Oil prices dip amid U.S. China trade uncertainty, supply risks

MG News | October 21, 2025 at 11:35 AM GMT+05:00

October 21, 2025 (MLN): Oil prices extended their decline on Tuesday as renewed uncertainty over global trade and supply dynamics weighed on market sentiment. The drop came despite U.S. President Donald Trump expressing optimism about securing a “fair and strong” trade deal with Chinese President Xi Jinping ahead of their scheduled meeting in South Korea next week.

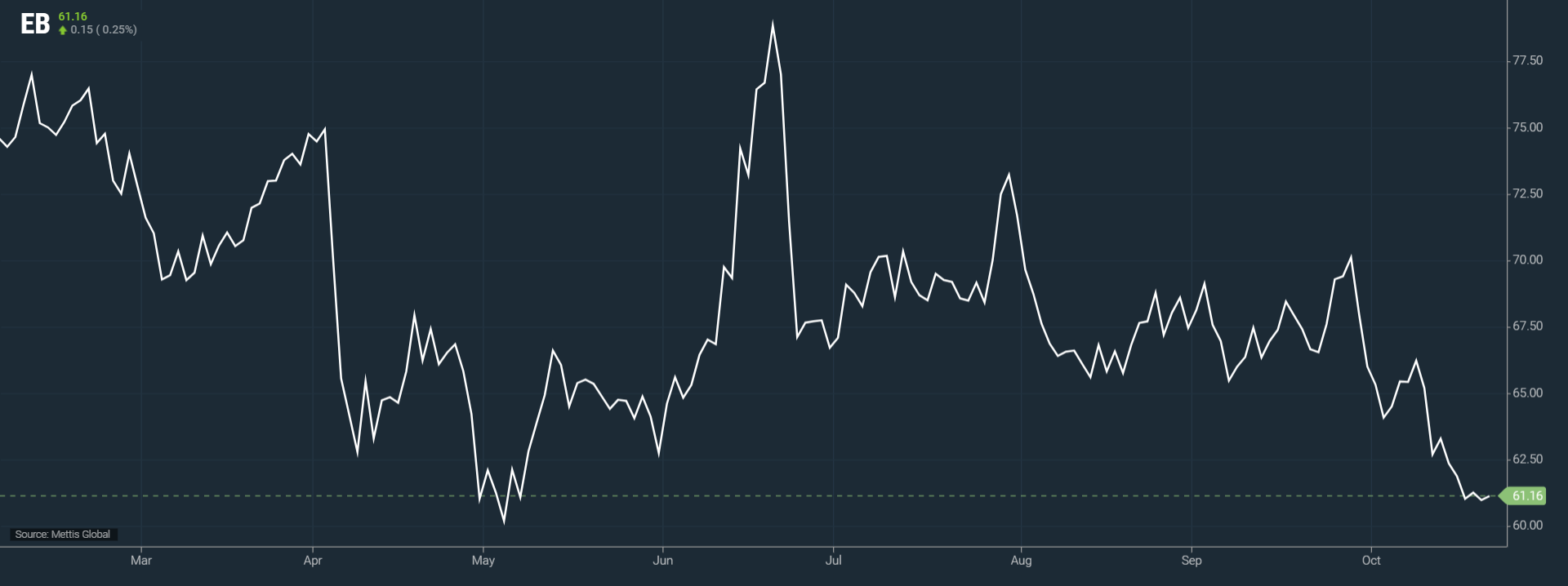

Brent crude futures

went up by $0.15, or 0.25%, to $61.16 per barrel.

West Texas

Intermediate (WTI) crude futures decreased by $0.08, or 0.14%, to $57.60 per

barrel by [11:30 pm] PST.

“I think we’ll end

up with a very strong trade deal. Both of us will be happy,” Trump said on

Monday. However, key disputes over tariffs, technology transfers, and market

access remain unresolved, keeping traders cautious about near-term demand

prospects.

Energy consultancy

Ritterbusch and Associates noted that crude’s short-term outlook remains

bearish, with a preference for “selling into price advances rather than buying

pullbacks.” The firm added that while geopolitical risks could occasionally

support prices, overall oil balances are turning “increasingly negative with

each passing week.”

A preliminary

Reuters poll suggested that U.S. crude inventories likely rose last week, ahead

of official data from the American Petroleum Institute (API) and the Energy

Information Administration (EIA). Rising stockpiles have added to bearish

sentiment as traders brace for signs of oversupply.

Meanwhile,

disruptions in Russia underscored ongoing geopolitical volatility. Rosneft’s

Novokuibyshevsk refinery in the Volga region suspended primary crude processing

after a drone attack on Sunday. Separately, a strike on the Orenburg gas

facility forced neighboring Kazakhstan to reduce output at its Karachaganak oil

and gas condensate field by 25% to 30%.

Uncertainty

surrounding Russian oil supply remains elevated, as President Trump warned

India of “massive” tariffs if it continues purchasing Russian crude. India has

emerged as the largest buyer of discounted Russian oil since Western sanctions

were imposed on Moscow.

Market weakness was

further compounded by a downbeat forecast from the International Energy Agency

(IEA), which last week projected a potential global oil surplus of nearly 4

million barrels per day by 2026. The agency cited rising output from OPEC+ members

and non-OPEC producers alongside sluggish demand recovery as key factors

contributing to the anticipated glut.

The combination of trade tensions, growing inventories, and a looming oversupply outlook has kept crude markets under pressure, with analysts expecting volatility to persist in the near term.

Copyright Mettis Link News

Related News

| Name | Price/Vol | %Chg/NChg |

|---|---|---|

| KSE100 | 167,085.58 225.68M | 0.48% 802.03 |

| ALLSHR | 101,220.72 685.91M | 0.47% 477.65 |

| KSE30 | 50,772.02 134.57M | 0.57% 290.16 |

| KMI30 | 239,923.35 145.03M | 0.77% 1831.31 |

| KMIALLSHR | 66,042.80 345.76M | 0.65% 425.34 |

| BKTi | 45,106.39 29.18M | 0.06% 24.91 |

| OGTi | 33,583.05 26.44M | 1.52% 502.39 |

| Symbol | Bid/Ask | High/Low |

|---|

| Name | Last | High/Low | Chg/%Chg |

|---|---|---|---|

| BITCOIN FUTURES | 89,425.00 | 0.00 0.00 | -175.00 -0.20% |

| BRENT CRUDE | 63.86 | 64.09 63.06 | 0.60 0.95% |

| RICHARDS BAY COAL MONTHLY | 91.00 | 0.00 0.00 | 0.10 0.11% |

| ROTTERDAM COAL MONTHLY | 97.25 | 97.25 97.25 | 0.05 0.05% |

| USD RBD PALM OLEIN | 1,016.00 | 1,016.00 1,016.00 | 0.00 0.00% |

| CRUDE OIL - WTI | 60.14 | 0.00 0.00 | 0.06 0.10% |

| SUGAR #11 WORLD | 14.82 | 15.02 14.73 | -0.06 -0.40% |

Chart of the Day

Latest News

Top 5 things to watch in this week

Pakistan Stock Movers

| Name | Last | Chg/%Chg |

|---|

| Name | Last | Chg/%Chg |

|---|

Savings Mobilized by National Savings Schemes

Savings Mobilized by National Savings Schemes