PSX Closing Bell: Meltdown Mode

MG News | October 13, 2025 at 04:05 PM GMT+05:00

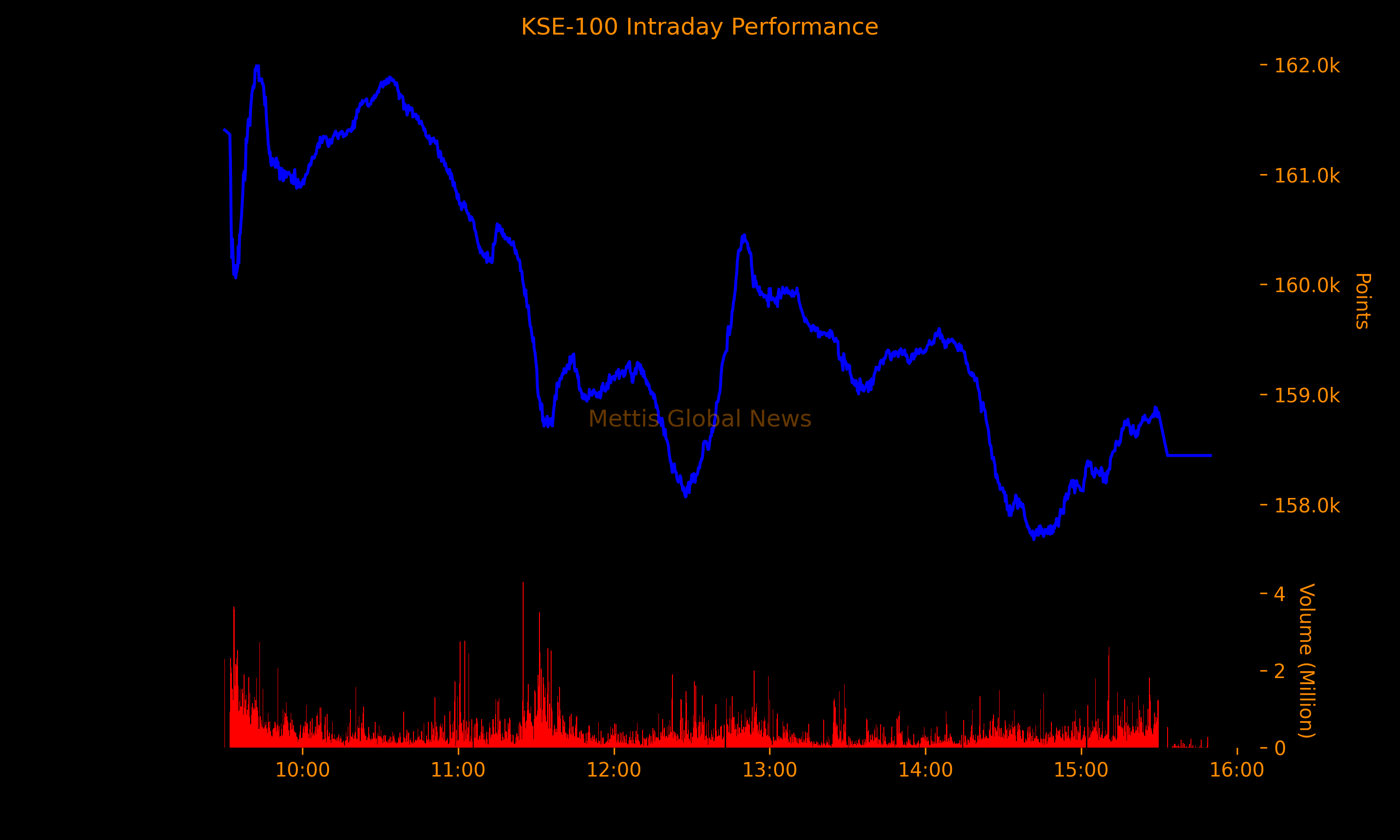

October 13, 2025 (MLN): The benchmark KSE-100 Index concluded Monday's trading session at 158,443.42, showing a decrease of 4,654.77 points or 2.85%.

The index traded in a range of 4,310.11 points showing an intraday high of 161,988.12 (-1,110.07) and a low of 157,678.01 (-5,420.18) points.

Rising tensions along the Afghan border, combined with ongoing domestic and global uncertainties, continue to weigh heavily on investor confidence on PSX, prompting many to adopt a cautious stance.

Meanwhile, the political unrest sweeping across major cities with frequent road blockages and protests has further intensified the already fragile market environment.

The total volume of the KSE-100 Index was 686.33 million shares.

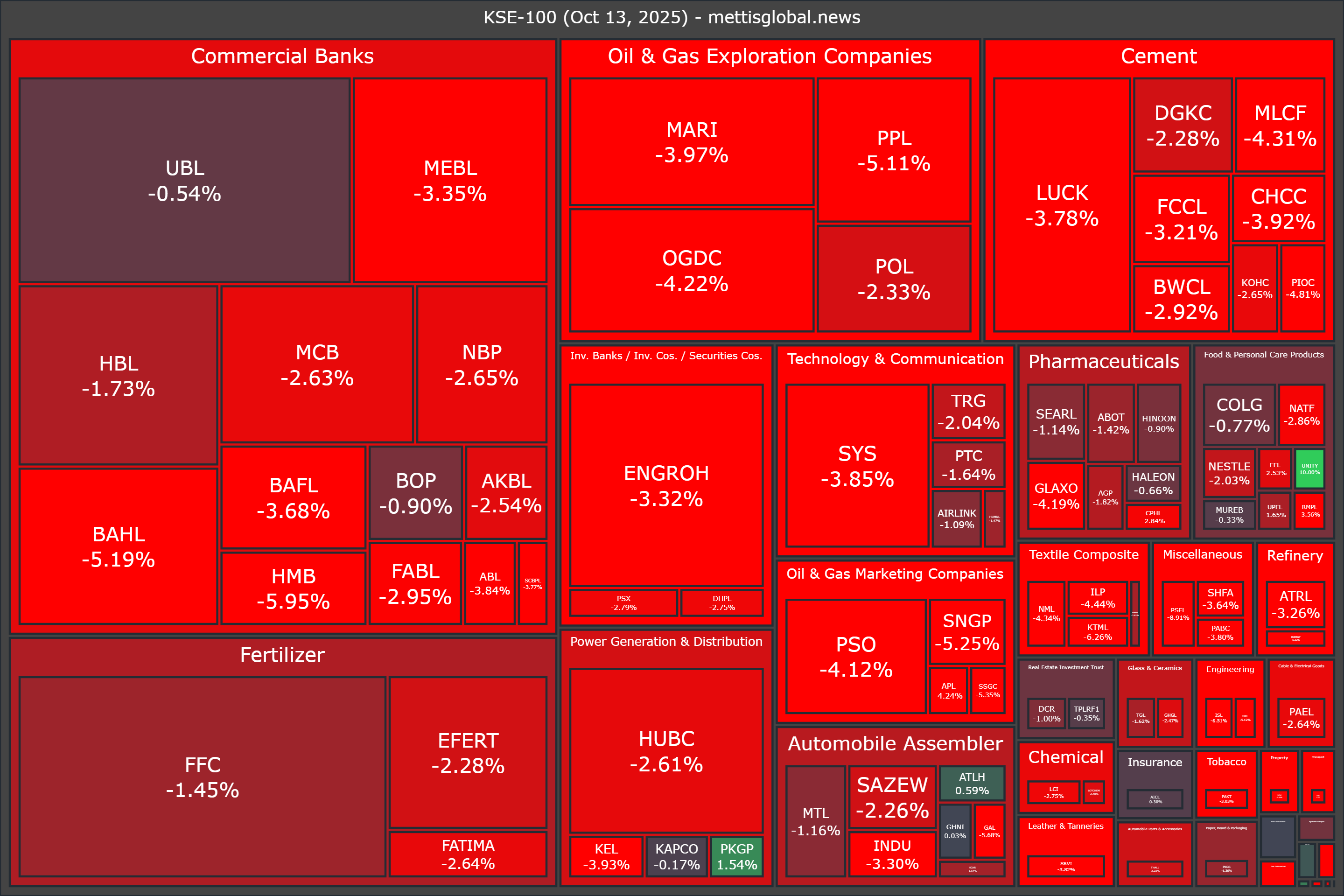

Of the 100 index companies 6 closed up, 93 closed down, while 1 were unchanged.

Top losers during the day were PSEL (-8.91%), HGFA (-8.06%), ISL (-6.51%), KTML (-6.26%), and HMB (-5.95%).

On the other hand, top gainers were UNITY (+10.00%), PKGP (+1.54%), SSOM (+1.25%), ATLH (+0.59%), and FHAM (+0.40%).

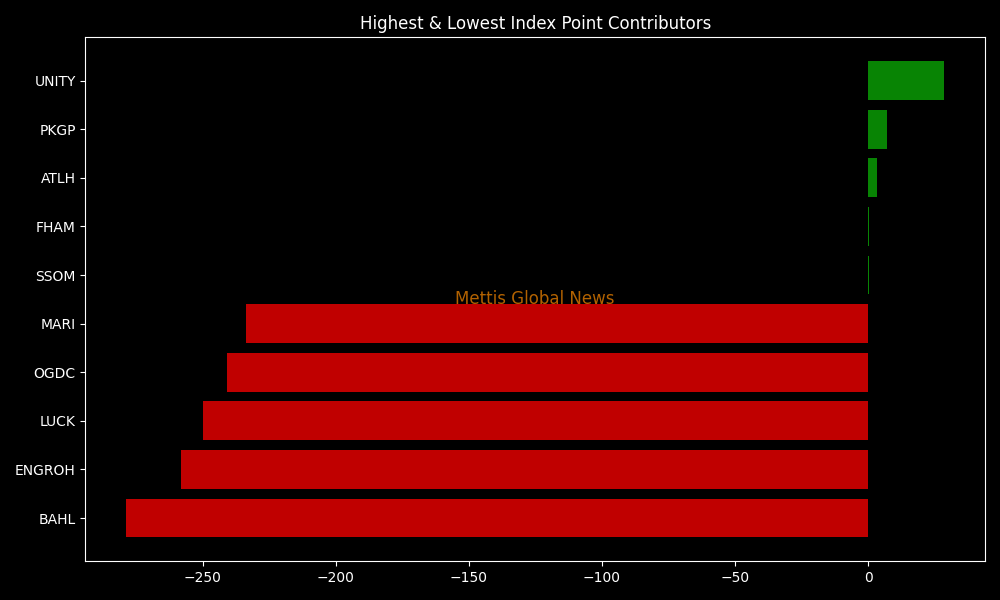

In terms of index-point contributions, companies that dragged the index lower were BAHL (-278.66pts), ENGROH (-258.15pts), LUCK (-249.99pts), OGDC (-240.81pts), and MARI (-233.86pts).

Meanwhile, companies that added points to the index were UNITY (+28.59pts), PKGP (+7.04pts), ATLH (+3.35pts), FHAM (+0.41pts), and SSOM (+0.21pts).

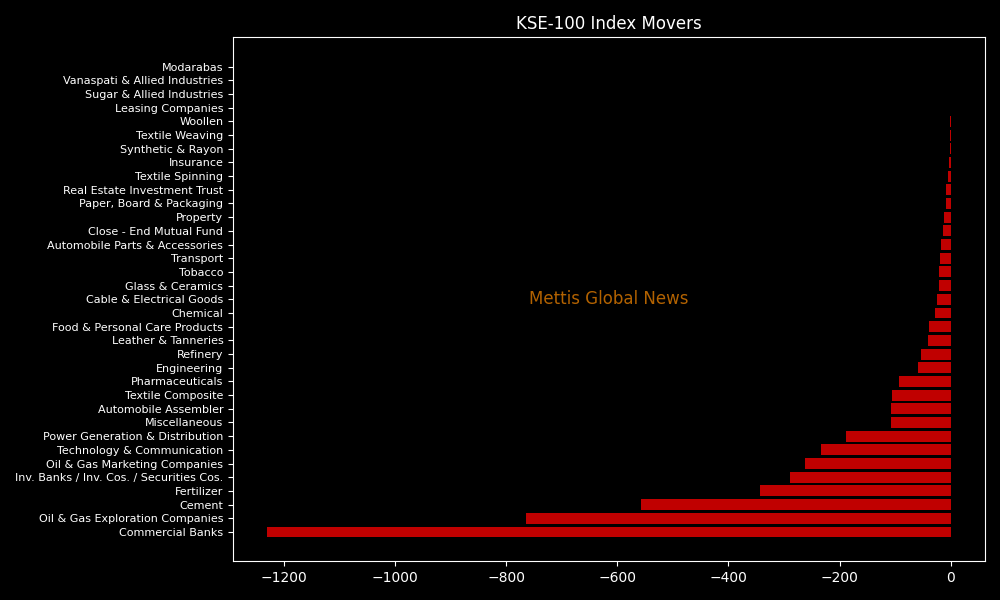

Sector-wise, KSE-100 Index was let down by Commercial Banks (-1230.68pts), Oil & Gas Exploration Companies (-764.40pts), Cement (-558.27pts), Fertilizer (-343.48pts), and Inv. Banks / Inv. Cos. / Securities Cos. (-289.34pts).

While the index was supported by Modarabas (+0.41pts), Vanaspati & Allied Industries (+0.21pts), Sugar & Allied Industries (+0.00pts), Leasing Companies (-0.01pts), and Woollen (-0.32pts).

In the broader market, the All-Share Index closed at 50,501.65 with a net loss of 1,488.33 points or 2.86%.

Total market volume was 1,365.70 million shares compared to 1,401.25m from the previous session while traded value was recorded at Rs62.47 billion showing an increase of Rs14.67bn.

There were 569,596 trades reported in 482 companies with 74 closing up, 375 closing down, and 33 remaining unchanged.

Last week, the PSX saw declines across most sectors, reduced trading volumes, and weaker capitalization following several weeks of sustained advances.

| Symbol | Price | Change % | Volume |

|---|---|---|---|

| KEL | 6.85 | -3.93% | 197,267,193 |

| BOP | 31.78 | -0.90% | 97,205,745 |

| WTL | 1.67 | -3.47% | 75,239,120 |

| TPLP | 11.66 | -1.44% | 60,714,431 |

| FCSC | 6.67 | 5.87% | 55,874,694 |

| PTC | 36.64 | -1.64% | 52,423,003 |

| FNEL | 11.42 | -9.51% | 48,382,383 |

| PACE | 19.18 | 4.24% | 46,463,420 |

| CNERGY | 7.83 | -5.32% | 44,902,590 |

| UNITY | 26.19 | 10.00% | 30,340,002 |

To note, the KSE-100 has gained 32,816 points or 26.12% during the fiscal year, whereas it has increased 43,317 points or 37.63% so far this calendar year.

Copyright Mettis Link News

Related News

| Name | Price/Vol | %Chg/NChg |

|---|---|---|

| KSE100 | 167,085.58 225.68M | 0.48% 802.03 |

| ALLSHR | 101,220.72 685.91M | 0.47% 477.65 |

| KSE30 | 50,772.02 134.57M | 0.57% 290.16 |

| KMI30 | 239,923.35 145.03M | 0.77% 1831.31 |

| KMIALLSHR | 66,042.80 345.76M | 0.65% 425.34 |

| BKTi | 45,106.39 29.18M | 0.06% 24.91 |

| OGTi | 33,583.05 26.44M | 1.52% 502.39 |

| Symbol | Bid/Ask | High/Low |

|---|

| Name | Last | High/Low | Chg/%Chg |

|---|---|---|---|

| BITCOIN FUTURES | 89,425.00 | 0.00 0.00 | -175.00 -0.20% |

| BRENT CRUDE | 63.86 | 64.09 63.06 | 0.60 0.95% |

| RICHARDS BAY COAL MONTHLY | 91.00 | 0.00 0.00 | 0.10 0.11% |

| ROTTERDAM COAL MONTHLY | 97.25 | 97.25 97.25 | 0.05 0.05% |

| USD RBD PALM OLEIN | 1,016.00 | 1,016.00 1,016.00 | 0.00 0.00% |

| CRUDE OIL - WTI | 60.14 | 0.00 0.00 | 0.06 0.10% |

| SUGAR #11 WORLD | 14.82 | 15.02 14.73 | -0.06 -0.40% |

Chart of the Day

Latest News

Top 5 things to watch in this week

Pakistan Stock Movers

| Name | Last | Chg/%Chg |

|---|

| Name | Last | Chg/%Chg |

|---|

Savings Mobilized by National Savings Schemes

Savings Mobilized by National Savings Schemes