Gold slips on firm dollar, U.S. jobs data in focus

MG News | January 08, 2026 at 12:20 PM GMT+05:00

January 08, 2026 (MLN): Gold prices edged lower on Thursday as a firmer U.S. dollar weighed on the market ahead of a key U.S. jobs report that could shape expectations for future Federal Reserve policy, while geopolitical risks remained in focus.

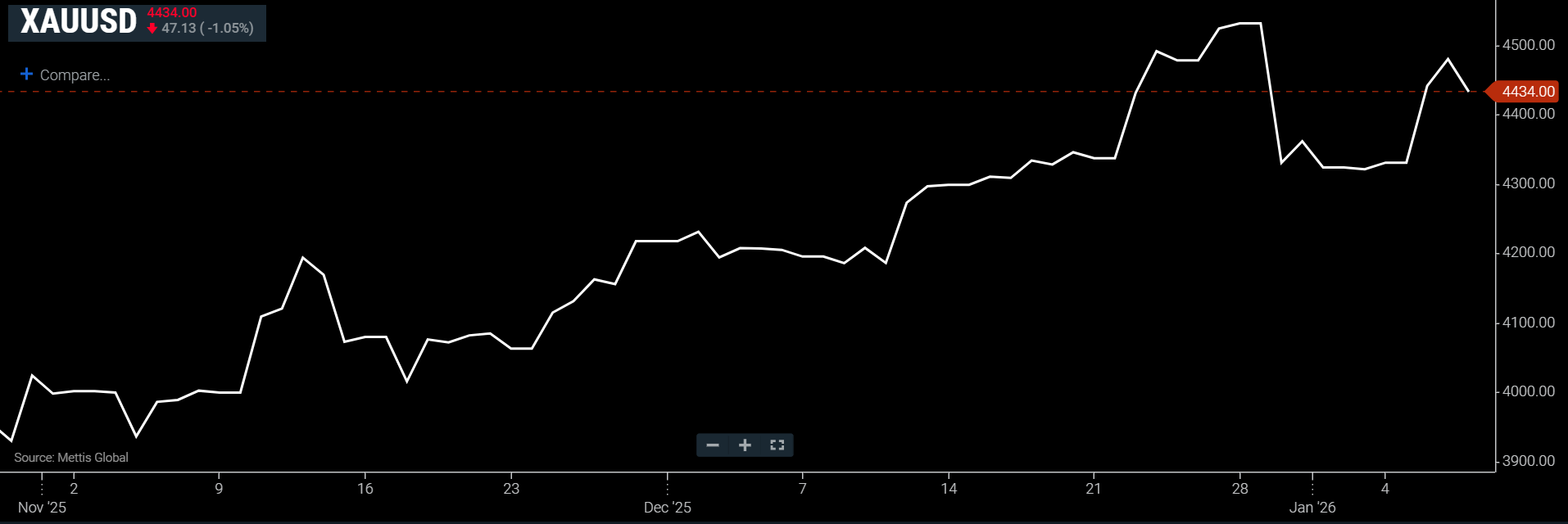

Spot gold fell 1.05% to $4,434 an ounce as of [12:17 PM] PST, according to data reported by Mettis Global.

U.S. gold futures for February delivery also declined 0.3%

to $4,449.60, CNBC reported.

Market participants are balancing geopolitical tensions with

macroeconomic signals from the United States, said Bernard Sin, regional

director for Greater China at MKS PAMP.

He pointed to U.S. pressure on Venezuela and speculation

over potential flashpoints under former President Donald Trump’s so-called

“Donroe Doctrine,” alongside incoming U.S. economic data.

Recent softer U.S. jobs data has strengthened expectations

of further Fed rate cuts, which typically support non-interest-bearing assets

such as gold.

However, sentiment remains cautious, with investors wary of

volatility and profit-taking at elevated price levels, Sin added.

Gold is trading about $110 below its record high of

$4,549.71 reached on December 29, with gains capped by dollar strength and

selling at higher levels.

Data released on Wednesday showed U.S. job openings fell to

a 14-month low in November, while hiring remained sluggish, signalling easing

demand in the labour market.

Attention now turns

to Friday’s U.S. non-farm payrolls report for further clues on the Fed’s policy

outlook.

Geopolitical concerns also lingered after the United States

seized two Venezuela-linked oil tankers in the Atlantic Ocean on Wednesday,

including one sailing under the Russian flag, as part of Washington’s efforts

to influence oil flows in the region.

In other precious metals, spot silver slipped 0.4% to $77.85

an ounce, after hitting an all-time high of $83.62 on December 29.

Platinum fell 0.8% to $2,288.23 an ounce, easing after touching a record high of $2,478.50 last Monday, while palladium lost 0.5% to $1,756.42 an ounce.

Copyright Mettis Link News

Related News

| Name | Price/Vol | %Chg/NChg |

|---|---|---|

| KSE100 | 185,770.57 39.34M | 0.12% 227.56 |

| ALLSHR | 111,035.53 174.11M | 0.14% 151.58 |

| KSE30 | 57,052.76 24.80M | 0.10% 54.76 |

| KMI30 | 261,587.79 21.98M | 0.04% 115.61 |

| KMIALLSHR | 71,235.01 63.73M | 0.14% 96.72 |

| BKTi | 54,084.48 7.25M | 0.02% 10.34 |

| OGTi | 36,365.79 2.68M | 0.29% 106.41 |

| Symbol | Bid/Ask | High/Low |

|---|

| Name | Last | High/Low | Chg/%Chg |

|---|---|---|---|

| BITCOIN FUTURES | 91,295.00 | 91,855.00 91,055.00 | 190.00 0.21% |

| BRENT CRUDE | 62.41 | 62.60 62.26 | 0.42 0.68% |

| RICHARDS BAY COAL MONTHLY | 86.75 | 0.00 0.00 | 0.05 0.06% |

| ROTTERDAM COAL MONTHLY | 97.90 | 98.15 97.75 | -0.80 -0.81% |

| USD RBD PALM OLEIN | 1,027.50 | 1,027.50 1,027.50 | 0.00 0.00% |

| CRUDE OIL - WTI | 58.14 | 58.45 57.98 | 0.38 0.66% |

| SUGAR #11 WORLD | 14.96 | 15.08 14.90 | -0.02 -0.13% |

Chart of the Day

Latest News

Top 5 things to watch in this week

Pakistan Stock Movers

| Name | Last | Chg/%Chg |

|---|

| Name | Last | Chg/%Chg |

|---|

MTB Auction

MTB Auction