PSX Intra Day: Up Where We Belong

MG News | June 12, 2025 at 11:02 AM GMT+05:00

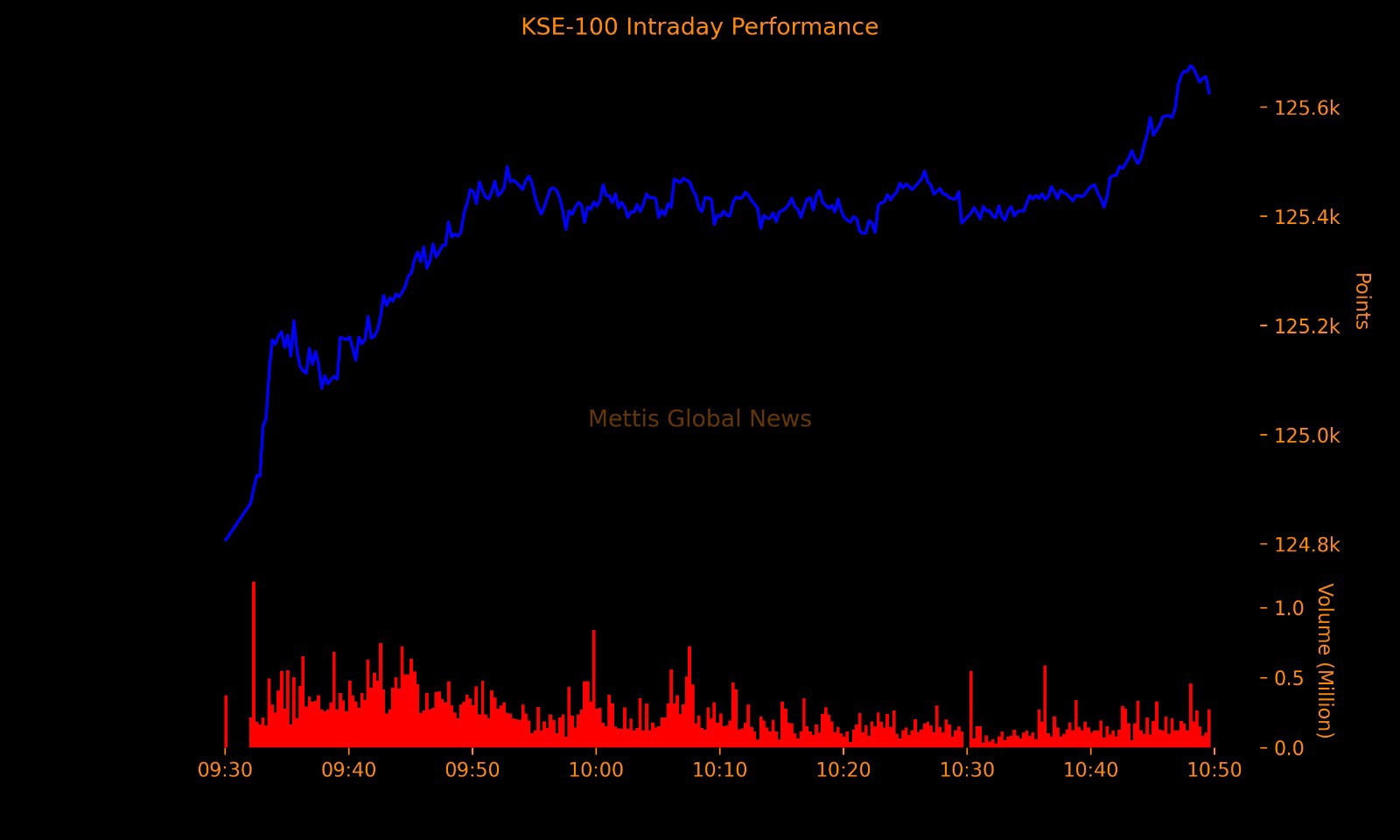

June 12, 2025 (MLN): The benchmark KSE-100 Index was trading positive on Thursday, reaching an intraday high of 125,675.57 points at 11:06 AM, up by 1,322.89 points or 1.06%.

The intraday low was recorded at 124,807.09, showing a gain of 454.41 points or 0.37%.

Total traded volume for the index stood at 74.63 million shares.

The stock market continued its upward momentum as investors responded positively to post-budget stability, record-high remittances, and growing expectations of monetary easing.

Confidence was further reinforced by the federal budget 2025–26, which signaled fiscal continuity and consolidation, reducing policy uncertainty.

Market participants viewed the budget as balanced and growth-friendly, prompting strong investor participation and driving key indices to record levels.

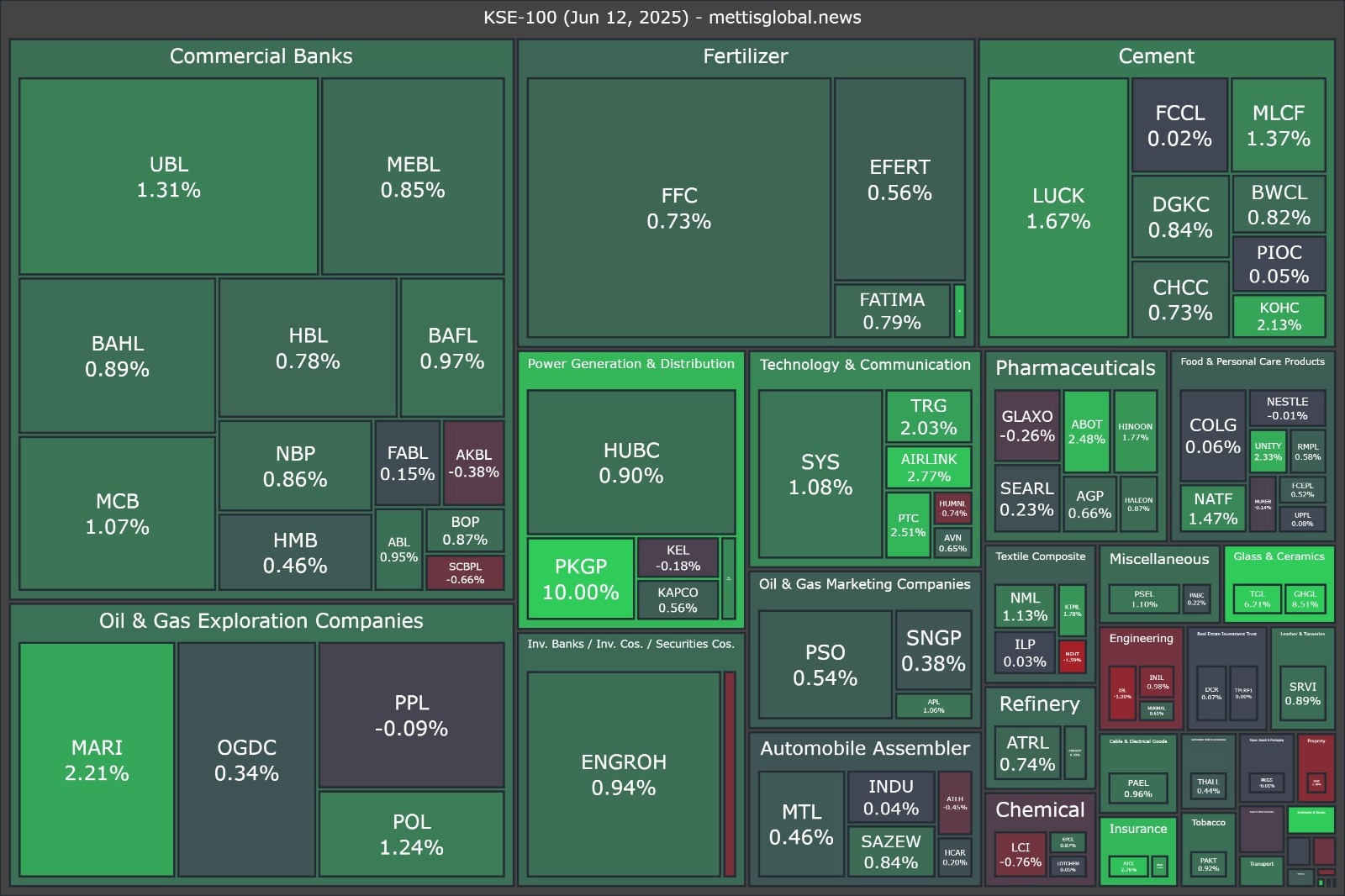

Top gainers were PKGP (+10.00%), BNWM (+8.99%), GHGL (+8.51%), TGL (+6.21%), and IBFL (+5.46%).

On the other hand, top losers were MEHT (-1.59%), ISL (-1.30%), JVDC (-1.09%), POML (-1.02%), and INIL (-0.98%).

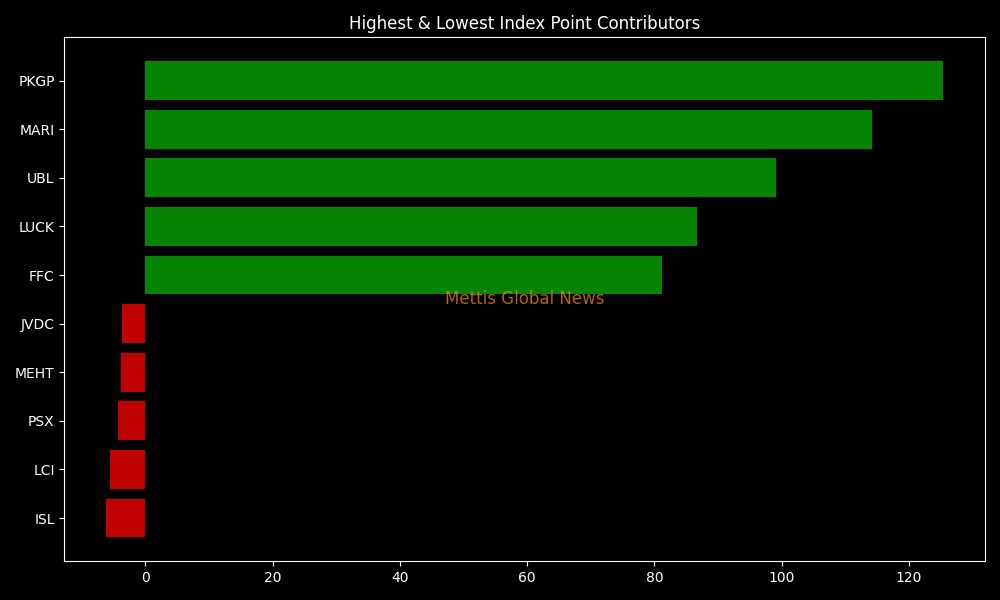

In terms of index-point contributions, companies that propped up the index were PKGP (+125.38pts), MARI (+114.21pts), UBL (+99.07pts), LUCK (+86.66pts), and FFC (+81.17pts).

Meanwhile, companies that dragged the index lower were ISL (-6.14pts), LCI (-5.56pts), PSX (-4.36pts), MEHT (-3.78pts), and JVDC (-3.68pts).

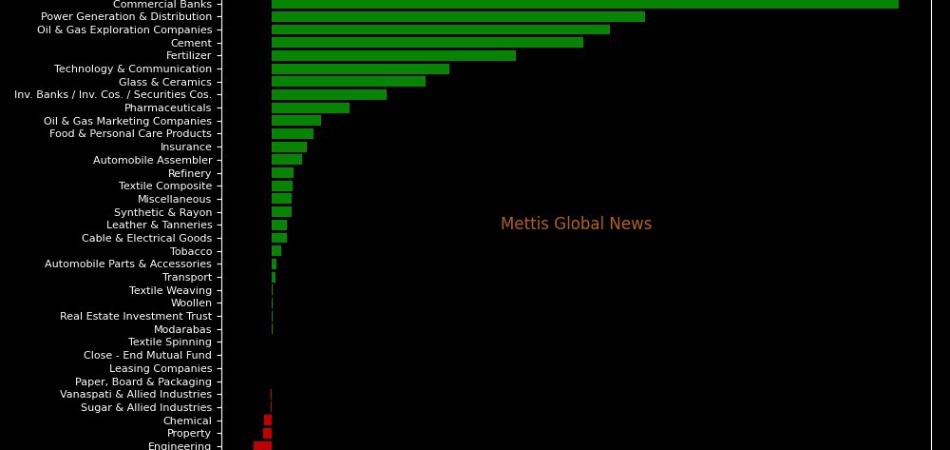

Sector-wise, KSE-100 Index was supported by Commercial Banks (+288.62pts), Power Generation & Distribution (+171.73pts), Oil & Gas Exploration Companies (+155.59pts), Cement (+143.26pts), and Fertilizer (+112.46pts).

While the index was let down by Engineering (-8.25pts), Property (-3.68pts), Chemical (-3.22pts), Sugar & Allied Industries (-0.55pts), and Vanaspati & Allied Industries (-0.25pts).

In the broader market, the All-Share Index at 78,000.11 with a net gain of 672.31 points or 0.87%.

Total market volume was 320.71 million shares compared to 1,041.13m from the previous session while traded value was recorded at Rs12.23 billion showing a decrease of Rs34.48bn.

Copyright Mettis Link News

Related News

| Name | Price/Vol | %Chg/NChg |

|---|---|---|

| KSE100 | 168,062.17 222.44M | -0.49% -830.92 |

| ALLSHR | 100,418.83 533.18M | -0.47% -469.95 |

| KSE30 | 51,322.39 95.56M | -0.78% -400.92 |

| KMI30 | 235,325.12 71.27M | -0.62% -1468.03 |

| KMIALLSHR | 64,292.17 192.91M | -0.54% -350.28 |

| BKTi | 49,115.42 49.83M | -0.78% -388.38 |

| OGTi | 32,316.78 8.08M | -1.33% -436.77 |

| Symbol | Bid/Ask | High/Low |

|---|

| Name | Last | High/Low | Chg/%Chg |

|---|---|---|---|

| BITCOIN FUTURES | 66,185.00 | 67,760.00 64,325.00 | -1640.00 -2.42% |

| BRENT CRUDE | 71.88 | 71.96 70.69 | 0.12 0.17% |

| RICHARDS BAY COAL MONTHLY | 96.00 | 0.00 0.00 | -3.50 -3.52% |

| ROTTERDAM COAL MONTHLY | 107.95 | 107.95 107.95 | 0.30 0.28% |

| USD RBD PALM OLEIN | 1,071.50 | 1,071.50 1,071.50 | 0.00 0.00% |

| CRUDE OIL - WTI | 66.60 | 66.67 65.38 | 0.12 0.18% |

| SUGAR #11 WORLD | 14.05 | 14.10 13.78 | 0.18 1.30% |

Chart of the Day

Latest News

Top 5 things to watch in this week

Pakistan Stock Movers

| Name | Last | Chg/%Chg |

|---|

| Name | Last | Chg/%Chg |

|---|

SCRA Balance

SCRA Balance