Gold, silver rally amid geopolitical turmoil

MG News | January 12, 2026 at 11:43 AM GMT+05:00

January 12, 2026 (MLN): Gold has push passed the $4,600-per-ounce

barrier while silver also touched historic peaks, as safe havens became an

investor umbrella amid a perfect storm of geopolitical turmoil, economic

uncertainty, and mounting pressure on the Federal Reserve to slash interest

rates, in a dramatic Monday trading session.

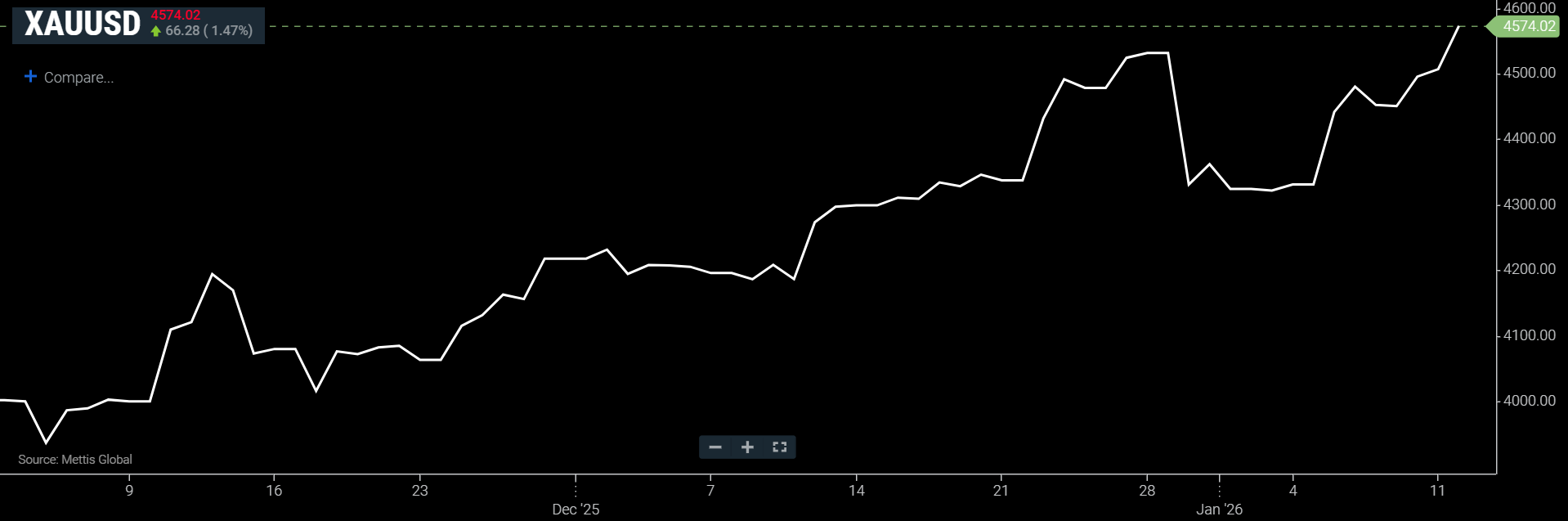

Currently, Spot gold has retreated, it was up 1.47% at $4,574.02 an ounce as of [11:38 am] PST, according to data reported by Mettis Global.

February U.S. gold futures advanced 2% to $4,591.10.

"The geopolitical risk factor is clearly the main

driver behind the intraday bullish momentum we're witnessing in both gold and

silver markets," explained Kelvin Wong, senior market analyst at OANDA,

CNBC reported.

Escalating tensions in Iran, with Tehran warning of

potential strikes against American military installations should President

Donald Trump follow through on threats to intervene militarily in support of

demonstrators.

The Iranian situation represents just one element of a

broader pattern of U.S. international assertiveness under Trump, including the

recent removal of Venezuelan President Nicolas Maduro and ongoing discussions

regarding Greenland's acquisition.

Domestic economic signals are also influencing market

sentiment. Friday's employment report revealed weaker-than-anticipated job

creation in December, with losses concentrated in construction, retail, and

manufacturing.

Despite the disappointing headline number, the unemployment

rate's decline suggests the labor market isn't experiencing rapid

deterioration.

Adding to the

pressure, Fed Chair Jerome Powell disclosed Sunday that the Trump

administration had threatened criminal charges related to his Congressional

testimony, a move Powell characterized as a "pretext" designed to

compel rate reductions.

A weakening dollar, which pulled back from month-long highs,

provided additional support for precious metals.

Gold and silver typically benefit during periods of low

interest rates and heightened geopolitical or economic uncertainty, as they

don't generate yield.

Silver surged 3.5% to $82.72 per ounce after reaching an all-time high of $83.96. Platinum jumped 3.2% to $2,345.40 following its December 29 record of $2,478.50. Palladium advanced 3.3% to $1,875.68.

Copyright Mettis Link News

Related News

| Name | Price/Vol | %Chg/NChg |

|---|---|---|

| KSE100 | 183,493.54 283.70M | -0.50% -916.13 |

| ALLSHR | 110,062.21 736.17M | -0.29% -320.37 |

| KSE30 | 56,227.36 90.23M | -0.65% -366.52 |

| KMI30 | 257,039.88 106.70M | -0.84% -2168.53 |

| KMIALLSHR | 70,290.16 363.65M | -0.59% -420.62 |

| BKTi | 53,504.82 42.22M | -0.50% -269.90 |

| OGTi | 35,736.62 5.59M | -0.86% -308.43 |

| Symbol | Bid/Ask | High/Low |

|---|

| Name | Last | High/Low | Chg/%Chg |

|---|---|---|---|

| BITCOIN FUTURES | 91,535.00 | 92,830.00 90,450.00 | 1130.00 1.25% |

| BRENT CRUDE | 63.16 | 64.00 62.89 | -0.18 -0.28% |

| RICHARDS BAY COAL MONTHLY | 86.75 | 0.00 0.00 | -1.25 -1.42% |

| ROTTERDAM COAL MONTHLY | 95.30 | 98.65 95.30 | -2.90 -2.95% |

| USD RBD PALM OLEIN | 1,027.50 | 1,027.50 1,027.50 | 0.00 0.00% |

| CRUDE OIL - WTI | 58.94 | 59.80 58.64 | -0.18 -0.30% |

| SUGAR #11 WORLD | 14.89 | 14.99 14.78 | -0.08 -0.53% |

Chart of the Day

Latest News

Top 5 things to watch in this week

Pakistan Stock Movers

| Name | Last | Chg/%Chg |

|---|

| Name | Last | Chg/%Chg |

|---|