Oil markets lose steam ahead of OPEC+ Meeting

MG News | October 31, 2025 at 12:20 PM GMT+05:00

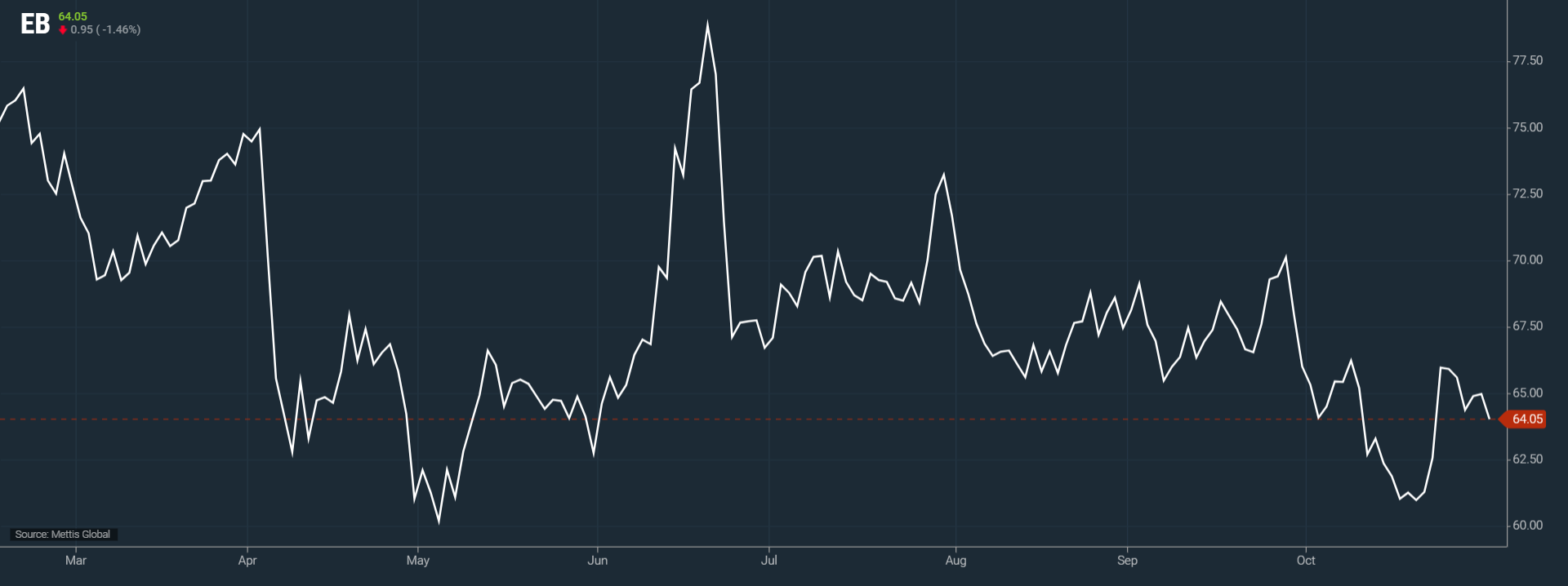

October 31, 2025 (MLN): Oil prices slipped on Friday, on track for a third consecutive monthly drop, as a stronger U.S. dollar and disappointing economic data from China limited upward momentum. Meanwhile, increasing global output from major producers continued to outweigh the effects of Western sanctions on Russian exports.

Brent crude futures went up by $0.95, or 1.46%, to $64.05

per barrel.

West Texas Intermediate (WTI) crude futures decreased by

$0.30, or 0.50%, to $60.27 per barrel by [11:45 am] PST.

According to ANZ analysts, “a stronger USD weighed on

investor appetite across the commodities complex.” The greenback strengthened

after U.S. Federal Reserve Chair Jerome Powell cautioned on Wednesday that a

rate cut in December was not assured, dampening risk appetite across markets.

Adding to the bearish tone, an official survey revealed that

China’s manufacturing sector contracted for the seventh consecutive month in

October, underscoring persistent weakness in the world’s second-largest oil

consumer.

Both benchmark contracts Brent and West Texas Intermediate

(WTI) are poised to drop about 3% in October, marking the third straight month

of losses.

Analysts attributed the decline to expectations that rising

global production will outpace demand growth this year, as members of the

Organization of the Petroleum Exporting Countries (OPEC) and major non-OPEC

producers continue to ramp up output to secure greater market share.

OPEC+ is leaning toward a modest production increase in

December, ahead of its scheduled meeting on Sunday. The alliance has already

boosted output targets by more than 2.7m barrels per day (bpd) roughly 2.5% of

global supply through a series of monthly hikes.

Fresh data from the Joint Organizations Data Initiative

(JODI) showed Saudi Arabia’s crude exports reached a six-month high of 6.407m

bpd in August and are expected to climb further in the coming months.

Meanwhile, the U.S. Energy Information Administration (EIA)

reported record crude production of 13.6m bpd last week, adding to global

supply pressures.

On the geopolitical front, U.S. President Donald Trump informed

Thursday that China has agreed to begin purchasing U.S. energy, including a

potential large-scale deal involving oil and gas from Alaska.

However, market analysts questioned whether such an

agreement would meaningfully lift Chinese demand.

“Alaska produces only 3% of total U.S. crude output, which

is not significant,” said Barclays analyst Michael McLean. “We believe any

Chinese purchases of Alaskan LNG would likely be market-driven rather than

politically motivated.”

Overall, with ample supply from major producers and weak

demand indicators from China, oil markets remain under pressure setting up a

cautious tone heading into the OPEC+ meeting this weekend.

Copyright Mettis

Link News

Related News

| Name | Price/Vol | %Chg/NChg |

|---|---|---|

| KSE100 | 167,085.58 225.68M | 0.48% 802.03 |

| ALLSHR | 101,220.72 685.91M | 0.47% 477.65 |

| KSE30 | 50,772.02 134.57M | 0.57% 290.16 |

| KMI30 | 239,923.35 145.03M | 0.77% 1831.31 |

| KMIALLSHR | 66,042.80 345.76M | 0.65% 425.34 |

| BKTi | 45,106.39 29.18M | 0.06% 24.91 |

| OGTi | 33,583.05 26.44M | 1.52% 502.39 |

| Symbol | Bid/Ask | High/Low |

|---|

| Name | Last | High/Low | Chg/%Chg |

|---|---|---|---|

| BITCOIN FUTURES | 89,425.00 | 92,995.00 88,405.00 | -3415.00 -3.68% |

| BRENT CRUDE | 63.86 | 64.09 63.06 | 0.60 0.95% |

| RICHARDS BAY COAL MONTHLY | 91.00 | 0.00 0.00 | 0.10 0.11% |

| ROTTERDAM COAL MONTHLY | 97.25 | 97.25 97.25 | 0.05 0.05% |

| USD RBD PALM OLEIN | 1,016.00 | 1,016.00 1,016.00 | 0.00 0.00% |

| CRUDE OIL - WTI | 60.14 | 60.50 59.42 | 0.47 0.79% |

| SUGAR #11 WORLD | 14.82 | 15.02 14.73 | -0.06 -0.40% |

Chart of the Day

Latest News

Top 5 things to watch in this week

Pakistan Stock Movers

| Name | Last | Chg/%Chg |

|---|

| Name | Last | Chg/%Chg |

|---|

Savings Mobilized by National Savings Schemes

Savings Mobilized by National Savings Schemes