Gold ticks up amid prolonged U.S Govt stalemate

MG News | November 06, 2025 at 11:10 AM GMT+05:00

November 06, 2025 (MLN): Gold prices edged higher on Thursday as a softer dollar and lingering uncertainty over the U.S. economic outlook supported safe-haven demand.

The modest decline helped lift gold even as broader market sentiment remained cautious.

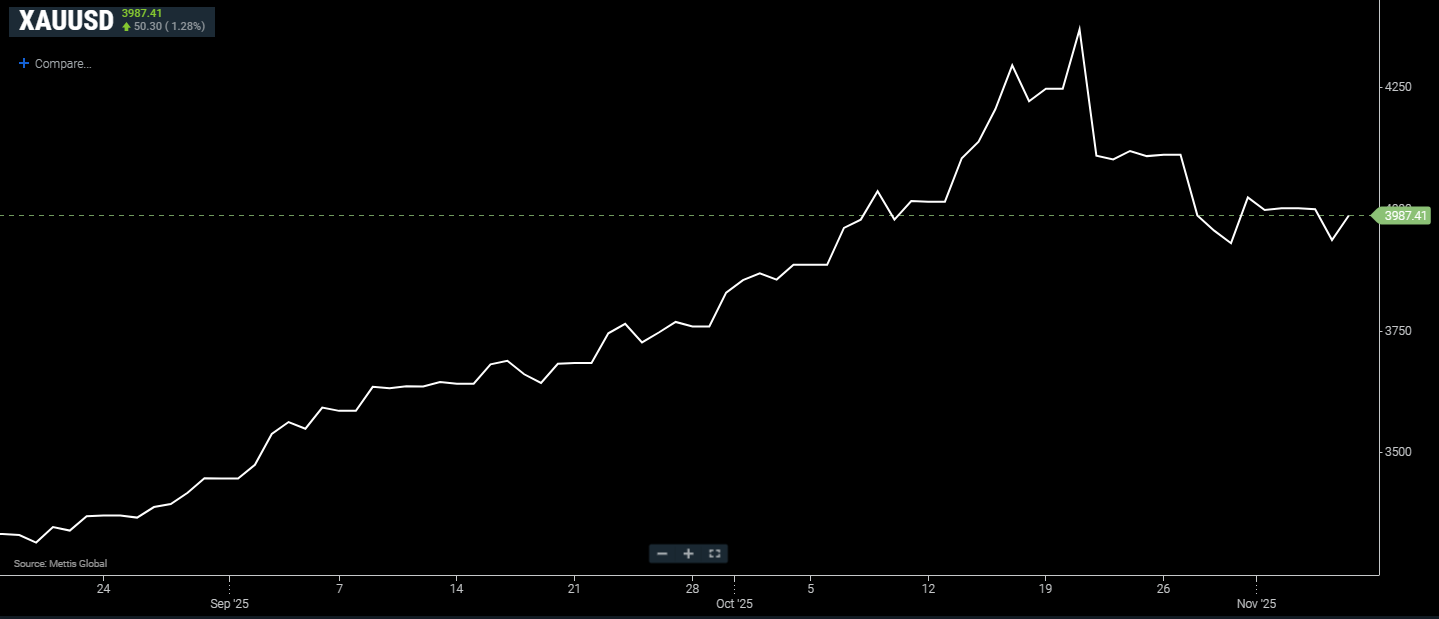

Spot gold was up 1.28% at $3,987.41 an ounce as of [11:02 am] PST, according to data reported by Mettis Global.

Investor focus has turned to Washington, where the congressional deadlock has led to the longest government shutdown in U.S. history.

The ongoing impasse has forced both the Federal Reserve and market participants to depend on private data to gauge the health of the economy.

The U.S. dollar slipped 0.2% after reaching a four-month peak in the previous session, making bullion more affordable for investors holding other currencies.

Despite recent strength in U.S. macroeconomic indicators, gold prices defied expectations and moved higher earlier this week.

The Federal Reserve’s recent rate cut the latest in 2025 added another layer of uncertainty.

While Chair Jerome Powell hinted it could be the final reduction for now, markets have trimmed expectations for further easing, with FedWatch data showing a 63% probability of another cut in December, down sharply from over 90% a week ago.

Since gold does not yield interest, it tends to benefit from a low-rate environment, where opportunity costs of holding the metal are reduced.

Meanwhile, global trade tensions resurfaced after U.S. Supreme Court justices questioned the legality of President Donald Trump’s wide-ranging tariffs, a case that could ripple through the global economy.

Among other precious metals, spot silver climbed 0.3% to $48.22 per ounce, palladium gained 0.2% to $1,422.23, while platinum declined 0.7% to $1,550.91.

Related News

| Name | Price/Vol | %Chg/NChg |

|---|---|---|

| KSE100 | 159,538.98 142.12M | -0.02% -39.21 |

| ALLSHR | 96,960.51 559.13M | 0.03% 28.80 |

| KSE30 | 48,267.45 53.68M | -0.21% -101.46 |

| KMI30 | 227,940.14 38.20M | -0.27% -615.54 |

| KMIALLSHR | 63,001.53 176.21M | -0.30% -189.55 |

| BKTi | 44,506.79 14.91M | -0.05% -20.68 |

| OGTi | 30,675.54 3.11M | -0.37% -113.60 |

| Symbol | Bid/Ask | High/Low |

|---|

| Name | Last | High/Low | Chg/%Chg |

|---|---|---|---|

| BITCOIN FUTURES | 103,585.00 | 104,590.00 103,090.00 | -655.00 -0.63% |

| BRENT CRUDE | 63.85 | 63.86 63.48 | 0.33 0.52% |

| RICHARDS BAY COAL MONTHLY | 87.15 | 87.50 87.00 | 0.35 0.40% |

| ROTTERDAM COAL MONTHLY | 97.00 | 97.50 97.00 | -0.75 -0.77% |

| USD RBD PALM OLEIN | 1,082.50 | 1,082.50 1,082.50 | 0.00 0.00% |

| CRUDE OIL - WTI | 59.96 | 59.97 59.55 | 0.36 0.60% |

| SUGAR #11 WORLD | 14.12 | 14.32 14.05 | -0.10 -0.70% |

Chart of the Day

Latest News

Top 5 things to watch in this week

Pakistan Stock Movers

| Name | Last | Chg/%Chg |

|---|

| Name | Last | Chg/%Chg |

|---|

PIB Auction

PIB Auction