KTrade upgrades 'Banking Sector' outlook, HBL tops picks

MG News | October 03, 2025 at 09:16 AM GMT+05:00

October 3, 2025 (MLN): KTrade Research has upgraded its outlook for Pakistan’s banking sector, citing stronger-than-expected earnings momentum, robust deposit growth, and capital gains from well-positioned investment books during the ongoing interest rate downcycle.

The brokerage house revised its earnings forecast for coverage banks in the range of -8% to +37%, projecting a sector-wide 20% earnings growth by end-CY25, compared to its earlier forecast of an 11% decline.

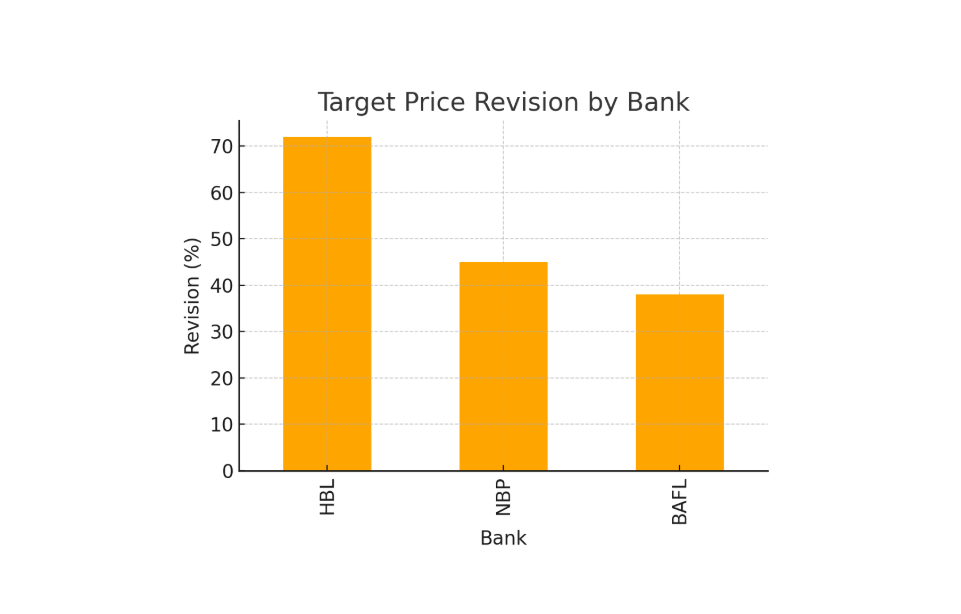

Target prices for coverage banks have also been lifted by 25%–72%, with Habib Bank Limited (HBL) identified as the top sector pick, followed by National Bank of Pakistan (NBP) and Bank Alfalah Limited (BAFL).

KTrade highlighted that non-remunerative deposits surged sharply, growing from 36% in December 2024 to 43% in June 2025, marking the highest sequential pace since 2022.

This compositional shift has enabled banks to offset the impact of lower yields through reduced cost of funds. UBL and Meezan Bank (MEBL) were noted as leaders in deposit mobilization, with current account ratios near 50%.

On the investment side, select banks strategically expanded their books by leveraging borrowings from the State Bank of Pakistan (SBP), capturing spreads and building sizable revaluation surpluses.

These buffers rose 81% sequentially in June 2025, compared to a 21% decline in March 2025, and are expected to strengthen further on the back of an additional 100–150 basis points cut in 1HCY26.

Earnings momentum has been strong, with 2QCY25 profits for coverage banks rising 36.4% YoY, driven by 22% growth in Net Interest Income (NII) and a doubling of capital gains.

Cost-to-income ratios improved by 150bps, helping absorb the impact of a sharp 700bps increase in effective taxation.

KTrade underscored that the Big-6 banks have outperformed the broader market by 55% CYTD, with sector valuations still trading below historical P/BV averages.

The report expects banks to continue their outperformance, supported by higher deposit growth, capital gains, and attractive dividend yields. Looking ahead, banking sector earnings are projected to grow at a 14% CAGR from 2026–2029.

Key strategic & future outlook highlights

Copyright Mettis Link News

Related News

| Name | Price/Vol | %Chg/NChg |

|---|---|---|

| KSE100 | 166,258.55 345.39M | -0.85% -1432.54 |

| ALLSHR | 99,756.66 682.04M | -0.84% -849.13 |

| KSE30 | 50,917.87 169.66M | -0.80% -409.75 |

| KMI30 | 232,771.76 122.66M | -0.63% -1483.82 |

| KMIALLSHR | 63,780.68 324.88M | -0.84% -537.69 |

| BKTi | 49,031.15 76.99M | -1.23% -610.02 |

| OGTi | 32,693.73 16.75M | -1.13% -372.59 |

| Symbol | Bid/Ask | High/Low |

|---|

| Name | Last | High/Low | Chg/%Chg |

|---|---|---|---|

| BITCOIN FUTURES | 66,185.00 | 67,760.00 64,325.00 | -1640.00 -2.42% |

| BRENT CRUDE | 71.88 | 71.96 70.69 | 0.12 0.17% |

| RICHARDS BAY COAL MONTHLY | 96.00 | 0.00 0.00 | -3.50 -3.52% |

| ROTTERDAM COAL MONTHLY | 107.95 | 107.95 107.95 | 0.30 0.28% |

| USD RBD PALM OLEIN | 1,071.50 | 1,071.50 1,071.50 | 0.00 0.00% |

| CRUDE OIL - WTI | 66.60 | 66.67 65.38 | 0.12 0.18% |

| SUGAR #11 WORLD | 14.05 | 14.10 13.78 | 0.18 1.30% |

Chart of the Day

Latest News

Top 5 things to watch in this week

Pakistan Stock Movers

| Name | Last | Chg/%Chg |

|---|

| Name | Last | Chg/%Chg |

|---|

Monetary Aggregates (M3) - Monthly Profile

Monetary Aggregates (M3) - Monthly Profile