Oil prices edge higher on easing U.S. Europe tensions

MG News | January 22, 2026 at 10:44 AM GMT+05:00

January 22, 2026 (MLN): Global oil prices edged higher on Thursday as easing geopolitical tensions between the United States and Europe helped improve the outlook for economic growth and fuel demand, while supply disruptions in Central Asia provided additional support.

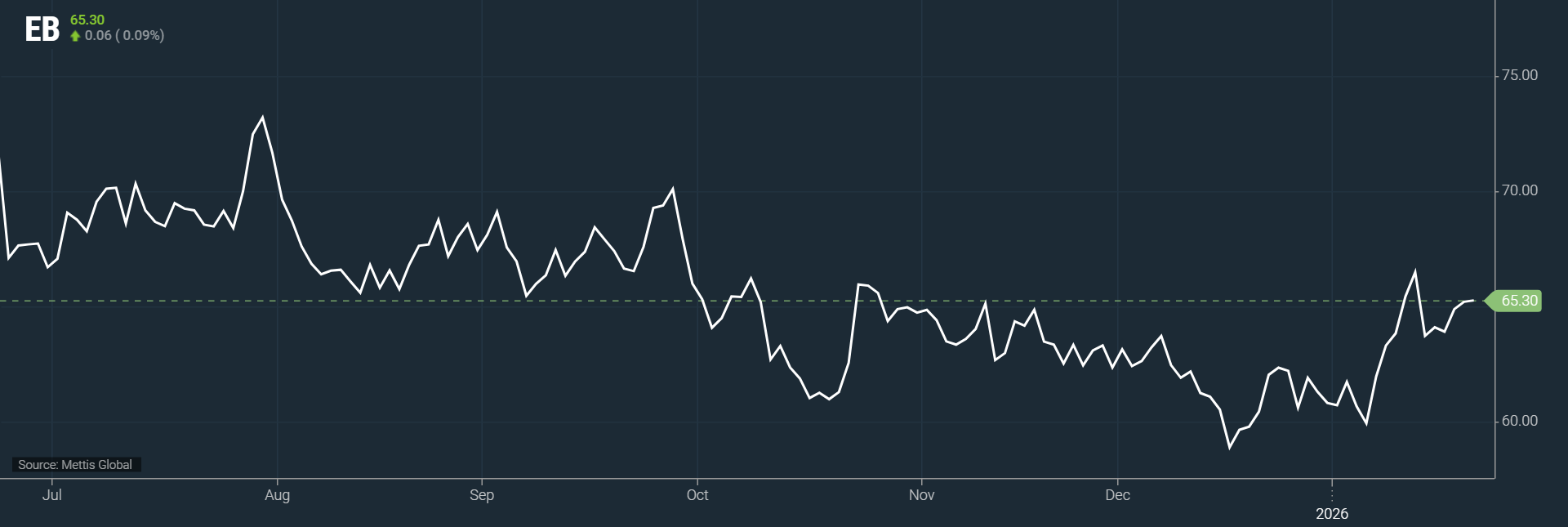

Brent crude futures climbed 6 cents, or 0.09%, to settle

at $65.30 per barrel, according to Mettis Global.

Meanwhile, U.S. West Texas Intermediate (WTI) crude rose

8 cents, or 0.1%, to $60.70 per barrel by 10:34 am PST.

The gains extended a multi-day rally, with oil contracts

advancing more than 1.5% on Tuesday and over 0.4% on Wednesday, following an

unexpected production halt at Kazakhstan’s Tengiz and Korolev oilfields.

Output at the fields was suspended on Sunday due to

power-distribution failures, tightening near-term supply expectations, according to CNBC.

Optimism improved after U.S. President Donald Trump

backed away from threats of imposing tariffs linked to his push to gain control

over Greenland.

On Wednesday, Trump ruled out the use of military force

and signaled that a negotiated framework with Denmark could be close, easing

fears of a major rupture in transatlantic relations.

However, geopolitical risks in the Middle East continue

to underpin prices. Trump stated he hoped there would be no further U.S.

military action involving Iran, while cautioning that Washington would respond

if Tehran restarted its nuclear program.

On the supply side, U.S. inventory data presented a mixed

picture.

American Petroleum Institute (API) figures cited by

market sources showed that U.S. crude oil stocks rose by 3.04m barrels in the

week ended January 16.

Gasoline inventories increased by 6.21m barrels, while

distillate stocks slipped by 33,000 barrels.

Despite inventory pressures, traders remain focused on geopolitical developments and supply disruptions, which continue to shape near-term oil price direction.

Copyright Mettis Link News

Related News

| Name | Price/Vol | %Chg/NChg |

|---|---|---|

| KSE100 | 155,777.21 361.95M | -0.86% -1354.88 |

| ALLSHR | 92,994.52 617.76M | -0.61% -572.34 |

| KSE30 | 47,890.76 137.29M | -0.85% -412.22 |

| KMI30 | 220,015.06 115.44M | -0.35% -783.45 |

| KMIALLSHR | 59,910.72 260.14M | -0.13% -77.81 |

| BKTi | 45,388.60 42.51M | -1.74% -804.48 |

| OGTi | 30,631.34 29.09M | 1.45% 438.24 |

| Symbol | Bid/Ask | High/Low |

|---|

| Name | Last | High/Low | Chg/%Chg |

|---|---|---|---|

| BITCOIN FUTURES | 69,660.00 | 70,020.00 67,615.00 | 1195.00 1.75% |

| BRENT CRUDE | 83.45 | 84.25 81.28 | 2.05 2.52% |

| RICHARDS BAY COAL MONTHLY | 99.40 | 0.00 0.00 | -7.85 -7.32% |

| ROTTERDAM COAL MONTHLY | 124.15 | 0.00 0.00 | -3.85 -3.01% |

| USD RBD PALM OLEIN | 1,083.50 | 1,083.50 1,083.50 | 0.00 0.00% |

| CRUDE OIL - WTI | 76.35 | 76.98 74.37 | 1.79 2.40% |

| SUGAR #11 WORLD | 13.95 | 14.20 13.91 | 0.04 0.29% |

Chart of the Day

Latest News

Top 5 things to watch in this week

Pakistan Stock Movers

| Name | Last | Chg/%Chg |

|---|

| Name | Last | Chg/%Chg |

|---|

Trade Balance

Trade Balance