Pakistan inflation set to hit 8% by Q4FY26: Bloomberg

MG News | February 12, 2026 at 09:45 AM GMT+05:00

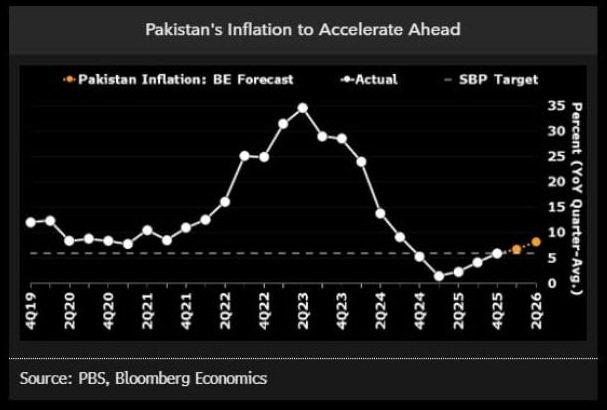

February 12, 2026 (MLN): Pakistan's inflation is projected to climb to approximately 8% by the fourth quarter of fiscal year 2026, well above the central bank's 6% target, according to Bloomberg Economics forecasts released today.

The South Asian nation saw inflation rise to 5.8% year-on-year in January from a prior 5.6%, driven primarily by increases in housing rents and water supply charges.

Bloomberg economists warn that this upward trajectory is set to continue through June, when the current fiscal year concludes.

"Stronger demand, as well as base effects reflecting cheaper food, gasoline and electricity a year ago, should drive price gains," Bloomberg Economics stated in its analysis.

The forecast poses a significant challenge for Pakistan's monetary policy framework. The State Bank of Pakistan currently maintains its policy rate at 10.5%, but the International Monetary Fund has recommended keeping real rates above the neutral level of 2.5% to anchor inflation expectations.

For the full fiscal year 2026, Bloomberg projects inflation will average around 6.2%, still above the central bank's comfort zone. However, the outlook carries substantial risks, particularly from external factors.

"A spike in oil prices, if the unrest in Iran escalates, could push it higher," the Bloomberg analysis cautioned, highlighting geopolitical tensions as a potential catalyst for additional price pressures.

The chart accompanying Bloomberg's forecast shows Pakistan's inflation trajectory peaking around 2023 at over 30%, before declining sharply through 2024 and 2025.

The expected uptick in 2026 represents a reversal of this disinflationary trend, though inflation would remain far below the crisis levels seen during the peak.

Given the inflation outlook, Bloomberg Economics suggests that interest rates are likely to remain on hold through the remainder of this fiscal year, as the central bank balances growth concerns against price stability objectives.

The forecast emphasized the delicate balancing act facing Pakistani policymakers as they navigate between supporting economic recovery and maintaining monetary discipline in line with IMF program requirements.

Copyright Mettis Link News

Related News

| Name | Price/Vol | %Chg/NChg |

|---|---|---|

| KSE100 | 181,483.10 91.75M | -0.86% -1566.70 |

| ALLSHR | 109,137.71 227.98M | -0.64% -704.25 |

| KSE30 | 55,415.48 26.21M | -1.01% -565.18 |

| KMI30 | 256,028.22 40.32M | -1.40% -3636.59 |

| KMIALLSHR | 70,023.93 146.98M | -0.89% -626.78 |

| BKTi | 52,658.31 4.38M | -0.24% -128.91 |

| OGTi | 35,496.04 5.19M | -1.87% -676.71 |

| Symbol | Bid/Ask | High/Low |

|---|

| Name | Last | High/Low | Chg/%Chg |

|---|---|---|---|

| BITCOIN FUTURES | 67,150.00 | 68,115.00 66,735.00 | -565.00 -0.83% |

| BRENT CRUDE | 69.52 | 69.85 69.43 | 0.12 0.17% |

| RICHARDS BAY COAL MONTHLY | 96.00 | 0.00 0.00 | 0.25 0.26% |

| ROTTERDAM COAL MONTHLY | 102.75 | 102.75 102.00 | 1.05 1.03% |

| USD RBD PALM OLEIN | 1,071.50 | 1,071.50 1,071.50 | 0.00 0.00% |

| CRUDE OIL - WTI | 64.79 | 65.10 64.70 | 0.16 0.25% |

| SUGAR #11 WORLD | 13.86 | 14.12 13.82 | -0.26 -1.84% |

Chart of the Day

Latest News

Top 5 things to watch in this week

Pakistan Stock Movers

| Name | Last | Chg/%Chg |

|---|

| Name | Last | Chg/%Chg |

|---|

.png?width=280&height=140&format=Webp)

Workers' Remittances

Workers' Remittances