Oil prices rise as OPEC+ plans modest output hike

MG News | September 09, 2025 at 03:53 PM GMT+05:00

September 09, 2025 (MLN): Oil prices rose on Tuesday after OPEC+ informed a smaller than-expected increase in production, easing fears of oversupply. Ongoing concerns about potential new sanctions on Russia also contributed to expectations of tighter global supply, further supporting the market.

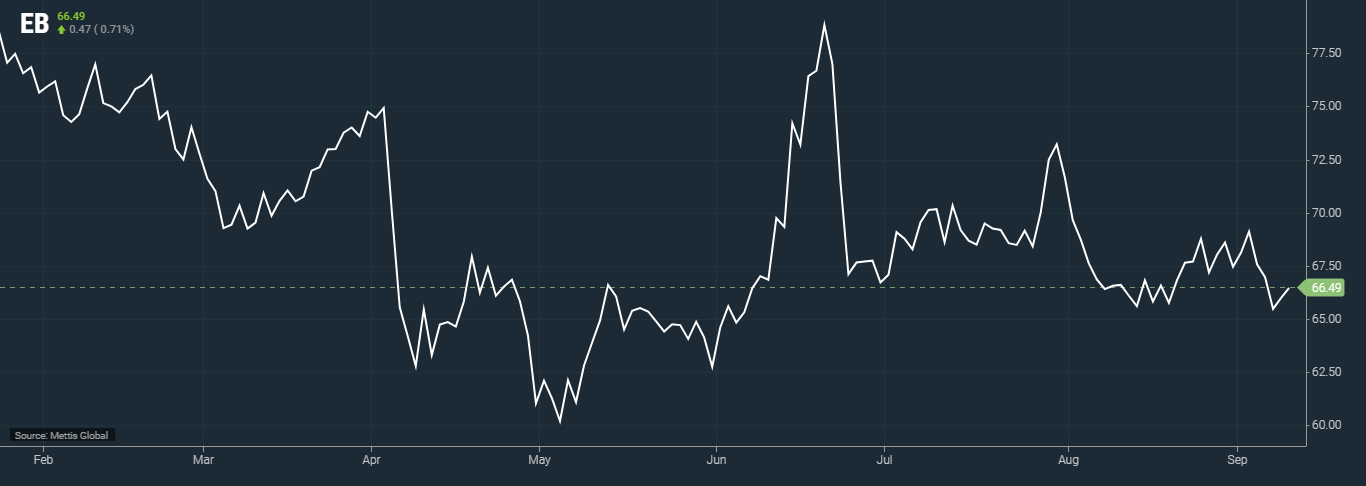

Brent crude futures decreased a little by $0.47, or 0.71%, to $66.49 per

barrel.

West Texas Intermediate (WTI) crude futures fell by $0.49,

or 0.79%, to $62.75 per barrel by [3:32 pm] PST.

Eight members of the Organization of the Petroleum

Exporting Countries and their allies, known collectively as OPEC+, agreed on

Sunday to increase oil production by 137,000 barrels per day starting in

October.

This planned rise is significantly smaller than previous

monthly hikes 555,000 barrels per day for August and September, and 411,000

barrels per day for June and July and fell short of many analysts’

expectations.

According to Daniel Hynes, senior commodity strategist at

ANZ, the decision effectively reverses production cuts that were initially

scheduled to remain in place until the end of 2026.

He noted in a client briefing on Tuesday that this move

follows the recent rapid restoration of previously idle production capacity.

Oil prices also found support from growing speculation

over new sanctions against Russia. The pressure intensified after Russia

carried out its largest airstrike on Ukraine to date, setting fire to a

government building in Kyiv. In response, U.S. President Donald Trump stated he

was prepared to implement a second round of restrictions.

Meanwhile, the European Union’s chief sanctions official

arrived in Washington with a delegation of experts to discuss the potential

rollout of the first joint transatlantic sanctions against Russia since Trump’s

return to office.

Any additional sanctions targeting Russian oil exports

are expected to tighten global supply, potentially driving prices higher.

On the economic front, markets are also closely watching the upcoming U.S. Federal Reserve’s Federal Open Market Committee (FOMC) meeting next week.

Traders currently assign an 89.4% probability to a 25-basis-point interest rate cut. Lower interest rates typically reduce borrowing costs, potentially boosting economic activity and increasing demand for oil.

Copyright Mettis Link News

Related News

| Name | Price/Vol | %Chg/NChg |

|---|---|---|

| KSE100 | 167,085.58 225.68M | 0.48% 802.03 |

| ALLSHR | 101,220.72 685.91M | 0.47% 477.65 |

| KSE30 | 50,772.02 134.57M | 0.57% 290.16 |

| KMI30 | 239,923.35 145.03M | 0.77% 1831.31 |

| KMIALLSHR | 66,042.80 345.76M | 0.65% 425.34 |

| BKTi | 45,106.39 29.18M | 0.06% 24.91 |

| OGTi | 33,583.05 26.44M | 1.52% 502.39 |

| Symbol | Bid/Ask | High/Low |

|---|

| Name | Last | High/Low | Chg/%Chg |

|---|---|---|---|

| BITCOIN FUTURES | 89,425.00 | 92,995.00 88,405.00 | -3415.00 -3.68% |

| BRENT CRUDE | 63.86 | 64.09 63.06 | 0.60 0.95% |

| RICHARDS BAY COAL MONTHLY | 91.00 | 0.00 0.00 | 0.10 0.11% |

| ROTTERDAM COAL MONTHLY | 97.25 | 97.25 97.25 | 0.05 0.05% |

| USD RBD PALM OLEIN | 1,016.00 | 1,016.00 1,016.00 | 0.00 0.00% |

| CRUDE OIL - WTI | 60.14 | 60.50 59.42 | 0.47 0.79% |

| SUGAR #11 WORLD | 14.82 | 15.02 14.73 | -0.06 -0.40% |

Chart of the Day

Latest News

Top 5 things to watch in this week

Pakistan Stock Movers

| Name | Last | Chg/%Chg |

|---|

| Name | Last | Chg/%Chg |

|---|

Savings Mobilized by National Savings Schemes

Savings Mobilized by National Savings Schemes