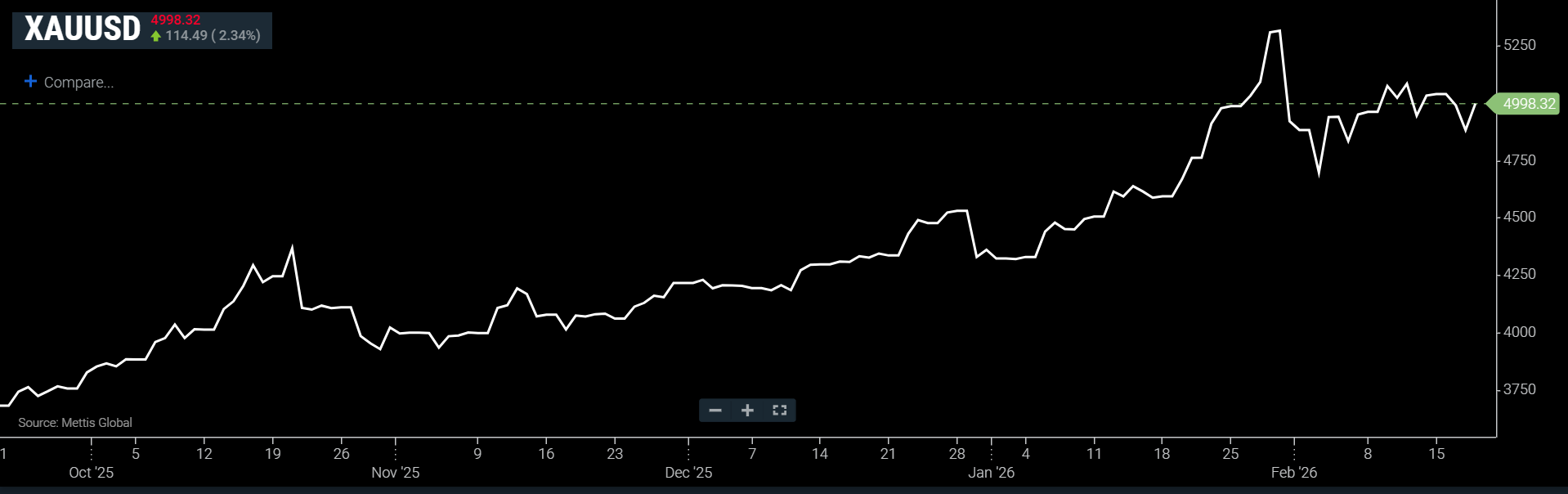

Gold stalls near $5,000 despite global uncertainty

MG News | February 19, 2026 at 11:29 AM GMT+05:00

February 19, 2026 (MLN): Gold prices moved slightly

up, though still struggling to break past the $5,000 mark amid a mix of

economic and geopolitical developments.

Currently, spot gold went up 2.34% to $4,998.32 an

ounce as of [11:22 am] PST, according to data reported by Mettis Global.

The yellow metal’s appeal remains tempered by the strength

of the US Dollar, which climbed to a one-week high following the release of

somewhat hawkish minutes from the Federal Reserve’s January monetary policy

meeting.

The Fed’s minutes revealed a split among policymakers over

the need and timing for further interest rate cuts.

While some officials suggested additional cuts might be

appropriate if inflation trends downward, others cautioned that easing too soon

could jeopardize the central bank’s 2% inflation target.

This dovetailed with stronger-than-expected US economic data

showing a rise in industrial production and the largest increase in

manufacturing output in 11 months, reinforcing the case for the Fed to maintain

current interest rate, according to FXStreet.

The stronger economic signals lifted US Treasury yields and

bolstered the US Dollar, putting downward pressure on non-yielding gold.

Nevertheless, markets are still pricing in the potential for

three 25 basis point rate cuts later this year.

At the same time, risks to the Fed’s independence and

ongoing geopolitical tensions provide some support to the precious metal,

suggesting traders exercise caution before betting on further losses.

Geopolitical concerns remain a key factor.

The latest round of US-mediated talks between Ukraine and

Russia concluded in Geneva on Wednesday with no significant progress,

highlighting ongoing disagreements over eastern Ukrainian territories.

Meanwhile, reports indicate that the US military could take

action against Iran as early as this weekend, although President Donald Trump

has yet to make a final decision.

These tensions continue to underpin gold’s safe-haven

demand.

Copyright Mettis Link News

Related News

| Name | Price/Vol | %Chg/NChg |

|---|---|---|

| KSE100 | 172,825.99 165.56M | -3.37% -6027.11 |

| ALLSHR | 103,912.45 414.39M | -3.19% -3423.42 |

| KSE30 | 52,834.96 78.13M | -3.37% -1841.73 |

| KMI30 | 241,400.94 51.26M | -3.68% -9219.99 |

| KMIALLSHR | 66,252.92 170.68M | -3.49% -2394.38 |

| BKTi | 51,150.91 40.70M | -3.07% -1622.19 |

| OGTi | 33,711.90 8.66M | -3.77% -1320.52 |

| Symbol | Bid/Ask | High/Low |

|---|

| Name | Last | High/Low | Chg/%Chg |

|---|---|---|---|

| BITCOIN FUTURES | 67,235.00 | 67,400.00 66,300.00 | 905.00 1.36% |

| BRENT CRUDE | 70.78 | 70.84 70.19 | 0.43 0.61% |

| RICHARDS BAY COAL MONTHLY | 96.00 | 0.00 0.00 | -3.00 -3.03% |

| ROTTERDAM COAL MONTHLY | 105.50 | 0.00 0.00 | -1.75 -1.63% |

| USD RBD PALM OLEIN | 1,071.50 | 1,071.50 1,071.50 | 0.00 0.00% |

| CRUDE OIL - WTI | 65.49 | 65.56 64.77 | 0.44 0.68% |

| SUGAR #11 WORLD | 13.77 | 13.78 13.47 | 0.29 2.15% |

Chart of the Day

Latest News

Top 5 things to watch in this week

Pakistan Stock Movers

| Name | Last | Chg/%Chg |

|---|

| Name | Last | Chg/%Chg |

|---|

Roshan Digital Account

Roshan Digital Account