PSX Close: KSE100 Index ends flat

MG News | September 06, 2022 at 06:39 PM GMT+05:00

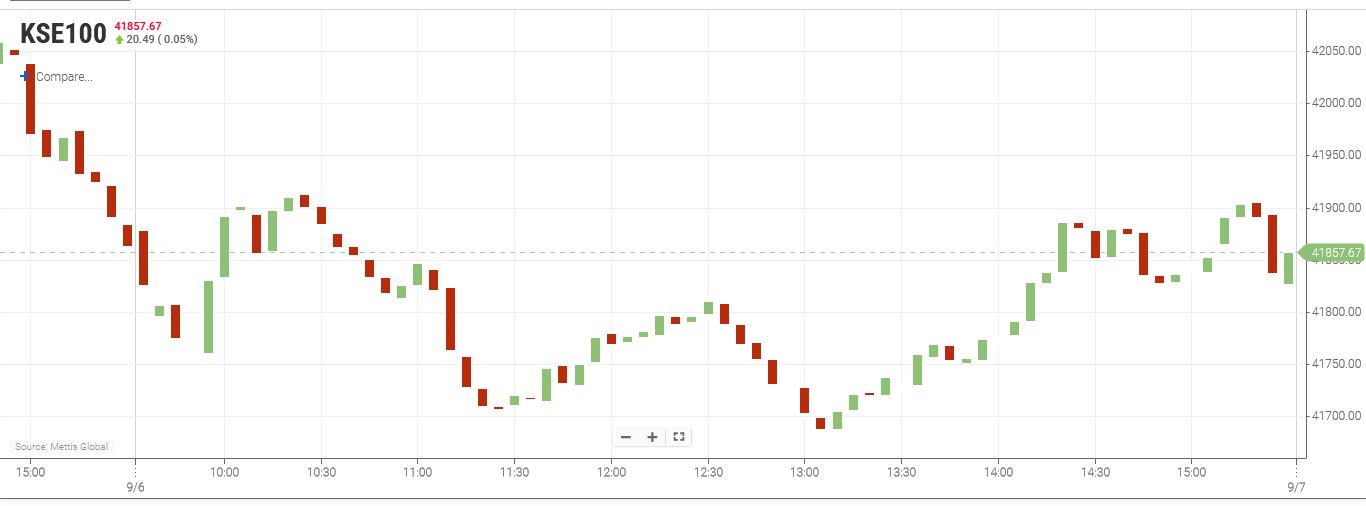

September 6, 2022 (MLN): Domestic equities remained volatile throughout the day today due to political noise, prevailing uncertainty on the damages caused from flash floods, and concerns of over rising inflation number.

Despite positive triggers that is disbursement from IMF loan followed by credit positive rating from Moody's, investors’ participation remained sideways due to continuous rupee devaluation against US dollar and higher oil prices in international market.

As a result, the benchmark KSE100 index made an intraday high of 41,927 and a low of 41,684 points to close at 41,860 level, up by just 1 point DoD.

Of the 91 traded companies in the KSE100 Index 46 closed up 42 closed down, while 3 remained unchanged. Total volume traded for the index was 52.48 million shares.

Sectors propping up the index were Commercial Banks with 33 points, Oil & Gas Marketing Companies with 31 points, Technology & Communication with 26 points, Automobile Assembler with 10 points and Chemical with 10 points.

The most points added to the index was by PSO which contributed 26 points followed by SYS with 19 points, MCB with 14 points, BAHL with 9 points and NBP with 8 points.

Sector wise, the index was let down by Fertilizer with 44 points, Cement with 36 points, Tobacco with 12 points, Power Generation & Distribution with 7 points and Textile Composite with 6 points.

The most points taken off the index was by FFC which stripped the index of 21 points followed by LUCK with 14 points, EFERT with 14 points, PAKT with 12 points and HUBC with 9 points.

All Share Volume increased by 30.46 million to 187.26 million Shares. Market Cap decreased by Rs.17.83 billion.

Total companies traded were 335 compared to 340 from the previous session. Of the scrips traded 146 closed up, 166 closed down while 23 remained unchanged.

Total trades decreased by 3,402 to 78,564.

Value Traded decreased by Rs0.35 billion to Rs4.02 billion.

| Company | Volume |

|---|---|

| Hascol Petroleum | 46,806,000 |

| Pakistan International Airlines Corp | 10,877,000 |

| Fauji Foods | 9,347,578 |

| Cnergyico PK | 9,250,525 |

| Pakistan Refinery | 8,934,389 |

| Worldcall Telecom | 7,806,500 |

| Summit Bank | 5,119,000 |

| Silkbank | 5,006,000 |

| TPL Properties | 4,195,820 |

| G3 Technologies | 3,929,500 |

| Sector | Volume |

|---|---|

| Oil & Gas Marketing Companies | 51,970,939 |

| Food & Personal Care Products | 19,186,995 |

| Refinery | 19,117,053 |

| Technology & Communication | 17,205,309 |

| Commercial Banks | 13,972,501 |

| Chemical | 11,376,980 |

| Transport | 11,170,900 |

| Cement | 9,708,369 |

| Power Generation & Distribution | 7,120,061 |

| Property | 4,668,820 |

Copyright Mettis Link News

Related News

| Name | Price/Vol | %Chg/NChg |

|---|---|---|

| KSE100 | 148,617.78 624.60M | 0.86% 1274.27 |

| ALLSHR | 91,685.08 1,340.28M | 0.74% 669.39 |

| KSE30 | 45,247.79 197.43M | 0.83% 370.74 |

| KMI30 | 212,370.79 224.51M | 1.05% 2209.48 |

| KMIALLSHR | 61,227.89 711.87M | 1.18% 715.56 |

| BKTi | 41,264.02 160.39M | 0.54% 221.73 |

| OGTi | 30,019.10 23.63M | 0.64% 190.41 |

| Symbol | Bid/Ask | High/Low |

|---|

| Name | Last | High/Low | Chg/%Chg |

|---|---|---|---|

| BITCOIN FUTURES | 108,265.00 | 0.00 0.00 | -510.00 -0.47% |

| BRENT CRUDE | 67.46 | 67.94 67.29 | -0.52 -0.76% |

| RICHARDS BAY COAL MONTHLY | 88.70 | 88.70 88.70 | -0.75 -0.84% |

| ROTTERDAM COAL MONTHLY | 96.15 | 96.75 96.00 | -0.40 -0.41% |

| USD RBD PALM OLEIN | 1,106.50 | 1,106.50 1,106.50 | 0.00 0.00% |

| CRUDE OIL - WTI | 64.01 | 0.00 0.00 | 0.00 0.00% |

| SUGAR #11 WORLD | 16.34 | 16.52 16.33 | -0.14 -0.85% |

Chart of the Day

Latest News

Top 5 things to watch in this week

Pakistan Stock Movers

| Name | Last | Chg/%Chg |

|---|

| Name | Last | Chg/%Chg |

|---|

SPI

SPI