Gold prices edge lower as investors take profits after record highs

MG News | October 21, 2025 at 11:38 AM GMT+05:00

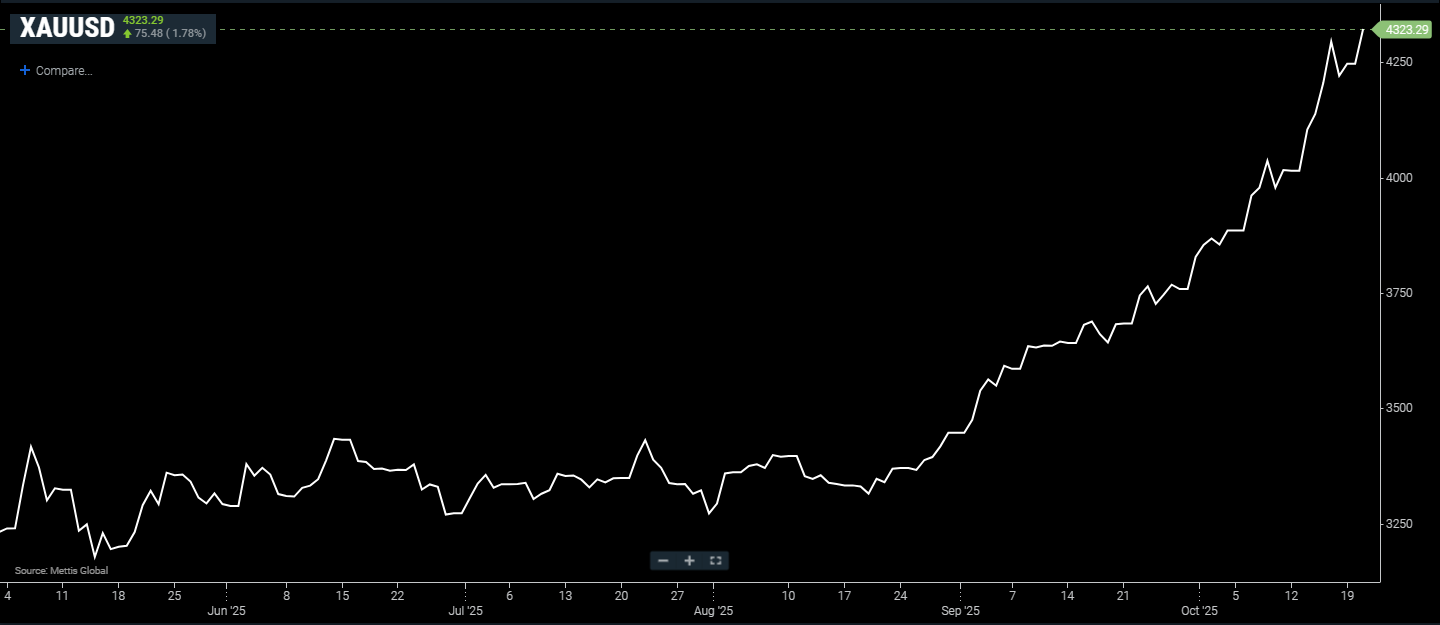

October 21, 2025 (MLN): Gold prices dipped slightly on Tuesday as investors locked in profits following bullion’s record-breaking rally in the previous session, driven by optimism over potential U.S. Federal Reserve rate cuts and robust safe-haven demand.

Spot gold was steady after a small dip, 1.78% at $4,323.29 an ounce as of [11:31 am] PST, according to data reported by Mettis Global.

U.S. gold futures

for December delivery slipped 0.1% to $4,356.40 per ounce.

“Profit-taking and a

cooling of safe-haven flows took some shine off gold today. However, any dips

are likely to be seen as buying opportunities while the Fed continues on its

rate-cutting path,” said Tim Waterer, Chief Market Analyst at KCM

Trade to CNBC.

Markets are

currently pricing in a quarter-point rate cut from the Fed this month,

with another expected in December, according to the CME FedWatch Tool.

Gold, a non-yielding asset, typically benefits in a lower interest rate

environment.

“The gold rally

still has room to move higher, provided the upcoming U.S. CPI data doesn’t

surprise to the upside,” Waterer added.

Meanwhile, the U.S.

government shutdown entered its 20th day on Monday as lawmakers failed

again to reach an agreement. White House economic adviser Kevin Hassett

suggested the impasse could end later this week.

The delay in key

economic reports has left both investors and policymakers with limited data

ahead of the Fed’s meeting next week.

On the trade front, U.S.

Treasury Secretary Scott Bessent is set to meet Chinese Vice Premier He

Lifeng in Malaysia this week, aiming to prevent a further escalation of

U.S. tariffs on Chinese goods.

In other precious metals, spot silver fell 1.6% to $51.64 per ounce, platinum declined 0.7% to $1,627.62, while palladium edged 0.5% higher to $1,503.17.

Related News

| Name | Price/Vol | %Chg/NChg |

|---|---|---|

| KSE100 | 167,085.58 225.68M | 0.48% 802.03 |

| ALLSHR | 101,220.72 685.91M | 0.47% 477.65 |

| KSE30 | 50,772.02 134.57M | 0.57% 290.16 |

| KMI30 | 239,923.35 145.03M | 0.77% 1831.31 |

| KMIALLSHR | 66,042.80 345.76M | 0.65% 425.34 |

| BKTi | 45,106.39 29.18M | 0.06% 24.91 |

| OGTi | 33,583.05 26.44M | 1.52% 502.39 |

| Symbol | Bid/Ask | High/Low |

|---|

| Name | Last | High/Low | Chg/%Chg |

|---|---|---|---|

| BITCOIN FUTURES | 89,425.00 | 0.00 0.00 | -175.00 -0.20% |

| BRENT CRUDE | 63.86 | 64.09 63.06 | 0.60 0.95% |

| RICHARDS BAY COAL MONTHLY | 91.00 | 0.00 0.00 | 0.10 0.11% |

| ROTTERDAM COAL MONTHLY | 97.25 | 97.25 97.25 | 0.05 0.05% |

| USD RBD PALM OLEIN | 1,016.00 | 1,016.00 1,016.00 | 0.00 0.00% |

| CRUDE OIL - WTI | 60.14 | 0.00 0.00 | 0.06 0.10% |

| SUGAR #11 WORLD | 14.82 | 15.02 14.73 | -0.06 -0.40% |

Chart of the Day

Latest News

Top 5 things to watch in this week

Pakistan Stock Movers

| Name | Last | Chg/%Chg |

|---|

| Name | Last | Chg/%Chg |

|---|

Savings Mobilized by National Savings Schemes

Savings Mobilized by National Savings Schemes