Loan demand surges to 85 in Q2-FY26: SBP

MG News | February 11, 2026 at 10:32 AM GMT+05:00

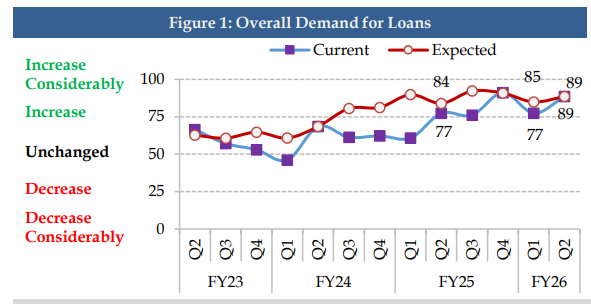

February 11, 2026 (MLN): Current loan demand has surged to 85, up from 84 in Q1-FY26, showing sustained momentum in borrowing activity, according to the latest Bank Lending Survey (BLS) for Q2-FY26, conducted by the State Bank of Pakistan (SBP).

Meanwhile, expected loan demand has climbed to 89,

indicating robust appetite for credit across businesses and consumers.

This upward trajectory continues to be primarily driven by

monetary policy decisions, improved security conditions, and enhanced

perceptions of general economic activity across various sectors.

Sector-Wise Growth

Loan demand increased across all major sectors except

consumer lending, which saw a slight moderation.

The agricultural sector experienced notable growth, with

demand rising from 74 in Q1-FY26 to 79 in Q2-FY26, marking a significant

improvement in rural financing needs.

The corporate sector saw steady expansion from 80 to 84

quarter-on-quarter, indicating sustained business growth and investment

activities.

The SME sector recorded the most impressive growth, with

demand jumping from 73 to 82, showing increasing entrepreneurial activity and

working capital requirements.

Consumer loans witnessed a marginal decline from 87 to 85,

though remaining in the "Increase Considerably" zone, suggesting

continued household borrowing albeit at a slightly moderated pace.

On a year-on-year basis, all sectors showed positive

momentum, with agricultural loans rising from 74 to 79, corporate sector from

78 to 84, SME sector from 77 to 82, and consumer loans from 82 to 85.

Loan Applications

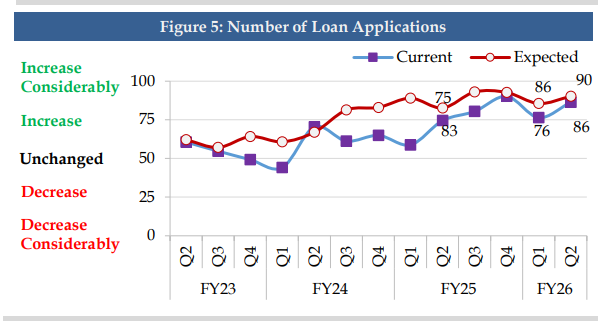

A continued rise in loan applications was observed, with the

current number increasing to 86, up from 76 in Q1-FY26.

Similarly, the expected number of applications improved to

90, up from 86 in the previous quarter, indicating strong future credit demand.

Borrowing Costs

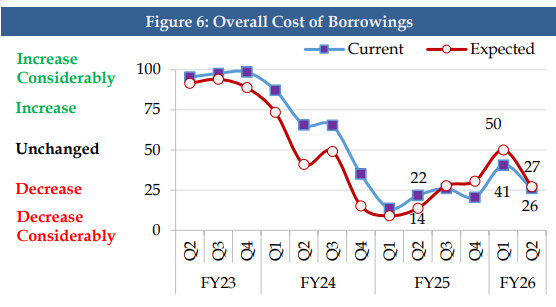

Borrowing costs remain favorable for businesses and

consumers in Q2-FY26.

The index for overall current borrowing costs stands at 27,

positioned in the "Decrease" zone.

At the same time, the availability of expected funds has

reached the "Increase Considerably" territory at 80, up from 74 in

Q1-FY26, showing significantly enhanced liquidity conditions within the banking

sector.

The current availability of funds has also improved,

standing at 74, though slightly lower than the previous year’s quarter 76,

indicating healthy liquidity levels supporting loan disbursements.

Key Drivers

The increase in loan demand continues to be largely

attributed to monetary policy decisions, which remained the dominant factor

with an index score of 82.

Other contributing factors include inventories and working capital requirements at 77, security conditions at 60, general economic activity at 66, seasonal effects at 69, and fixed investment needs at 66.

Copyright Mettis Link News

Related News

| Name | Price/Vol | %Chg/NChg |

|---|---|---|

| KSE100 | 182,947.56 165.65M | 0.44% 794.01 |

| ALLSHR | 109,845.51 300.26M | 0.37% 410.11 |

| KSE30 | 56,020.17 35.56M | 0.45% 248.92 |

| KMI30 | 259,663.44 81.14M | 0.67% 1732.86 |

| KMIALLSHR | 70,809.37 215.24M | 0.49% 347.85 |

| BKTi | 52,768.51 13.81M | 0.09% 45.49 |

| OGTi | 36,479.68 1.52M | 0.05% 16.75 |

| Symbol | Bid/Ask | High/Low |

|---|

| Name | Last | High/Low | Chg/%Chg |

|---|---|---|---|

| BITCOIN FUTURES | 67,220.00 | 69,415.00 66,715.00 | -1715.00 -2.49% |

| BRENT CRUDE | 69.24 | 69.46 69.00 | 0.44 0.64% |

| RICHARDS BAY COAL MONTHLY | 96.00 | 0.00 0.00 | 0.40 0.42% |

| ROTTERDAM COAL MONTHLY | 101.95 | 102.30 101.60 | -0.35 -0.34% |

| USD RBD PALM OLEIN | 1,071.50 | 1,071.50 1,071.50 | 0.00 0.00% |

| CRUDE OIL - WTI | 64.40 | 64.63 64.15 | 0.44 0.69% |

| SUGAR #11 WORLD | 14.11 | 14.34 14.08 | -0.24 -1.67% |

Chart of the Day

Latest News

Top 5 things to watch in this week

Pakistan Stock Movers

| Name | Last | Chg/%Chg |

|---|

| Name | Last | Chg/%Chg |

|---|

Workers' Remittances

Workers' Remittances