Oil gains as Fed holds rates, Trump signals uncertainty on Mideast

MG News | June 19, 2025 at 01:20 PM GMT+05:00

June 19, 2025 (MLN): Oil prices rose on Thursday as investors remained cautious, holding back from taking new positions following mixed signals from former President Donald Trump regarding possible U.S. involvement in the ongoing Israel-Iran conflict.

At the same time, the U.S. Federal Reserve left interest rates unchanged,

adding another layer of market hesitation.

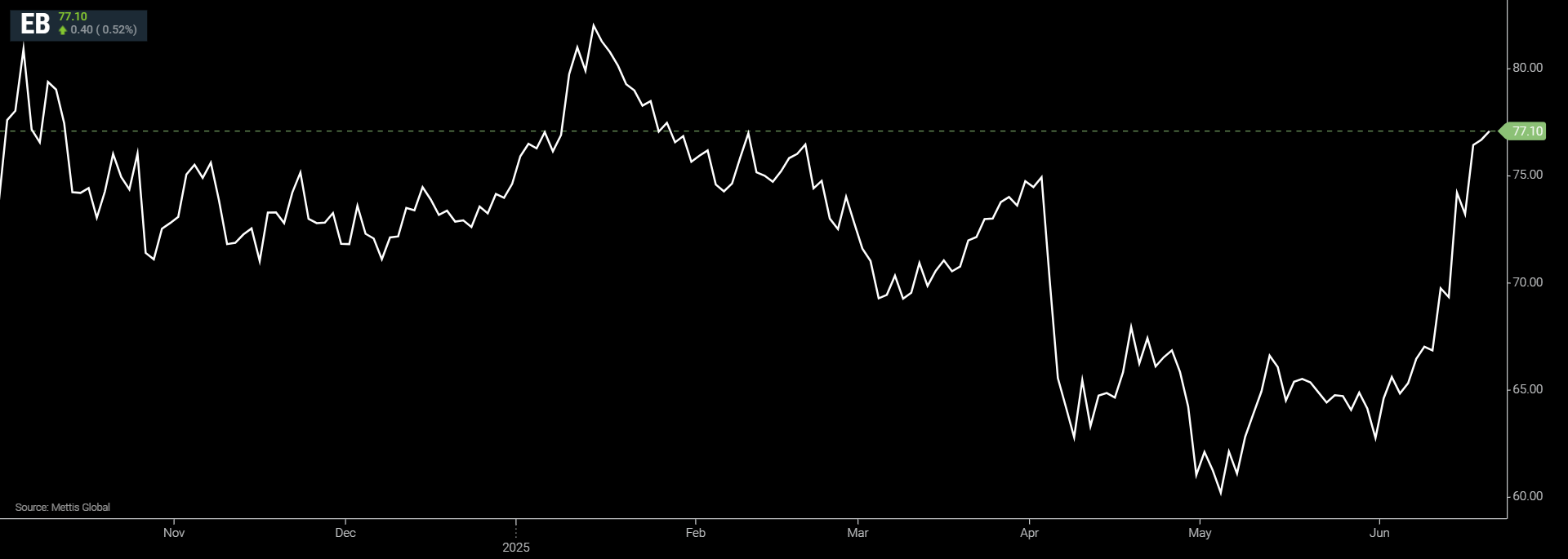

Brent crude futures climbed by $0.40, or 0.52%,

to $77.10 a barrel.

However, the more actively traded August contract saw a slight decline of 8

cents, or 0.11%, to $73.42 per barrel, with the July contract set to expire on

Friday.

According to Tony Sycamore, market analyst at

IG, a “healthy risk premium” is already priced in, as traders await clarity on

whether the next phase of the Israel-Iran conflict will involve a U.S. military

strike or a move toward peace talks.

Goldman Sachs, in a note issued Wednesday, stated that a geopolitical risk

premium of around $10 per barrel is warranted, citing reduced Iranian supply

and the potential for wider disruption that could push Brent prices above $90.

On Wednesday, Trump told reporters he

"may or may not" decide whether the U.S. will support Israel in its

strikes on Iran.

The conflict entered its seventh day on Thursday, and analysts warn that

direct U.S. involvement would broaden the conflict and increase risks to the

region’s energy infrastructure.

Given Trump’s unpredictable foreign policy track record, markets remain

volatile. “Markets remain jittery, awaiting firmer signals that could influence

global oil supply and regional stability,” said Priyanka Sachdeva, senior

market analyst at Phillip Nova.

Iran, which extracts about 3.3 million barrels

per day (bpd) of crude oil, is the third-largest producer in the Organization

of the Petroleum Exporting Countries (OPEC).

The Strait of Hormuz, along Iran’s southern coast, sees the transit of

approximately 19m bpd of oil and oil products, raising concerns that the

conflict could disrupt vital trade flows.

Meanwhile,

the U.S. Federal Reserve kept its interest rates steady on Wednesday but

indicated two potential cuts by the end of the year.

Chair Jerome Powell said these cuts would be “data-dependent,” and noted

that the Fed anticipates increased consumer inflation stemming from Trump's

proposed import tariffs.

While lower interest rates could stimulate economic growth and boost oil

demand, they also pose the risk of intensifying inflation.

Copyright Mettis Link News

Related News

| Name | Price/Vol | %Chg/NChg |

|---|---|---|

| KSE100 | 134,299.77 290.06M |

0.39% 517.42 |

| ALLSHR | 84,018.16 764.12M |

0.48% 402.35 |

| KSE30 | 40,814.29 132.59M |

0.33% 132.52 |

| KMI30 | 192,589.16 116.24M |

0.49% 948.28 |

| KMIALLSHR | 56,072.25 387.69M |

0.32% 180.74 |

| BKTi | 36,971.75 19.46M |

-0.05% -16.94 |

| OGTi | 28,240.28 6.19M |

0.21% 58.78 |

| Symbol | Bid/Ask | High/Low |

|---|

| Name | Last | High/Low | Chg/%Chg |

|---|---|---|---|

| BITCOIN FUTURES | 118,140.00 | 119,450.00 115,635.00 |

4270.00 3.75% |

| BRENT CRUDE | 70.63 | 70.71 68.55 |

1.99 2.90% |

| RICHARDS BAY COAL MONTHLY | 97.50 | 0.00 0.00 |

1.10 1.14% |

| ROTTERDAM COAL MONTHLY | 108.75 | 108.75 108.75 |

0.40 0.37% |

| USD RBD PALM OLEIN | 998.50 | 998.50 998.50 |

0.00 0.00% |

| CRUDE OIL - WTI | 68.75 | 68.77 66.50 |

2.18 3.27% |

| SUGAR #11 WORLD | 16.56 | 16.60 16.20 |

0.30 1.85% |

Chart of the Day

Latest News

Top 5 things to watch in this week

Pakistan Stock Movers

| Name | Last | Chg/%Chg |

|---|

| Name | Last | Chg/%Chg |

|---|

MTB Auction

MTB Auction