INDU- Driving growth

By MG News | August 27, 2021 at 11:21 AM GMT+05:00

August 27, 2021 (MLN): Indus Motor Company Limited (INDU) has unveiled its financial results for the year ended June 30, 2021, whereby the company has made net profits of Rs12.83 billion, showing an extraordinary growth of 2.5x YoY when compared to net profits of Rs5.08bn reported in the same period last year (SPLY).

This has translated into earnings per share (EPS) of Rs163.21 which significantly increased by 2.5 times YoY against EPS of Rs64.66.

This robust growth may be attributable to volumetric sales growth due to lower interest rate, revival of economic activity post-lockdown and improved gross margins amid PKR appreciation against USD.

During the period under review, the topline witnessed a two-fold increase to Rs179bn owing to volumetric growth of 102% YoY to 57,236 units against 28,378 units in FY20. Resultantly, the gross profit of the company surged to Rs16.65bn, up by 2.23x YoY, expanding gross margins from 8.65% to 9.30%.

The company posted a 74% YoY rise in other income mainly on the higher dividends from AUMs, higher interest income from PIBs, capital gain on T-bills in the midst of low yields along with the interest on TDRs, a research note by Shajar Securities highlighted.

Along with the financial results, the company announced a final cash dividend of Rs36.50 per share, bringing the full year cash dividend to Rs103.50 per share.

|

Financial results for the year ended June 30th 2021 ('000 Rupees) |

|||

|---|---|---|---|

|

|

Jun-21 |

Jun-20 |

% Change |

|

Revenue from contracts with customers |

179,161,727 |

86,167,016 |

107.92% |

|

Cost of sales |

(162,508,017) |

(78,716,157) |

106.45% |

|

Gross profit |

16,653,710 |

7,450,859 |

123.51% |

|

Distribution expenses |

(1,618,863) |

(1,468,603) |

10.23% |

|

Administrative expenses |

(1,464,888) |

(1,385,099) |

5.76% |

|

Other operating expenses |

(76,342) |

(196,999) |

-61.25% |

|

Workers' Profit Participation Fund and Workers' Welfare Fund |

(740,193) |

(231,934) |

219.14% |

|

Other income |

5,579,339 |

3,204,872 |

74.09% |

|

Finance cost |

(133,570) |

(85,737) |

55.79% |

|

Profit before taxation |

18,199,193 |

7,287,359 |

149.74% |

|

Taxation |

(5,370,601) |

(2,205,332) |

143.53% |

|

Profit after taxation |

12,828,592 |

5,082,027 |

152.43% |

|

Earnings per share - basic and diluted (Rupees) |

163.21 |

64.66 |

152.41% |

|

Financial results for the year ended June 30th 2021 ('000 Rupees) |

|

|

|

|

|

Jun-21 |

Jun-20 |

% Change |

|

Revenue from contracts with customers |

179,161,727 |

86,167,016 |

107.92% |

|

Cost of sales |

(162,508,017) |

(78,716,157) |

106.45% |

|

Gross profit |

16,653,710 |

7,450,859 |

123.51% |

|

Distribution expenses |

(1,618,863) |

(1,468,603) |

10.23% |

|

Administrative expenses |

(1,464,888) |

(1,385,099) |

5.76% |

|

Other operating expenses |

(76,342) |

(196,999) |

-61.25% |

|

Workers' Profit Participation Fund and Workers' Welfare Fund |

(740,193) |

(231,934) |

219.14% |

|

Other income |

5,579,339 |

3,204,872 |

74.09% |

|

Finance cost |

(133,570) |

(85,737) |

55.79% |

|

Profit before taxation |

18,199,193 |

7,287,359 |

149.74% |

|

Taxation |

(5,370,601) |

(2,205,332) |

143.53% |

|

Profit after taxation |

12,828,592 |

5,082,027 |

152.43% |

|

Earnings per share - basic and diluted (Rupees) |

163.21 |

64.66 |

152.41% |

Copyright Mettis Link News

Related News

| Name | Price/Vol | %Chg/NChg |

|---|---|---|

| KSE100 | 131,949.07 198.95M |

0.97% 1262.41 |

| ALLSHR | 82,069.26 730.83M |

0.94% 764.01 |

| KSE30 | 40,387.76 80.88M |

1.11% 442.31 |

| KMI30 | 191,376.82 77.76M |

0.36% 678.77 |

| KMIALLSHR | 55,193.97 350.11M |

0.22% 119.82 |

| BKTi | 35,828.25 28.42M |

3.64% 1259.85 |

| OGTi | 28,446.34 6.84M |

-1.02% -293.01 |

| Symbol | Bid/Ask | High/Low |

|---|

| Name | Last | High/Low | Chg/%Chg |

|---|---|---|---|

| BITCOIN FUTURES | 108,125.00 | 110,525.00 107,865.00 |

-2290.00 -2.07% |

| BRENT CRUDE | 68.51 | 68.89 67.75 |

-0.29 -0.42% |

| RICHARDS BAY COAL MONTHLY | 97.50 | 0.00 0.00 |

0.75 0.78% |

| ROTTERDAM COAL MONTHLY | 106.00 | 106.00 105.85 |

-2.20 -2.03% |

| USD RBD PALM OLEIN | 998.50 | 998.50 998.50 |

0.00 0.00% |

| CRUDE OIL - WTI | 66.50 | 67.18 66.04 |

-0.50 -0.75% |

| SUGAR #11 WORLD | 16.37 | 16.40 15.44 |

0.79 5.07% |

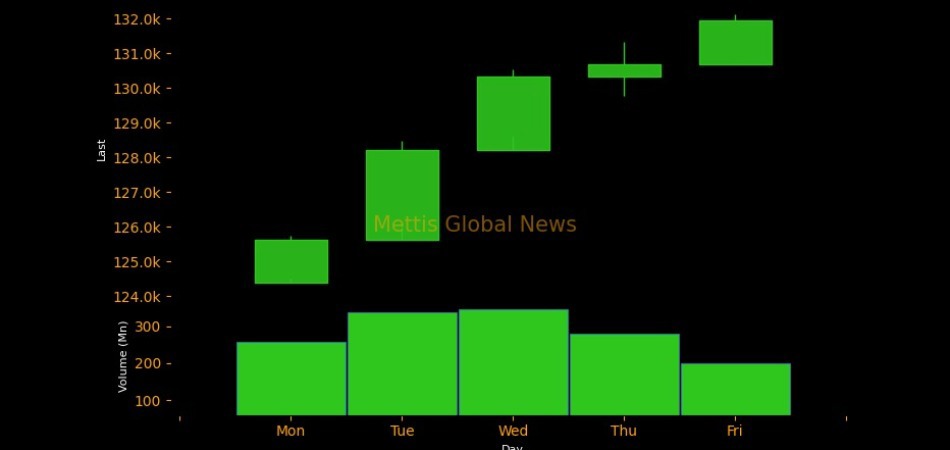

Chart of the Day

Latest News

Top 5 things to watch in this week

Pakistan Stock Movers

| Name | Last | Chg/%Chg |

|---|

| Name | Last | Chg/%Chg |

|---|

Central Government Debt

Central Government Debt

CPI

CPI