Oil retreats slightly as U.S., China extend tariff freeze

MG News | August 12, 2025 at 02:40 PM GMT+05:00

August 12, 2025 (MLN): Oil prices climbed on Tuesday after the United States and China agreed to prolong a suspension of planned tariff hikes, easing fears that an escalation of their trade dispute could harm their economies and dampen fuel demand in the world’s two biggest oil-consuming nations

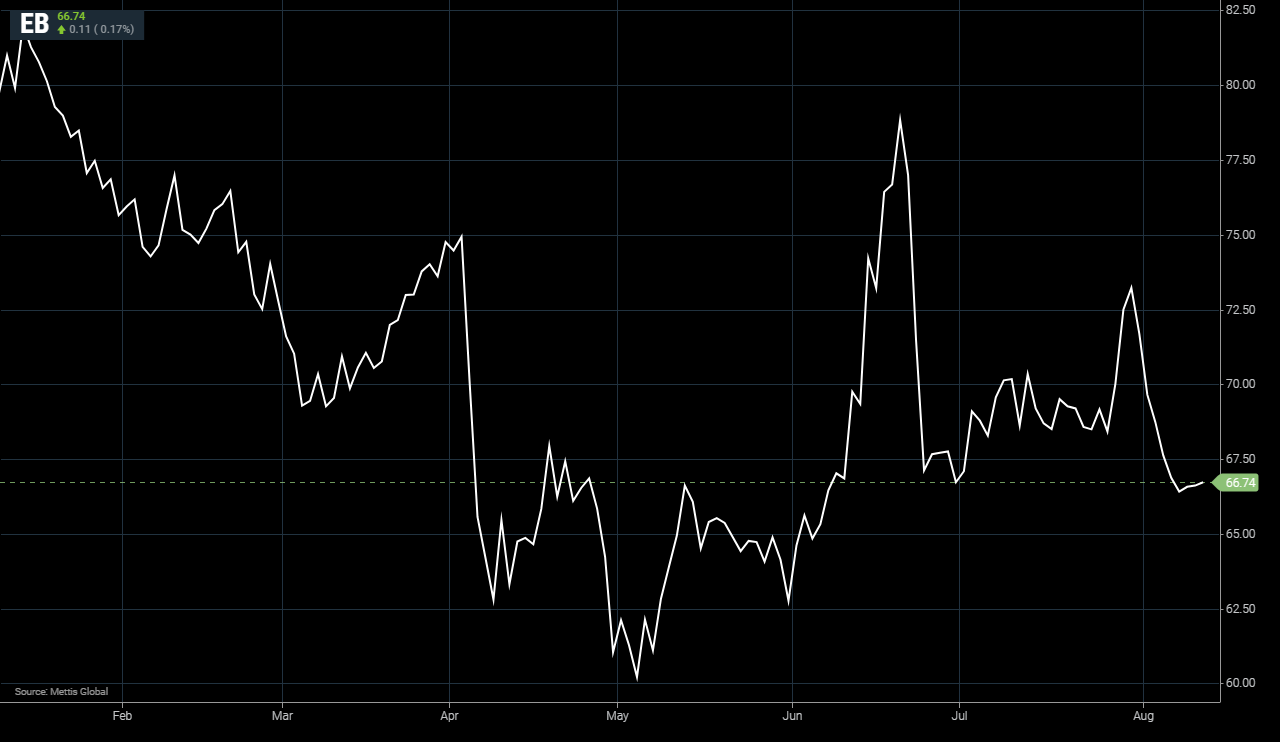

Brent crude futures decreased by $0.11 or 0.17%, to

$66.74 per barrel.

West Texas Intermediate (WTI) crude futures fall

by $0.10, or 0.16%, to $64.06 per barrel by [2:33 pm] PST

U.S. President Donald Trump has extended the tariff truce with China for

another 90 days a White House official said Monday averting the imposition of

steep triple-digit duties on Chinese imports as American retailers gear up for

the crucial year-end holiday shopping season.

The move has fueled optimism that the world’s

two largest economies could reach a broader trade agreement, potentially

preventing what would amount to a de facto trade embargo. Higher tariffs risk

slowing global economic growth, which could weaken fuel demand and weigh on oil

prices.

Market attention is also turning to the

upcoming August 15 meeting between Trump and Russian President Vladimir Putin

in Alaska, where the two leaders are expected to discuss ending the war in

Ukraine.

The talks come as Washington intensifies pressure on Moscow, warning of

stricter measures against buyers of Russian oil including China and India if no

peace deal is reached a scenario that could disrupt global oil trade flows.

“Any peace agreement between Russia and

Ukraine would remove the lingering threat of disruptions to Russian oil supply

that has been overshadowing the market,” ANZ senior commodity strategist Daniel

Hynes noted.

Trump had set a deadline last Friday for

Russia to agree to peace or face secondary sanctions targeting its oil buyers,

while urging India to scale back its imports of Russian crude.

Beijing has also been pressed to halt purchases, with Trump threatening

additional tariffs on Chinese imports if it continues buying Russian oil.

The likelihood of these sanctions taking

effect has diminished ahead of the scheduled Trump-Putin talks.

Traders

are also watching for U.S. inflation figures due later today, which could

provide clues about the Federal Reserve’s next policy moves.

Any indication of an impending rate cut would likely lend further support to

crude prices.

Copyright Mettis Link News

Related News

| Name | Price/Vol | %Chg/NChg |

|---|---|---|

| KSE100 | 188,587.66 447.87M | -0.31% -579.17 |

| ALLSHR | 112,503.19 863.72M | -0.27% -306.46 |

| KSE30 | 58,026.90 154.85M | -0.31% -180.82 |

| KMI30 | 268,418.81 154.34M | -0.40% -1078.22 |

| KMIALLSHR | 72,509.98 546.87M | -0.44% -318.36 |

| BKTi | 53,346.13 36.88M | -0.33% -174.24 |

| OGTi | 38,638.48 11.10M | -0.64% -248.26 |

| Symbol | Bid/Ask | High/Low |

|---|

| Name | Last | High/Low | Chg/%Chg |

|---|---|---|---|

| BITCOIN FUTURES | 87,875.00 | 88,385.00 85,900.00 | -1625.00 -1.82% |

| BRENT CRUDE | 65.92 | 66.54 65.39 | 0.04 0.06% |

| RICHARDS BAY COAL MONTHLY | 86.75 | 0.00 0.00 | -3.00 -3.34% |

| ROTTERDAM COAL MONTHLY | 98.50 | 0.00 0.00 | -0.45 -0.45% |

| USD RBD PALM OLEIN | 1,027.50 | 1,027.50 1,027.50 | 0.00 0.00% |

| CRUDE OIL - WTI | 61.06 | 61.71 60.60 | -0.01 -0.02% |

| SUGAR #11 WORLD | 14.74 | 14.79 14.67 | 0.01 0.07% |

Chart of the Day

Latest News

Top 5 things to watch in this week

Pakistan Stock Movers

| Name | Last | Chg/%Chg |

|---|

| Name | Last | Chg/%Chg |

|---|