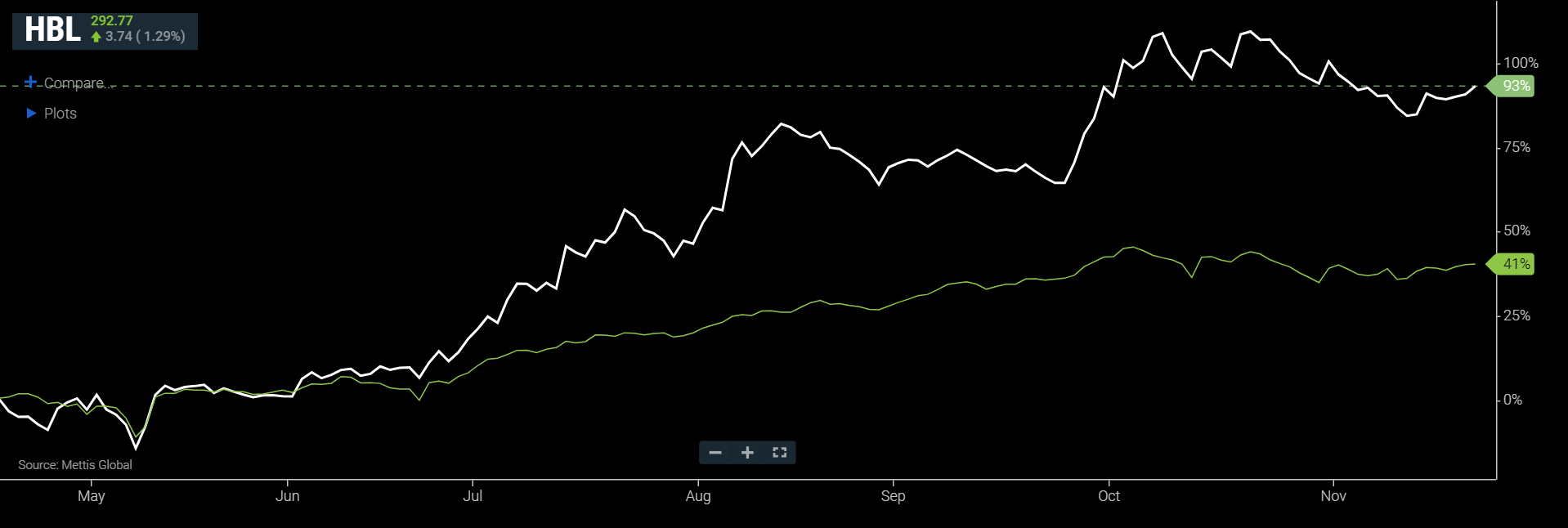

HBL eyes strong deposit growth and operational efficiency

_20251104162633356_667cfa.jpg?width=950&height=450&format=Webp)

MG News | November 21, 2025 at 11:08 AM GMT+05:00

November 21, 2025 (MLN): Habib Bank Limited (PSX:HBL) is

set to strengthen its position in Pakistan’s banking sector, with management

targeting a current account (CA) mix exceeding 40% to sustain margins and

support low-cost funding.

The bank also plans to continue expanding its Islamic

banking footprint, particularly in Khyber Pakhtunkhwa, while focusing on

digital payments and consumer lending to drive growth.

Management expects interest rates to remain stable in the

near term, with inflation only modestly rising by year-end, supporting a

predictable operating environment for the bank.

The bank held its corporate briefing today, providing

detailed insights into its strategic initiatives and operational performance.

HBL emphasized its ongoing transformation, including the

conversion of 458 branches to Islamic banking, with an additional 143 planned for their customer base of 40m plus users.

Management highlighted efforts to improve operational

efficiency, noting that the domestic cost-to-income ratio currently stands at

49.8%, with plans to further optimize international operations.

The bank continues to

strengthen its digital offerings, with mobile banking payments reaching Rs8tn

in 9M2025 and digital transactions accounting for 92% of total activity.

During 9MCY25, HBL reported consolidated profit after tax of

Rs51bn up 19% YoY from same period last year.

Net interest income (NII) grew 11% YoY, supported by strong

growth in CA deposits, reduction in costs of deposits, and increased allocation

to floating-rate government securities.

The bank’s total deposits expanded to Rs5.1tn from 4.4tn

last year, with current accounts increasing to Rs1.9tn.

Asset quality improved, with the infection ratio at 4.9% in September

2025 a 0.1% decrease from June. The bank’s capital adequacy ratio (CAR) stood

at a robust 18.32%, well above regulatory requirements and 62bps points higher

from December 2024.

HBL also declared a third-quarter dividend of Rs5 per share,

bringing cumulative 9M2025 dividends to Rs14 per share.

Overall, the bank’s performance reflects solid deposit growth, strong consumer lending, disciplined cost management, and strategic positioning in digital banking and Islamic finance, all while maintaining a strong capital base and asset quality.

Copyright Mettis Link News

Related News

| Name | Price/Vol | %Chg/NChg |

|---|---|---|

| KSE100 | 173,169.71 245.48M | 0.58% 999.42 |

| ALLSHR | 103,952.96 533.68M | 0.46% 476.31 |

| KSE30 | 53,042.90 95.92M | 0.73% 384.11 |

| KMI30 | 242,931.39 83.21M | 1.01% 2420.10 |

| KMIALLSHR | 66,507.09 270.16M | 0.79% 519.06 |

| BKTi | 51,058.55 42.50M | 0.09% 45.65 |

| OGTi | 34,159.98 10.77M | 1.77% 594.51 |

| Symbol | Bid/Ask | High/Low |

|---|

| Name | Last | High/Low | Chg/%Chg |

|---|---|---|---|

| BITCOIN FUTURES | 67,925.00 | 68,450.00 66,565.00 | 720.00 1.07% |

| BRENT CRUDE | 71.68 | 72.34 71.06 | 0.02 0.03% |

| RICHARDS BAY COAL MONTHLY | 96.00 | 0.00 0.00 | -3.50 -3.52% |

| ROTTERDAM COAL MONTHLY | 105.50 | 0.00 0.00 | -1.45 -1.36% |

| USD RBD PALM OLEIN | 1,071.50 | 1,071.50 1,071.50 | 0.00 0.00% |

| CRUDE OIL - WTI | 66.31 | 67.03 65.81 | -0.09 -0.14% |

| SUGAR #11 WORLD | 13.86 | 14.02 13.61 | 0.16 1.17% |

Chart of the Day

Latest News

Top 5 things to watch in this week

Pakistan Stock Movers

| Name | Last | Chg/%Chg |

|---|

| Name | Last | Chg/%Chg |

|---|

_20251104162633356_667cfa.jpg?width=280&height=140&format=Webp)

Roshan Digital Account

Roshan Digital Account