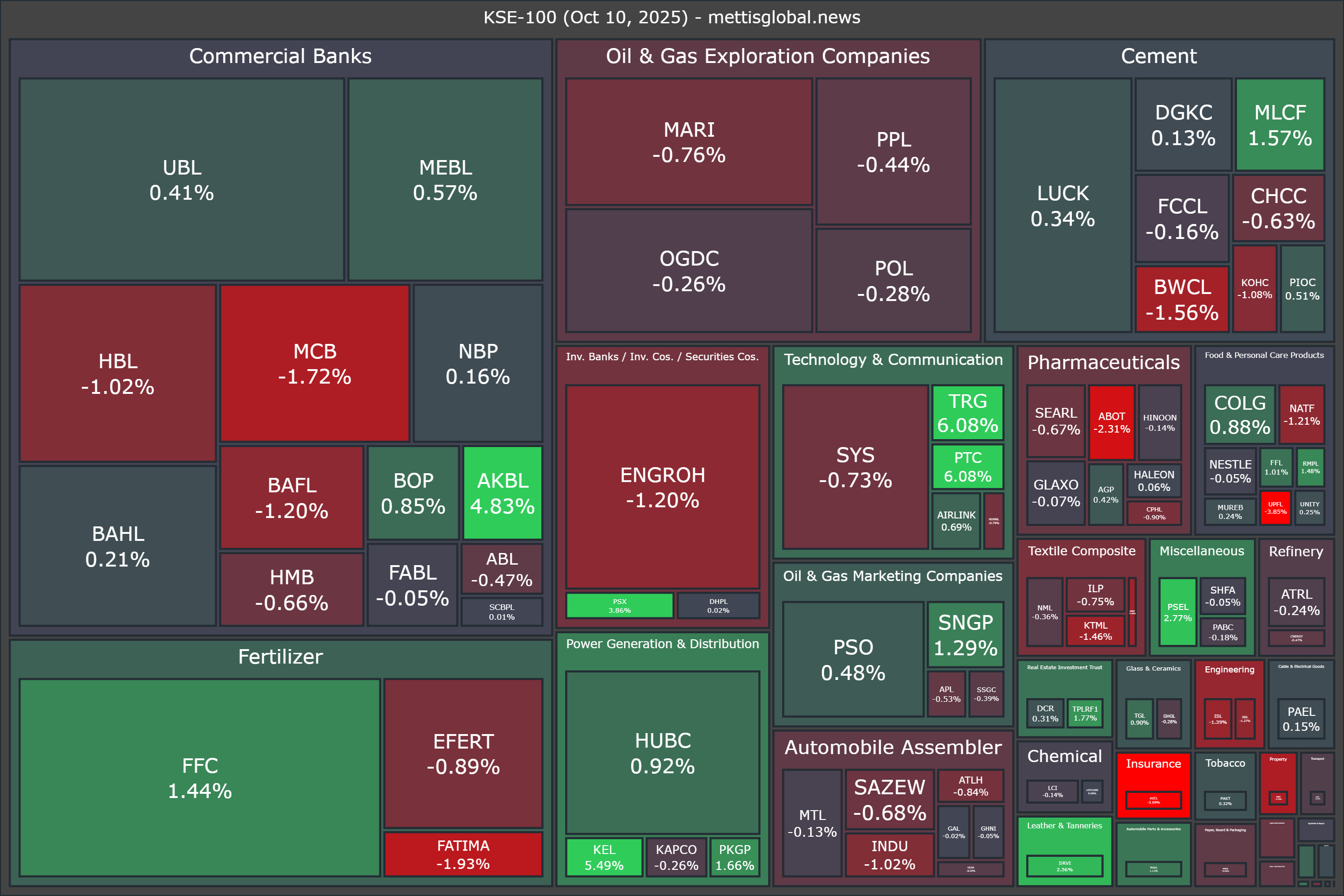

During intraday trading, the market witnessed notable activity, with several stocks posting strong gains. PTC and TRG both surged by 6.08%, followed by KEL which rose 5.49%, AKBL gaining 4.83%, and PSX advancing 3.86%.

Market sentiment was further lifted by positive corporate developments, as two key memorandums of understanding (MoUs) were signed marking significant progress in defining K-Electric’s ownership structure and setting the stage for future collaboration.

The first MoU involves the sale and purchase of shares in KES Power Ltd, while the second, between K-Electric Limited and Trident Energy Ltd, focuses on exploring strategic cooperation and investment opportunities within Pakistan’s power sector.

Meanwhile, some stocks faced downward pressure, with UPFL (-3.85%), AICL (-3.09%), ABOT (-2.31%), FATIMA (-1.93%), and JVDC (-1.72%) emerging as the top losers of the session.

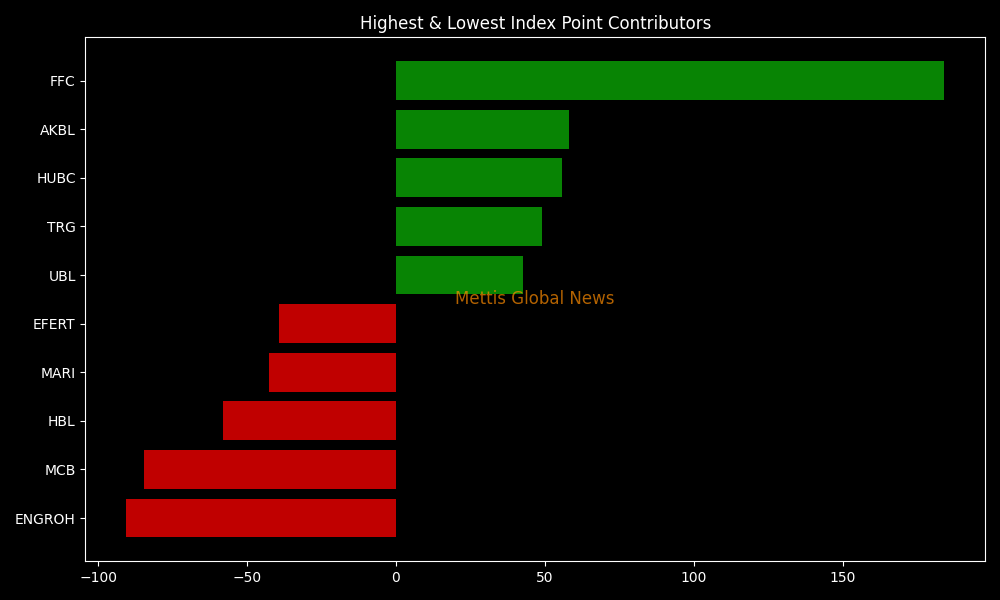

In terms of index-point contributions, companies that propped up the index were FFC (+184.12pts), AKBL (+58.12pts), HUBC (+55.82pts), TRG (+49.06pts), and UBL (+42.83pts).

Meanwhile, companies that dragged the index lower were ENGROH (-90.51pts), MCB (-84.47pts), HBL (-57.90pts), MARI (-42.69pts), and EFERT (-39.40pts).

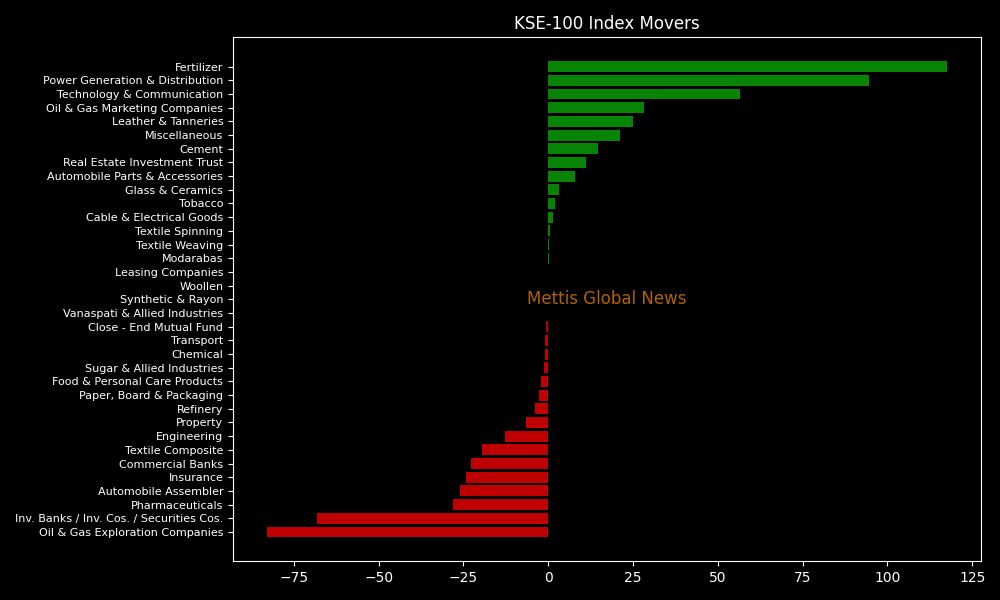

Sector-wise, KSE-100 Index was supported by Fertilizer (+117.51pts), Power Generation & Distribution (+94.45pts), Technology & Communication (+56.43pts), Oil & Gas Marketing Companies (+28.29pts), and Leather & Tanneries (+24.94pts).

While the index was let down by Oil & Gas Exploration Companies (-82.92pts), Inv. Banks / Inv. Cos. / Securities Cos. (-68.11pts), Pharmaceuticals (-27.95pts), Automobile Assembler (-26.05pts), and Insurance (-24.10pts).

In the broader market, the All-Share Index was trading at 52,472.47 with a net gain of 23.22 points or 0.04%.

Total market volume was 749.55 million shares compared to 1,570.38m from the previous session while traded value was recorded at Rs22.2 billion showing a decrease of Rs28.33bn.

There were 204,798 trades reported in 454 companies with 193 closing up, 242 closing down, and 19 remaining unchanged.

| Symbol | Price | Change % | Volume |

|---|---|---|---|

| KEL | 7.3 | 5.49% | 111,306,745 |

| WTL | 1.83 | 3.39% | 82,079,898 |

| TELE | 10.57 | 4.97% | 60,465,885 |

| PTC | 37.85 | 6.08% | 58,038,085 |

| BOP | 33.15 | 0.85% | 45,818,713 |

| FCSC | 6.84 | 14.00% | 44,546,057 |

| TPLP | 11.97 | 5.00% | 25,671,176 |

| WASL | 7.8 | 14.71% | 21,898,562 |

| BML | 7.8 | 2.09% | 18,812,323 |

| PACE | 18.4 | 9.98% | 18,609,013 |

To note, the KSE-100 has gained 38,984 points or 31.03% during the fiscal year, whereas it has increased 49,485 points or 42.98% so far this calendar year.

Previously, on Thursday, the Pakistan Stock Exchange (PSX) ended in the red as widespread selling pressure wiped out earlier gains, pushing major indices lower by the close. The benchmark KSE-100 Index declined by 735.94 points, or 0.45%, to close at 164,530.81.

Copyright Mettis Link News

Related News

| Name | Price/Vol | %Chg/NChg |

|---|---|---|

| KSE100 | 167,085.58 225.68M | 0.48% 802.03 |

| ALLSHR | 101,220.72 685.91M | 0.47% 477.65 |

| KSE30 | 50,772.02 134.57M | 0.57% 290.16 |

| KMI30 | 239,923.35 145.03M | 0.77% 1831.31 |

| KMIALLSHR | 66,042.80 345.76M | 0.65% 425.34 |

| BKTi | 45,106.39 29.18M | 0.06% 24.91 |

| OGTi | 33,583.05 26.44M | 1.52% 502.39 |

| Symbol | Bid/Ask | High/Low |

|---|

| Name | Last | High/Low | Chg/%Chg |

|---|---|---|---|

| BITCOIN FUTURES | 89,425.00 | 92,995.00 88,405.00 | -3415.00 -3.68% |

| BRENT CRUDE | 63.86 | 64.09 63.06 | 0.60 0.95% |

| RICHARDS BAY COAL MONTHLY | 91.00 | 0.00 0.00 | 0.10 0.11% |

| ROTTERDAM COAL MONTHLY | 97.25 | 97.25 97.25 | 0.05 0.05% |

| USD RBD PALM OLEIN | 1,016.00 | 1,016.00 1,016.00 | 0.00 0.00% |

| CRUDE OIL - WTI | 60.14 | 60.50 59.42 | 0.47 0.79% |

| SUGAR #11 WORLD | 14.82 | 15.02 14.73 | -0.06 -0.40% |

Chart of the Day

Latest News

Top 5 things to watch in this week

Pakistan Stock Movers

| Name | Last | Chg/%Chg |

|---|

| Name | Last | Chg/%Chg |

|---|

Savings Mobilized by National Savings Schemes

Savings Mobilized by National Savings Schemes