PKR edges lower by 7 paisa per USD

MG News | August 18, 2022 at 04:50 PM GMT+05:00

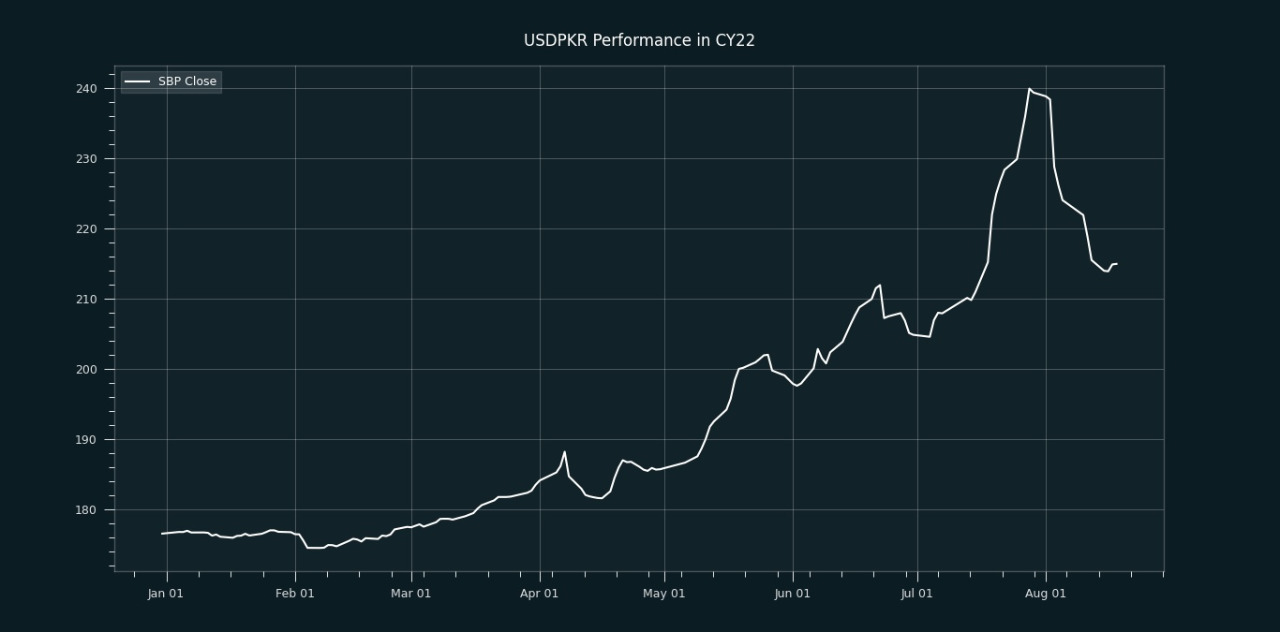

August 18, 2022 (MLN): Continuing its downward journey for the second consecutive session, the Pakistani rupee (PKR) has depreciated by 7 paisa against the US dollar in today's interbank session as the currency settled the trade at PKR 214.95 compared to yesterday's closing of 214.88 per USD.

During the session, the rupee traded in a range of 85 paisa per USD showing an intraday high bid of 215.25 and an intraday low offer of 214.99 while in the open market, PKR was traded at 217/219 per USD.

Market experts are of the view that the government’s decision to remove the ban on imported items has again increased the demand for dollars in the interbank market.

Meanwhile, Malik Boston, President of Forex Association of Pakistan told Mettis Global, “Around 20 million USD is being transported from Pakistan to Afghanistan as its international accounts have been frozen.”

He also clarified that there is no element of smuggling exists as the Afghanis who take dollars with them from Pakistan have dual nationality. Hence, they are allowed to carry a certain amount of dollars with them.

In FYTD, PKR lost 10.10 rupees or 4.70%, while it plummeted by 38.44 rupees or 17.88% against the USD in CYTD, as per data compiled by Mettis Global.

During the last 52 weeks, PKR lost 23.62% against the greenback while reaching its lowest at 239.94 on July 28, 2022, and the highest of 164.18 on August 20, 2021.

Furthermore, the local unit has weakened by 12.29% and 13.58% against EUR and GBP, respectively, since the high on August 20, 2021.

Within a month, the local unit has appreciated against CNY, EUR, SAR, AED, USD, GBP, CHF, and JPY by 4.03%, 4%, 3.28%, 3.27%, 3.27%, 3.05%, 1.47%, and 1.42%, respectively.

Alternatively, the currency gained 1.1 rupees against the Pound Sterling as the day's closing quote stood at PKR 258.74 per GBP, while the previous session closed at PKR 259.83 per GBP.

On the other hand, PKR's value weakened by 32 paisa against EUR which closed at PKR 218.52 at the interbank today.

On another note, within the money market, the State Bank of Pakistan (SBP) conducted an Open Market Operation (OMO) in which it injected Rs310.4 billion at a 15.16% rate of return.

The overnight repo rate towards the close of the session was 15.70/15.90%, whereas the 1-week rate was 14.95/15.05%.

Copyright Mettis Link News

Related News

| Name | Price/Vol | %Chg/NChg |

|---|---|---|

| KSE100 | 138,412.25 167.69M | 0.32% 447.43 |

| ALLSHR | 85,702.96 423.92M | 0.15% 131.52 |

| KSE30 | 42,254.84 82.09M | 0.43% 180.24 |

| KMI30 | 194,109.59 84.37M | 0.15% 281.36 |

| KMIALLSHR | 56,713.67 217.03M | 0.03% 16.37 |

| BKTi | 37,831.34 13.04M | 1.62% 603.62 |

| OGTi | 27,440.63 3.93M | -0.09% -23.70 |

| Symbol | Bid/Ask | High/Low |

|---|

| Name | Last | High/Low | Chg/%Chg |

|---|---|---|---|

| BITCOIN FUTURES | 117,670.00 | 119,740.00 116,460.00 | -625.00 -0.53% |

| BRENT CRUDE | 73.50 | 73.63 71.75 | 0.99 1.37% |

| RICHARDS BAY COAL MONTHLY | 96.50 | 0.00 0.00 | 2.20 2.33% |

| ROTTERDAM COAL MONTHLY | 104.50 | 104.50 104.50 | -0.30 -0.29% |

| USD RBD PALM OLEIN | 998.50 | 998.50 998.50 | 0.00 0.00% |

| CRUDE OIL - WTI | 70.36 | 70.51 68.45 | 1.15 1.66% |

| SUGAR #11 WORLD | 16.46 | 16.58 16.37 | -0.13 -0.78% |

Chart of the Day

Latest News

Top 5 things to watch in this week

Pakistan Stock Movers

| Name | Last | Chg/%Chg |

|---|

| Name | Last | Chg/%Chg |

|---|