Oil slips as U.S. stockpiles climb, demand signals fade

MG News | November 19, 2025 at 10:33 AM GMT+05:00

November 19, 2025 (MLN): Oil prices slipped on Wednesday after an industry report revealed an increase in U.S. crude and fuel stockpiles, deepening worries that global supply is outpacing demand.

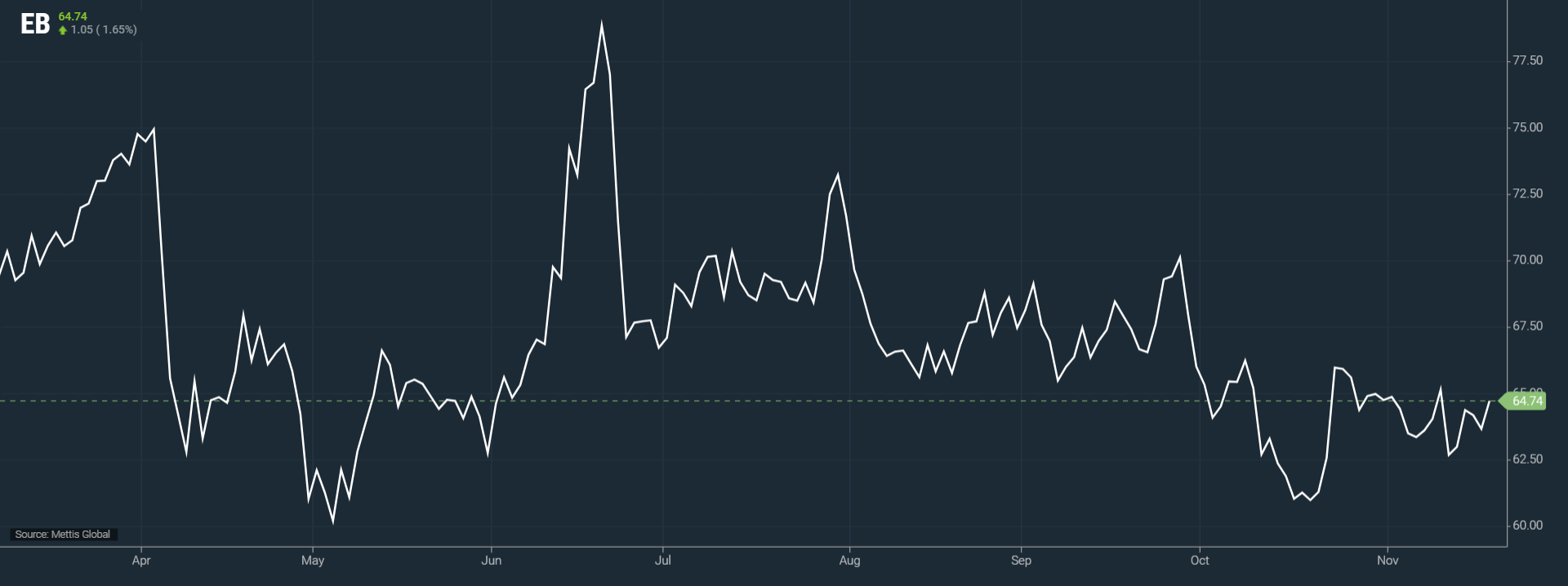

Brent crude futures went

down by $1.05, or 1.65%, to $64.74 per barrel.

West Texas Intermediate

(WTI) crude futures decreased by $0.10, or 0.16%, to $60.64 per barrel by [10:27

am] PST.

U.S. crude and fuel inventories climbed last week, according to market sources who cited data from the American Petroleum Institute (API) late Tuesday.

The API figures showed a 4.45 million-barrel increase in crude stocks

for the week ending Nov 14, alongside a 1.55m-barrel rise in gasoline supplies

and a 577,000-barrel build in distillate inventories reinforcing concerns about

softening demand.

A report from Chinese brokerage Haitong Futures

noted that the larger-than-expected stock builds “signal weak demand and imply

a bearish outlook for oil prices,” adding to downward pressure on the market.

Oil prices had firmed on Tuesday as traders

assessed the potential impact of fresh U.S. sanctions on Russian oil exports,

as well as escalating Ukrainian strikes on Russian refineries and export

terminals developments that have heightened fears of supply disruptions.

However, analysts continue to warn that global

production remains higher than current consumption levels, limiting upside

momentum in crude prices.

In Europe, diesel profit margins surged to

their highest level since September 2023 following recent Ukrainian attacks

targeting Russian energy infrastructure. A broader boost in global refining

margins has also provided support for fuel markets.

Despite stronger diesel fundamentals, Haitong

Futures said the persistent crude oversupply is making investors hesitant to

pursue additional gains.

Meanwhile, a senior White House official said U.S. President Donald Trump is prepared to sign legislation advancing through Congress that would impose new sanctions on Russia, provided he retains authority over how those measures are implemented.

Additional secondary sanctions on buyers of Russian crude are expected to offer continued support for global oil prices.

Copyright Mettis Link

News

Related News

| Name | Price/Vol | %Chg/NChg |

|---|---|---|

| KSE100 | 161,935.54 160.22M | 0.62% 1000.41 |

| ALLSHR | 98,131.33 451.84M | 0.46% 445.04 |

| KSE30 | 49,021.50 62.25M | 0.70% 340.51 |

| KMI30 | 230,450.77 55.19M | 0.41% 932.74 |

| KMIALLSHR | 63,735.68 251.77M | 0.40% 254.56 |

| BKTi | 44,116.50 10.75M | 0.30% 131.99 |

| OGTi | 31,092.16 1.97M | 0.46% 143.88 |

| Symbol | Bid/Ask | High/Low |

|---|

| Name | Last | High/Low | Chg/%Chg |

|---|---|---|---|

| BITCOIN FUTURES | 90,580.00 | 93,290.00 90,055.00 | -2345.00 -2.52% |

| BRENT CRUDE | 64.75 | 64.85 64.51 | -0.14 -0.22% |

| RICHARDS BAY COAL MONTHLY | 85.00 | 85.00 85.00 | -0.55 -0.64% |

| ROTTERDAM COAL MONTHLY | 96.45 | 96.45 96.45 | 0.00 0.00% |

| USD RBD PALM OLEIN | 1,082.50 | 1,082.50 1,082.50 | 0.00 0.00% |

| CRUDE OIL - WTI | 60.53 | 60.70 60.31 | -0.14 -0.23% |

| SUGAR #11 WORLD | 14.71 | 14.88 14.63 | -0.09 -0.61% |

Chart of the Day

Latest News

Top 5 things to watch in this week

Pakistan Stock Movers

| Name | Last | Chg/%Chg |

|---|

| Name | Last | Chg/%Chg |

|---|

Private Sector Credit

Private Sector Credit