HSBC stays bullish, bets on AI, Fed cuts

MG News | September 29, 2025 at 09:54 AM GMT+05:00

September 29, 2025 (MLN): HSBC Private Banking’s Global Investment Committee has reaffirmed its bullish stance on equities, citing a “positive cocktail” of AI-driven innovation, U.S. Federal Reserve rate cuts, and supportive corporate actions such as M&A, dividends, and share buybacks.

The Committee said it will continue overweighting U.S. equities, technology, and communication services, while emphasizing the need for diversification amid high U.S. valuations and a weakening dollar.

Fed Policy Shifts

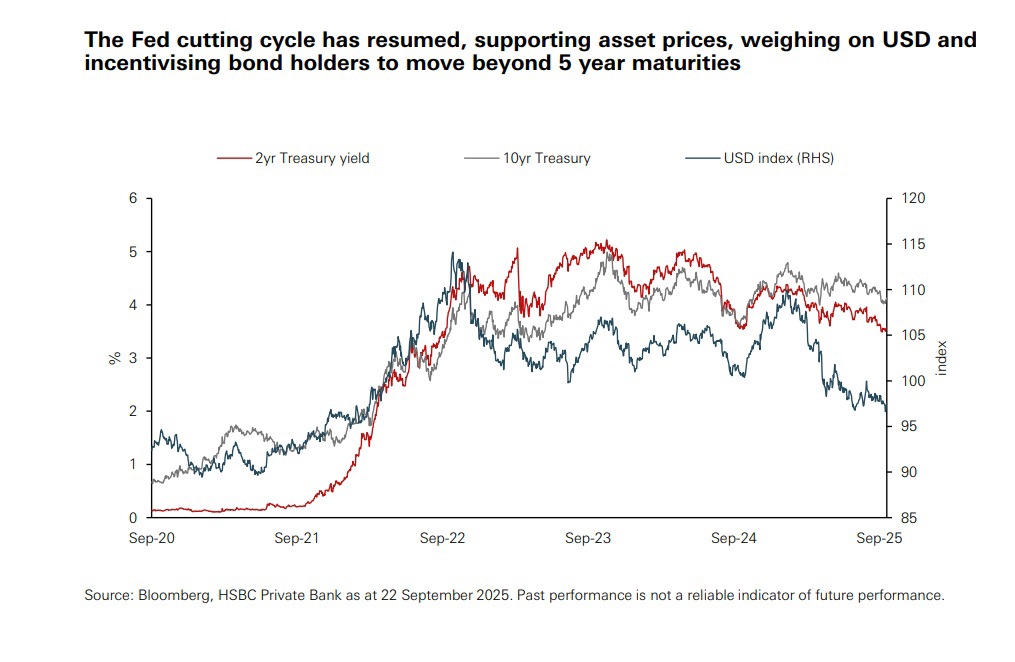

Following the Fed’s 25-basis-point cut in September, HSBC now expects 50 basis points in total cuts by year-end, bringing the policy rate to 3.50–3.75%.

“As cash rates fall, bond yields should come down too, so we want to lock them in now and put cash to work,” the Committee noted while maintaining a preference for quality investment-grade bonds and extending duration beyond five years.

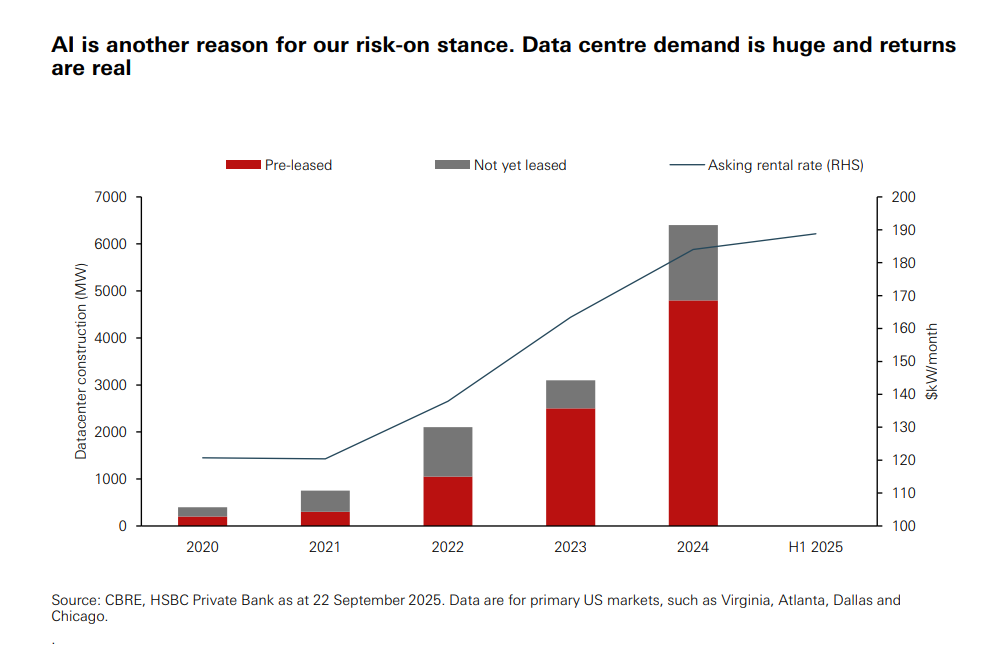

AI as a Structural Growth Driver

Artificial intelligence remains central to HSBC’s investment thesis. The bank pointed to strong earnings from AI-related companies, surging demand for data centers, and accelerating monetization across the AI ecosystem.

It sees opportunities not just in U.S. tech giants, but also in Chinese technology firms trading at steep discounts to global peers.

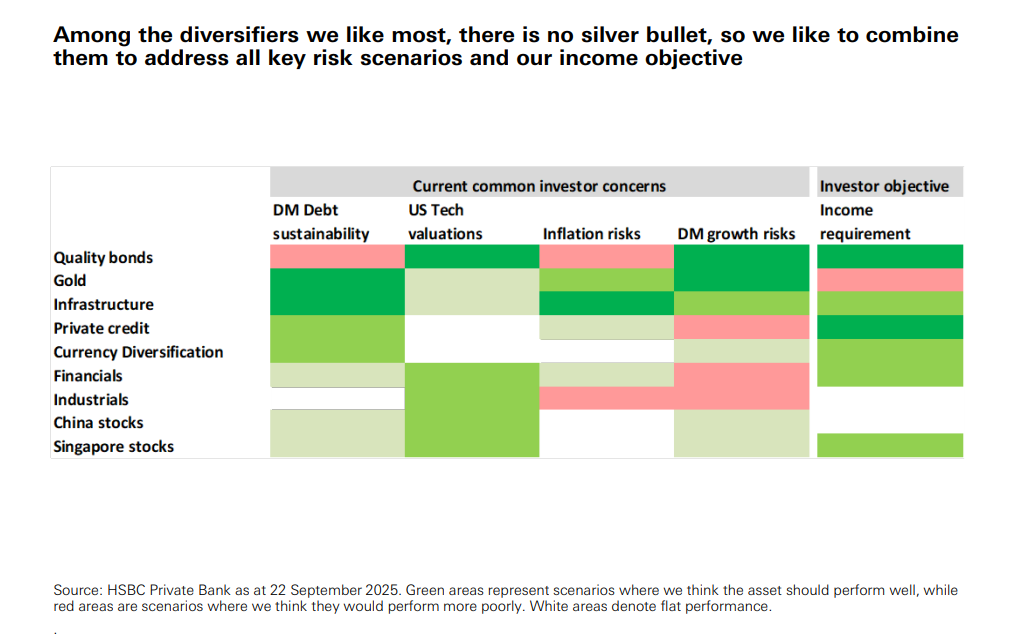

Diversification to Manage Risks

While maintaining a mild risk-on tilt, HSBC advised clients to hedge risks through alternatives, multi-asset strategies, and volatility plays.

It highlighted gold, hedge funds, private equity, and infrastructure as effective diversifiers in an environment of stretched valuations and lingering tariff uncertainties.

Asia in Focus

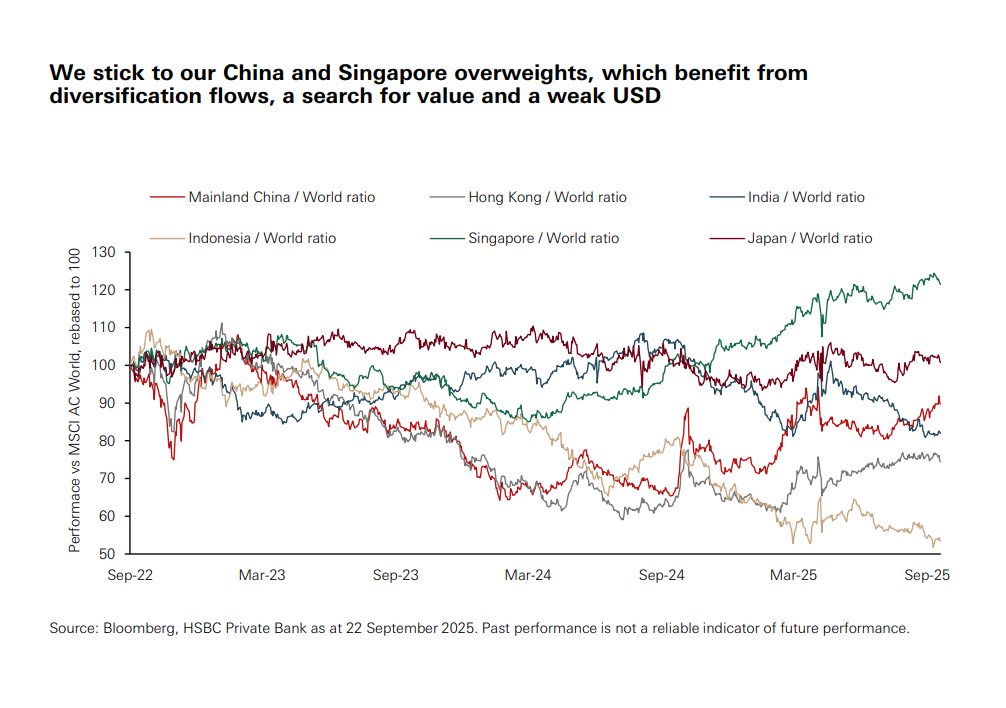

HSBC also reiterated its overweight on China and Singapore, citing policy stimulus, AI innovation, and corporate governance reforms. The bank’s “High Conviction” themes include China’s Innovation Champions and Power Up Asian Shareholder Returns.

It added that a weaker dollar and Fed easing should further boost Asian markets.

“Even bulls like us should diversify,” the report concluded, indicating four investment priorities: quality bonds, AI adoption, risk-mitigation strategies, and Asia’s policy-driven growth.

Copyright Mettis Link News

Related News

| Name | Price/Vol | %Chg/NChg |

|---|---|---|

| KSE100 | 167,085.58 225.68M | 0.48% 802.03 |

| ALLSHR | 101,220.72 685.91M | 0.47% 477.65 |

| KSE30 | 50,772.02 134.57M | 0.57% 290.16 |

| KMI30 | 239,923.35 145.03M | 0.77% 1831.31 |

| KMIALLSHR | 66,042.80 345.76M | 0.65% 425.34 |

| BKTi | 45,106.39 29.18M | 0.06% 24.91 |

| OGTi | 33,583.05 26.44M | 1.52% 502.39 |

| Symbol | Bid/Ask | High/Low |

|---|

| Name | Last | High/Low | Chg/%Chg |

|---|---|---|---|

| BITCOIN FUTURES | 89,425.00 | 92,995.00 88,405.00 | -3415.00 -3.68% |

| BRENT CRUDE | 63.86 | 64.09 63.06 | 0.60 0.95% |

| RICHARDS BAY COAL MONTHLY | 91.00 | 0.00 0.00 | 0.10 0.11% |

| ROTTERDAM COAL MONTHLY | 97.25 | 97.25 97.25 | 0.05 0.05% |

| USD RBD PALM OLEIN | 1,016.00 | 1,016.00 1,016.00 | 0.00 0.00% |

| CRUDE OIL - WTI | 60.14 | 60.50 59.42 | 0.47 0.79% |

| SUGAR #11 WORLD | 14.82 | 15.02 14.73 | -0.06 -0.40% |

Chart of the Day

Latest News

Top 5 things to watch in this week

Pakistan Stock Movers

| Name | Last | Chg/%Chg |

|---|

| Name | Last | Chg/%Chg |

|---|

Savings Mobilized by National Savings Schemes

Savings Mobilized by National Savings Schemes