Pakistan’s inflation falls sharply to 4.7% in Jul–Apr FY25

MG News | June 09, 2025 at 05:15 PM GMT+05:00

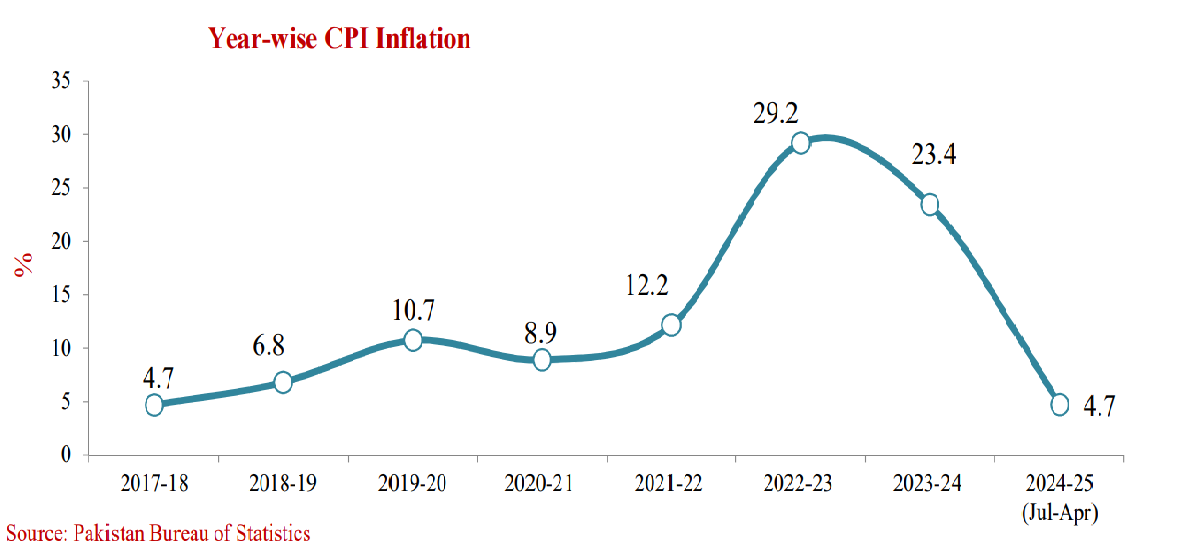

June 09, 2025 (MLN): Pakistan's Consumer Price Index (CPI) plummeted to 4.7% during July–April

FY2025, a steep fall from 26% in the same period last year, according

to the Economic Survey 2024–25.

This remarkable decline is credited to the government's tireless efforts to tackle this complex issue that creates uncertainties and affects households and businesses alike.

The survey notes that the sharp deceleration in inflation reflects the

government’s success in stabilizing prices through improved food availability,

declining energy costs, and exchange rate stability.

In particular, the CPI dropped from 29.2% in FY23 and 23.4% in FY24 to just

4.7% in FY25.

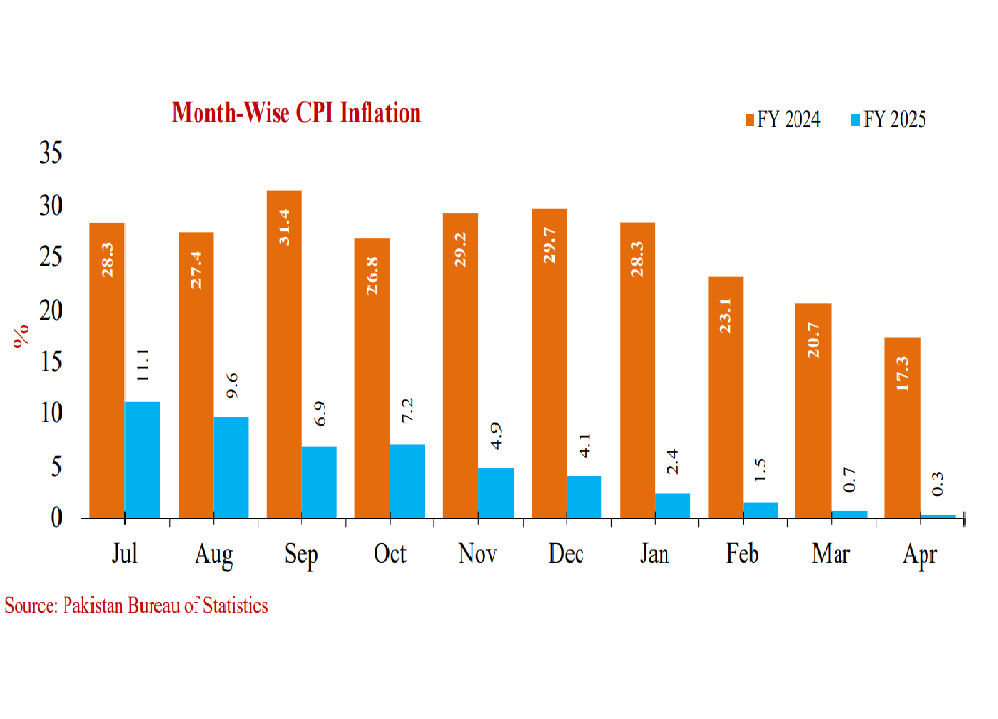

Inflationary pressure reduced consistently throughout the year, with year-on-year CPI inflation falling from 11.1% in July 2024 to a mere 0.3% in April 2025—the lowest since September 2015.

The survey attributes this easing to falling global commodity prices and the

government’s domestic relief measures, including energy sector reforms and food

supply improvements.

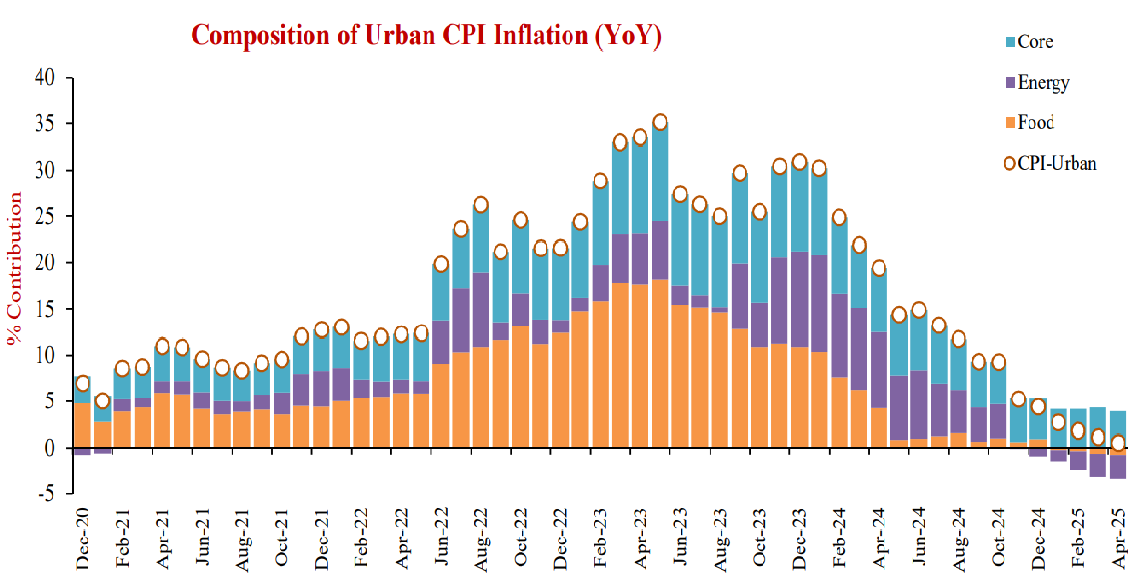

Urban inflation averaged 5.7%, while rural inflation settled at 3.3%.

Urban inflation increased by 0.5% on a YoY basis in April 2025 compared to an increase of 1.2% in the previous month and 19.4% in April 2024.

The Urban food recorded a decline of 1.9% and Non-Food inflation increased

by 2.2%, compared to increases of 11.3% and 25.6%, respectively, in the same

month last year.

During July-April FY 2025, CPI Inflation-Urban was recorded at 5.7% against

26.3% in the previous year.

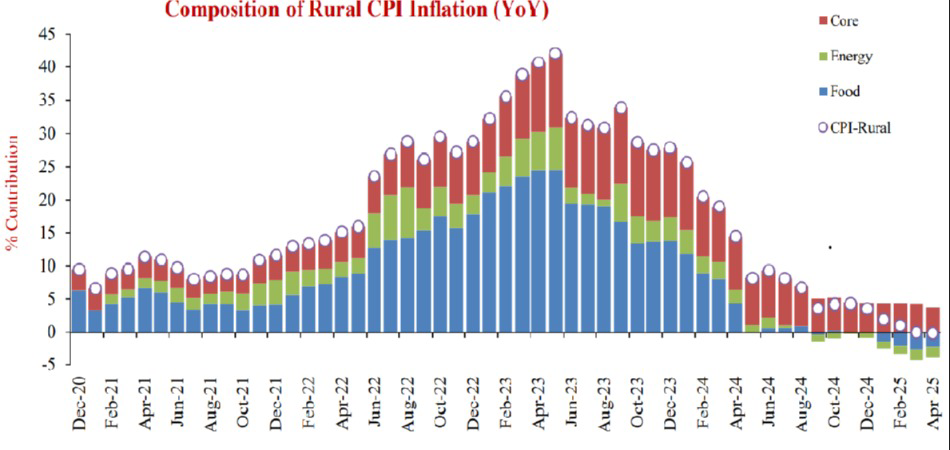

Rural inflation declined by 0.1% YoY in April 2025 compared to 0.02% in the

previous month and 14.5% in April 2024.

While Food recorded a decline of 4.6%, Non-Food inflation increased by 4.4%, compared to 9.5% and 20%, respectively, in the same month last year.

During July-April FY 2025, rural inflation was recorded at 3.3%, as against

25.5% during the same period the previous year.

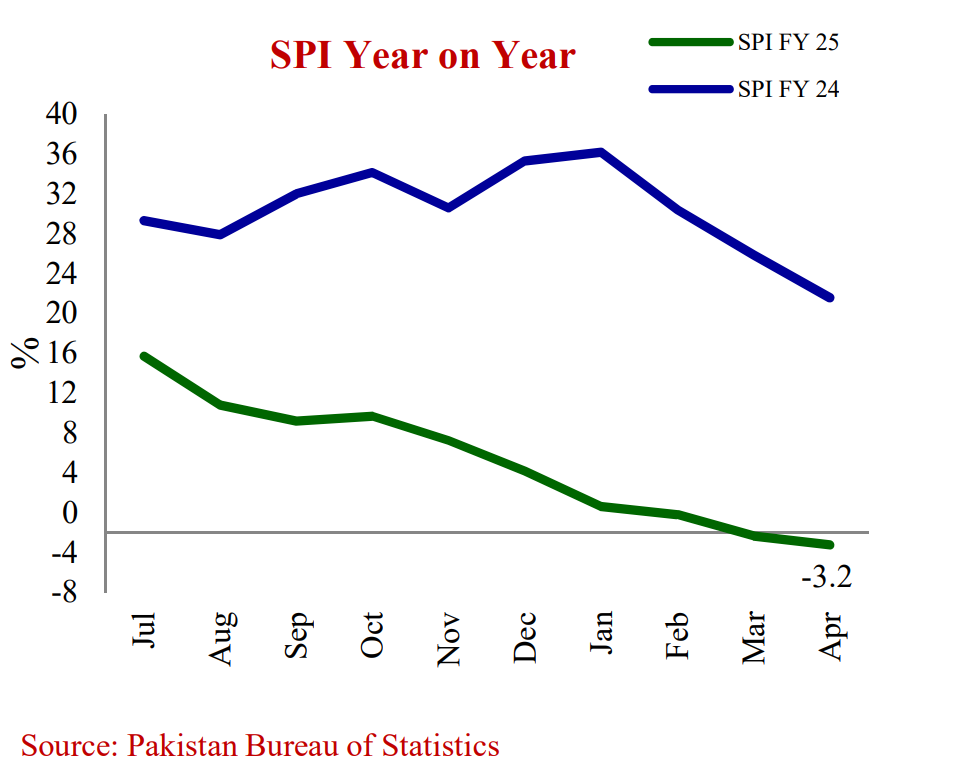

Wholesale Price Index (WPI) inflation also dropped sharply to 2.2% in FY2025 from 22.4% last year, while the Sensitive Price Indicator (SPI) decreased to 4.9% from 30.2%.

The government emphasized that this drop is not merely statistical but has

practical implications such as reduced cost burdens on households and

businesses, revived investor confidence, and improved economic predictability.

The trend is expected to continue with inflation projected to remain within

4.5% to 5% for the remainder of FY2025.

Related News

| Name | Price/Vol | %Chg/NChg |

|---|---|---|

| KSE100 | 157,496.10 196.19M | -2.30% -3714.58 |

| ALLSHR | 94,227.01 359.74M | -1.95% -1870.28 |

| KSE30 | 48,330.20 95.67M | -2.92% -1451.54 |

| KMI30 | 224,687.33 101.59M | -2.56% -5909.78 |

| KMIALLSHR | 60,839.09 199.88M | -2.16% -1344.18 |

| BKTi | 45,489.96 23.93M | -2.22% -1033.26 |

| OGTi | 32,083.47 15.22M | -1.82% -594.75 |

| Symbol | Bid/Ask | High/Low |

|---|

| Name | Last | High/Low | Chg/%Chg |

|---|---|---|---|

| BITCOIN FUTURES | 68,400.00 | 71,645.00 67,860.00 | -3130.00 -4.38% |

| BRENT CRUDE | 93.32 | 94.64 83.16 | 7.91 9.26% |

| RICHARDS BAY COAL MONTHLY | 99.40 | 0.00 0.00 | -11.85 -10.65% |

| ROTTERDAM COAL MONTHLY | 127.00 | 129.00 123.00 | 3.55 2.88% |

| USD RBD PALM OLEIN | 1,083.50 | 1,083.50 1,083.50 | 0.00 0.00% |

| CRUDE OIL - WTI | 91.27 | 92.61 78.24 | 10.26 12.67% |

| SUGAR #11 WORLD | 14.09 | 14.17 13.69 | 0.37 2.70% |

Chart of the Day

Latest News

Top 5 things to watch in this week

Pakistan Stock Movers

| Name | Last | Chg/%Chg |

|---|

| Name | Last | Chg/%Chg |

|---|

_20260101112329999_0153db_20260209062258909_9180ec.webp?width=280&height=140&format=Webp)

Savings Mobilized by National Savings Schemes

Savings Mobilized by National Savings Schemes