Oil prices slip amid Russia Ukraine tensions

MG News | September 02, 2025 at 03:03 PM GMT+05:00

September 2, 2025 (MLN): Oil prices climbed in early Asian trading on Tuesday, driven by mounting worries over potential supply disruptions as the Russia–Ukraine conflict intensified.

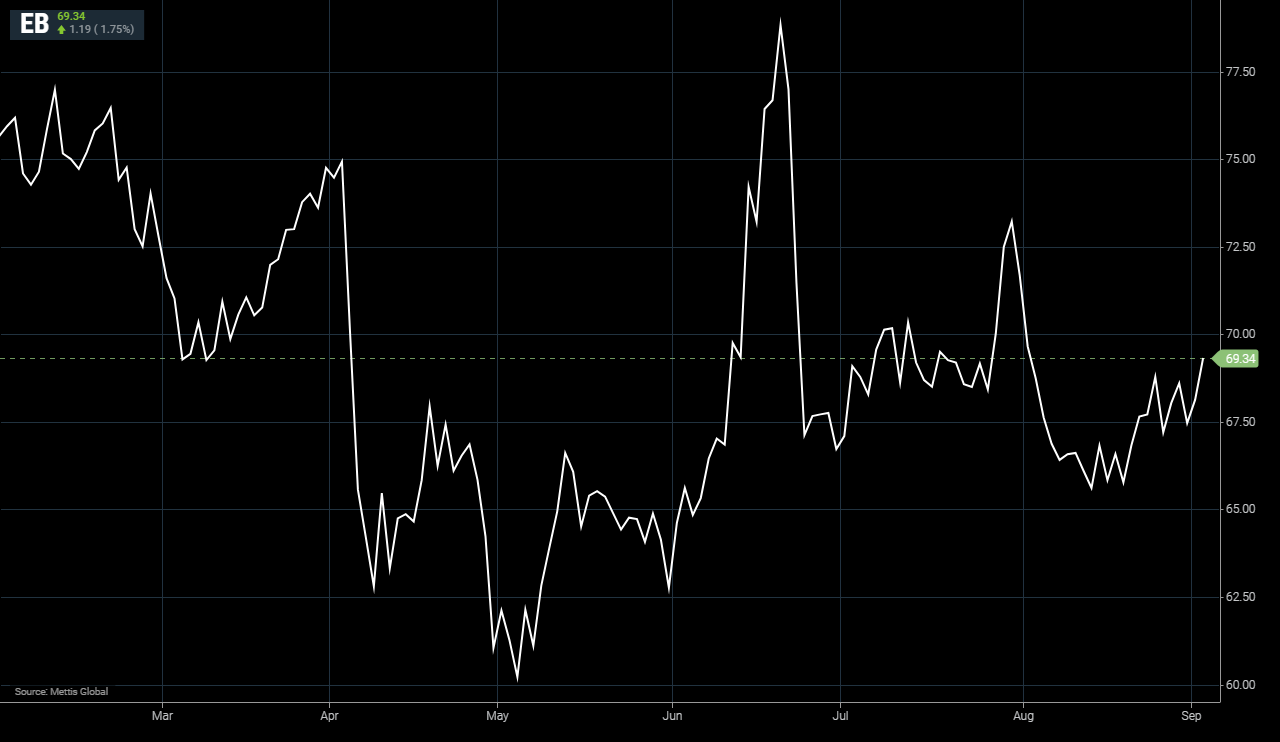

Brent crude futures decreased a little by $1.19, or 1.75%,

to $69.34 per barrel.

West Texas Intermediate (WTI) crude futures fell by $1.81,

or 2.83%, to $65.82 per barrel by [2:55 pm] PST.

WTI crude futures were not settled on Monday due to the U.S. Labor Day

holiday.

According to Reuters estimates, recent Ukrainian

drone strikes have taken offline facilities responsible for around 17% of

Russia’s refining capacity, equal to about 1.1 million barrels per day.

On Sunday, President Volodymyr Zelenskyy informed

that Ukraine would launch new attacks deeper inside Russia following weeks of

intensified strikes on Russian energy assets.

Now in its fourth year, the conflict has seen

both sides escalate aerial assaults. Moscow has focused on Ukraine’s power and

transport infrastructure, while Kyiv has stepped up strikes on Russian

refineries and pipelines.

“The risk to Russia’s energy infrastructure

remains elevated. Over the weekend, Ukraine targeted more refineries as it

broadened its campaign against Russian facilities,” noted Daniel Hynes, senior

commodity strategist at ANZ, in a Tuesday report.

Meanwhile, geopolitical uncertainty could

deepen following Chinese President Xi Jinping’s push for a “new global order.”

At a Monday summit with Russian and Indian leaders, Xi promoted his security

and economic vision centered on the “Global South,” in a move seen as a

challenge to U.S. influence.

China and India remain Russia’s largest crude

buyers, even as Washington has imposed additional tariffs on India over such

imports while sparing China.

Market

participants are now awaiting the September 7 meeting of OPEC and its partners

for guidance on whether the alliance might adjust production levels further.

Copyright Mettis Link News

Related News

| Name | Price/Vol | %Chg/NChg |

|---|---|---|

| KSE100 | 168,910.68 504.72M | -0.32% -541.18 |

| ALLSHR | 102,475.82 921.00M | -0.08% -78.98 |

| KSE30 | 51,219.39 75.44M | -0.47% -241.26 |

| KMI30 | 241,958.40 75.24M | -0.55% -1331.87 |

| KMIALLSHR | 66,805.57 358.05M | -0.19% -130.31 |

| BKTi | 45,359.06 19.35M | -0.18% -83.28 |

| OGTi | 33,530.45 13.16M | 0.54% 181.33 |

| Symbol | Bid/Ask | High/Low |

|---|

| Name | Last | High/Low | Chg/%Chg |

|---|---|---|---|

| BITCOIN FUTURES | 90,330.00 | 92,800.00 89,575.00 | -2455.00 -2.65% |

| BRENT CRUDE | 61.59 | 62.63 61.57 | -0.62 -1.00% |

| RICHARDS BAY COAL MONTHLY | 91.00 | 0.00 0.00 | 0.35 0.39% |

| ROTTERDAM COAL MONTHLY | 97.40 | 0.00 0.00 | 0.60 0.62% |

| USD RBD PALM OLEIN | 1,016.00 | 1,016.00 1,016.00 | 0.00 0.00% |

| CRUDE OIL - WTI | 57.88 | 58.94 57.85 | -0.58 -0.99% |

| SUGAR #11 WORLD | 14.90 | 15.02 14.66 | 0.23 1.57% |

Chart of the Day

Latest News

Top 5 things to watch in this week

Pakistan Stock Movers

| Name | Last | Chg/%Chg |

|---|

| Name | Last | Chg/%Chg |

|---|

MTB Auction

MTB Auction