PKR devaluation to put ILP in a sweet spot

By MG News | July 07, 2021 at 01:55 PM GMT+05:00

July 7, 2021 (MLN): In order to intact its legacy in textile industry, Interloop Private Limited (ILP) is continuously modernizing and upgrading its product line.

The Company is primarily engaged in the manufacturing of Hosiery segment which contributes 76% to overall topline. In addition, the production line is also extended to denim, yarn, Knitwear, and seamless activewear.

With regard to the growth, Property, Plant, and Equity (PPE) has grown at a 7-year CAGR of 14%. The company also incurred annual CAPEX around Rs6.5bn in FY20, whereas in 9MFY21, an addition of Rs1.7bn has already taken place, a report by Insight Securities highlighted.

On the revenue side, the Hosiery segment alone clocked in at Rs31bn in 9MFY21, increased by approximately 25% on a YoY basis. The growth is primarily attributable to its customer base which includes top brands such as Nike, Adidas, Puma etc.

The report further noted that the company has announced a capital outlay of $300mn under Vision 2025. This will include addition of a 6th hosiery plant for capacity enhancements.

At present, ILP currently has 5 operational hosiery plants with approximately 6,000 machines capable of producing 64.5mn dozens per annum of socks.

As of FY20, ILP has obtained LTFF and Demand Finance Loan for the expansion of its Hosiery Division V. The facility is expected to have 1200 knitting machines by CY22, with a capacity to produce around 15mn dozens per annum of socks.

The plant was running at a capacity utilization of 70% as compared to 80% in FY19. The decline in utilization was mainly due to hampering of economic activity due to COVID.

Going forward, it is expected that utilization levels to hover in the range of 80-90% as expansions come online and resumption of global trade activities lead to an increase in quantity demanded, it added.

The report also stated that ILP introduced its denim plant in Dec’19 and it started operations in 2QFY20 in the first phase. However, capacity utilization was at the lower end due to dampening of economic activity by COVID, ranging at 57%.

To note, the company expects to double its production capacity from 0.5mn pieces per month to 1mn pieces per month in the second phase.

Therefore, the company has built the capacity utilization in the range of 80-85% in FY22/23. As per accounts, revenue of the segment has increased from PKR0.6bn in 9MFY20 to Rs2.5bn in 9MFY21, posting a growth of 339%.

However, the segment is still making a loss on operating level. As per management, the reason for losses is due to 3rd wave of COVID that led to cancellation of orders.

Furthermore, the breakeven cost per piece of this segment is around $7.5 as per the back of envelope working, whereas the company sells it at $5-5.5 per piece, with a spot price of $6.5 in the recent quarter.

Moving on, it is expected that the segment to post revenues in excess of Rs8bn in FY22, amid rupee appreciation and rising prices of value-added products globally. PKR appreciated by 9% against the USD in 9MFY21, affecting earnings of major textile players. However, it has depreciated by more than 3% since then and has constantly been on the decline.

According to Shuja Ahmed, Analyst at insight Securities, PKR to reach 165-170 against USD in FY22. ILP is likely to be a major beneficiary of the currency devaluation as ~90% of the company’s topline is driven by exports.

All in all, the textile exports of Pakistan have soared by 18% on a yearly basis, mainly due to favorable policies of the govt. ILP being a major exporter (90% export sales) has largely benefitted from these policies, as evident by company’s profitability.

Furthermore, companies have invested a significant amount on capacity enhancements on the back of subsidized financing facilities in the form of TERF and LTFF. This is witnessed by the rise in textile machinery imports in FY21, which have increased by 17% YoY, he added.

Going by the report, it is expected that current account deficit (CAD) to reach $7-8bn next year (vs. surplus of $0.8bn in 10MFY21) on account of higher oil & machinery imports under the TERF and LTFF schemes.

However, uncertainties related to Textile Policy 2020- 25, PKR appreciation against USD, rising cotton prices and falling output, discontinuation of subsidized energy rates, lower economic growth of importing countries, uncertainty due to possible COVID wave, and delay in expansions of hosiery and denim segments may put the sector in risk.

Copyright Mettis link News

Related News

| Name | Price/Vol | %Chg/NChg |

|---|---|---|

| KSE100 | 131,949.07 198.95M |

0.97% 1262.41 |

| ALLSHR | 82,069.26 730.83M |

0.94% 764.01 |

| KSE30 | 40,387.76 80.88M |

1.11% 442.31 |

| KMI30 | 191,376.82 77.76M |

0.36% 678.77 |

| KMIALLSHR | 55,193.97 350.11M |

0.22% 119.82 |

| BKTi | 35,828.25 28.42M |

3.64% 1259.85 |

| OGTi | 28,446.34 6.84M |

-1.02% -293.01 |

| Symbol | Bid/Ask | High/Low |

|---|

| Name | Last | High/Low | Chg/%Chg |

|---|---|---|---|

| BITCOIN FUTURES | 108,125.00 | 110,525.00 107,865.00 |

-2290.00 -2.07% |

| BRENT CRUDE | 68.51 | 68.89 67.75 |

-0.29 -0.42% |

| RICHARDS BAY COAL MONTHLY | 97.50 | 0.00 0.00 |

0.75 0.78% |

| ROTTERDAM COAL MONTHLY | 106.00 | 106.00 105.85 |

-2.20 -2.03% |

| USD RBD PALM OLEIN | 998.50 | 998.50 998.50 |

0.00 0.00% |

| CRUDE OIL - WTI | 66.50 | 67.18 66.04 |

-0.50 -0.75% |

| SUGAR #11 WORLD | 16.37 | 16.40 15.44 |

0.79 5.07% |

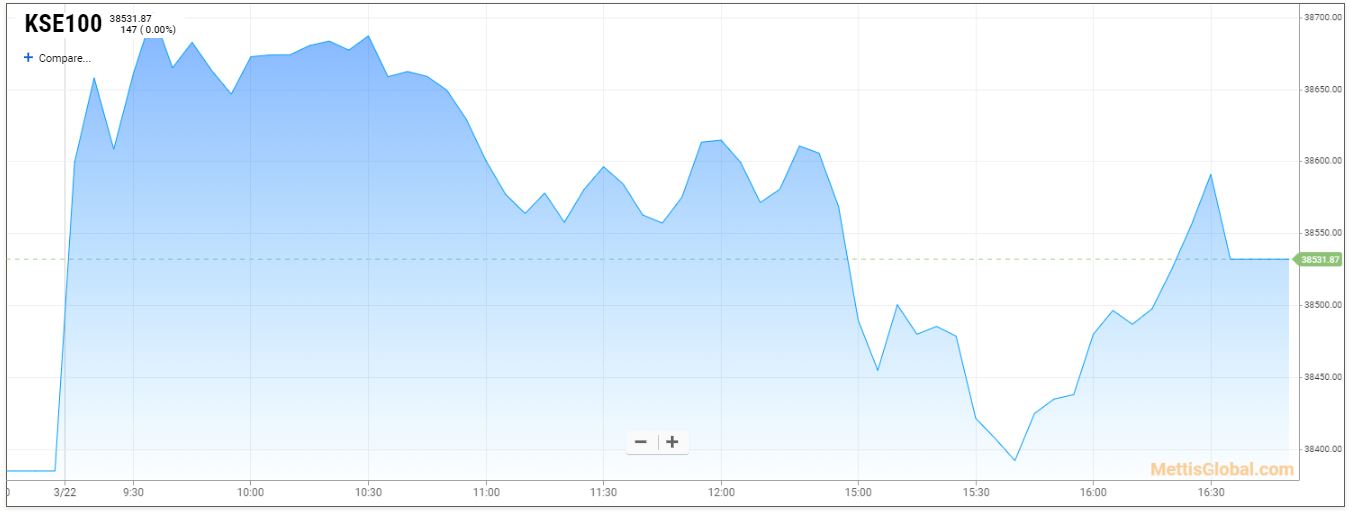

Chart of the Day

Latest News

Top 5 things to watch in this week

Pakistan Stock Movers

| Name | Last | Chg/%Chg |

|---|

| Name | Last | Chg/%Chg |

|---|

Central Government Debt

Central Government Debt

CPI

CPI