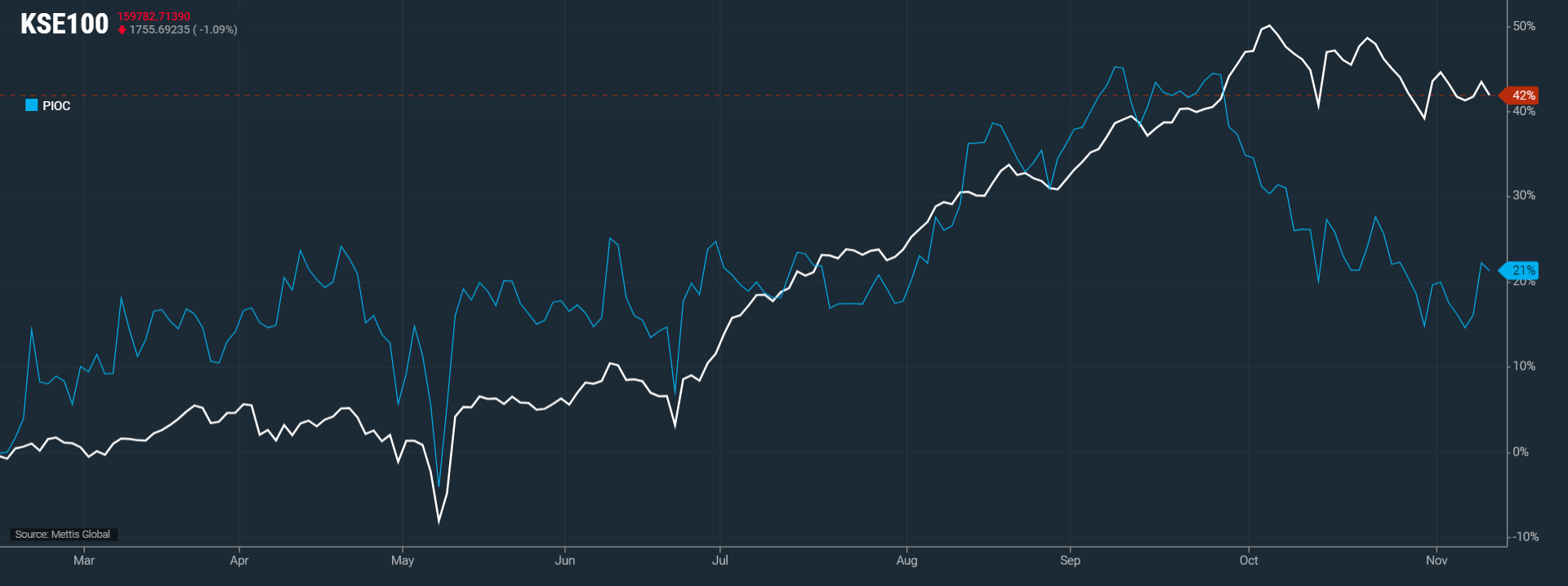

PIOC eyes strong sales, margin recovery in FY26

MG News | November 11, 2025 at 12:09 PM GMT+05:00

November 11, 2025 (MLN): Pioneer Cement Limited (PSX: PIOC) shared an optimistic outlook during its corporate briefing session, projecting double-digit growth in domestic sales for FY26, supported by renewed momentum in private sector construction and reconstruction activities in flood-affected regions.

The company noted that the cement industry has already

recorded an 18% year-on-year growth in sales during FY26-to-date, showing a

strong recovery in demand after a subdued FY25.

Management expressed confidence that improving

macroeconomic conditions and ongoing infrastructure projects would continue to

fuel cement consumption in the coming months.

During FY25, Pioneer Cement reported net revenue of Rs33.3billion,

with total offtakes of 2.07m tons, while net earnings stood at Rs4.9bn (EPS: Rs21.5),

down 6% year-on-year mainly due to lower volumetric sales and higher operating

expenses.

The 6% royalty imposed by the Punjab government weighed

on profitability, reducing gross profit margins by 11.2% YoY, though margins

improved slightly on a per-ton basis due to stronger pricing discipline.

Finance costs fell sharply by around 50% YoY, supported by declining interest rates and repayment of project financing.

The company’s

power mix remained 95% captive and 5% grid-based, with captive power comprising

25% Waste Heat Recovery (WHR) and 75% coal-based energy. The average power cost

stood between Rs19–20 per kWh.

Regarding the fuel mix, Pioneer Cement utilized 65% local coal, 5% Afghan coal, and 30% blended coal during FY25, compared to 75% local and 25% imported coal in the previous year.

Amid rising local coal prices, the

company has transitioned to a more cost-efficient imported Indonesian RB2 coal,

currently priced at around Rs41,000 per ton, while Afghan coal trades near Rs50,000

per ton.

In terms of market performance, the company’s market share stood at 5.4% in FY25, slightly below its capacity-based share of 5.9%, due to a focus on premium markets.

Management stated that Pioneer aims to regain

its full market share in FY26, as the company outperformed industry trends with

a 25% YoY increase in cement dispatches during 1QFY26 compared to the overall

sector’s 18% rise.

Looking ahead, management anticipates margins to improve

in FY26 owing to an optimized fuel mix, lower variable costs, and reduced

finance expenses.

The company also revealed plans to expand plant capacity

and make significant investments in captive energy solutions once production

utilization reaches optimal levels.

Furthermore, Pioneer Cement is exploring medium-term

diversification opportunities, particularly in real estate and steel sectors,

though management emphasized that these initiatives will depend on macroeconomic

and political stability.

With a 6% share of Pakistan’s cement market, Pioneer

Cement remains one of the country’s top six cement producers, positioning

itself for sustainable growth through operational efficiency, energy

optimization, and strategic expansion.

Copyright Mettis Link News

Related News

| Name | Price/Vol | %Chg/NChg |

|---|---|---|

| KSE100 | 159,037.24 164.55M | -1.55% -2501.17 |

| ALLSHR | 96,947.48 526.97M | -1.23% -1210.16 |

| KSE30 | 48,155.56 90.75M | -1.66% -811.95 |

| KMI30 | 229,133.02 57.96M | -1.85% -4327.21 |

| KMIALLSHR | 63,175.46 179.13M | -1.46% -936.95 |

| BKTi | 44,112.97 36.01M | -1.15% -513.73 |

| OGTi | 30,755.84 8.06M | -1.89% -591.77 |

| Symbol | Bid/Ask | High/Low |

|---|

| Name | Last | High/Low | Chg/%Chg |

|---|---|---|---|

| BITCOIN FUTURES | 105,235.00 | 107,900.00 105,090.00 | -1130.00 -1.06% |

| BRENT CRUDE | 63.81 | 64.06 63.60 | -0.25 -0.39% |

| RICHARDS BAY COAL MONTHLY | 87.25 | 0.00 0.00 | 1.25 1.45% |

| ROTTERDAM COAL MONTHLY | 96.25 | 0.00 0.00 | 0.25 0.26% |

| USD RBD PALM OLEIN | 1,082.50 | 1,082.50 1,082.50 | 0.00 0.00% |

| CRUDE OIL - WTI | 59.86 | 60.12 59.66 | -0.27 -0.45% |

| SUGAR #11 WORLD | 14.26 | 14.42 14.08 | 0.16 1.13% |

Chart of the Day

Latest News

Top 5 things to watch in this week

Pakistan Stock Movers

| Name | Last | Chg/%Chg |

|---|

| Name | Last | Chg/%Chg |

|---|