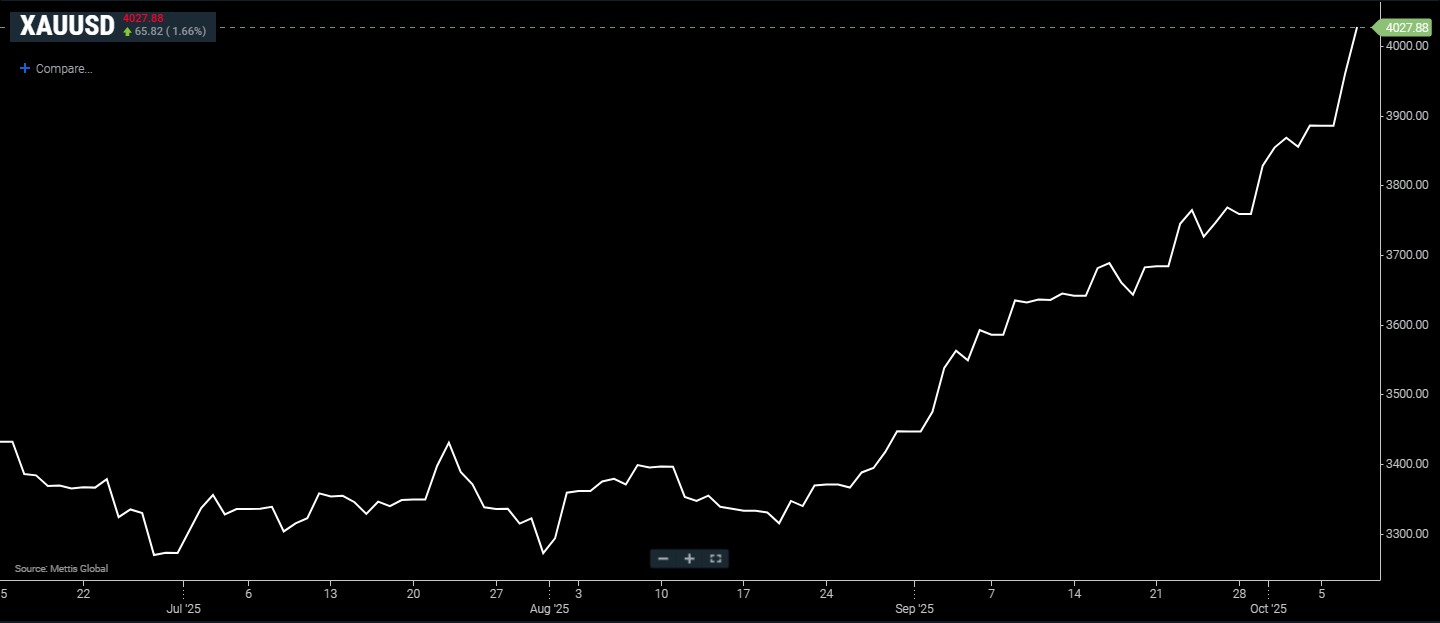

Gold prices surge past $4,000 for the first time as investors seek safety from inflation

MG News | October 08, 2025 at 10:13 AM GMT+05:00

October 08, 2025 (MLN): Gold prices climbed

above $4,000 per ounce for the first time on Tuesday, as investors poured into

the precious metal amid a weakening U.S. dollar, mounting geopolitical

tensions, and persistent inflation.

Spot gold was up 1.66% at $4027.88 an ounce as of [10:09 am]

PST, according to data reported by Mettis Global.

Gold futures settled at a record $4,004.40

per ounce, after touching an intraday high of $4,014.60.

The metal has soared nearly 50% so

far this year, driven by safe-haven demand as the U.S. dollar index

dropped 10% and President Donald Trump’s trade and monetary policies

fueled market uncertainty.

Central banks and retail investors

have been aggressively accumulating gold. Nations such as China are

diversifying reserves away from U.S. Treasurys, especially after Washington’s

sweeping sanctions on Russia following its 2022 invasion of Ukraine, according

to CNBC.

Individual investors are also seeking

protection against stubbornly high inflation.

The latest rally came on the heels of

the Federal Reserve’s September rate cut, its first of 2025, which made

short-term government debt less appealing.

Markets now anticipate two more

reductions in the federal funds rate, currently in the 4.00%–4.25%

range, before year-end. The Fed’s next policy meeting is scheduled for October

29.

Prominent hedge fund manager Ray

Dalio, founder of Bridgewater Associates, advised investors on Tuesday to

allocate roughly 15% of their portfolios to gold, calling traditional

debt investments “not an effective store of wealth,” CNBC noted.

“Gold is the one asset that performs

well when the typical parts of your portfolio go down,” Dalio said at the Greenwich

Economic Forum in Connecticut.

However, not all analysts are bullish. Bank of America on Monday urged caution as gold approached the $4,000 mark, warning of potential “uptrend exhaustion” that could trigger a price correction or consolidation later this year.

Related News

| Name | Price/Vol | %Chg/NChg |

|---|---|---|

| KSE100 | 167,085.58 225.68M | 0.48% 802.03 |

| ALLSHR | 101,220.72 685.91M | 0.47% 477.65 |

| KSE30 | 50,772.02 134.57M | 0.57% 290.16 |

| KMI30 | 239,923.35 145.03M | 0.77% 1831.31 |

| KMIALLSHR | 66,042.80 345.76M | 0.65% 425.34 |

| BKTi | 45,106.39 29.18M | 0.06% 24.91 |

| OGTi | 33,583.05 26.44M | 1.52% 502.39 |

| Symbol | Bid/Ask | High/Low |

|---|

| Name | Last | High/Low | Chg/%Chg |

|---|---|---|---|

| BITCOIN FUTURES | 89,425.00 | 92,995.00 88,405.00 | -3415.00 -3.68% |

| BRENT CRUDE | 63.86 | 64.09 63.06 | 0.60 0.95% |

| RICHARDS BAY COAL MONTHLY | 91.00 | 0.00 0.00 | 0.10 0.11% |

| ROTTERDAM COAL MONTHLY | 97.25 | 97.25 97.25 | 0.05 0.05% |

| USD RBD PALM OLEIN | 1,016.00 | 1,016.00 1,016.00 | 0.00 0.00% |

| CRUDE OIL - WTI | 60.14 | 60.50 59.42 | 0.47 0.79% |

| SUGAR #11 WORLD | 14.82 | 15.02 14.73 | -0.06 -0.40% |

Chart of the Day

Latest News

Top 5 things to watch in this week

Pakistan Stock Movers

| Name | Last | Chg/%Chg |

|---|

| Name | Last | Chg/%Chg |

|---|

Savings Mobilized by National Savings Schemes

Savings Mobilized by National Savings Schemes