Pakistan banks lead Asia-Pacific in Q3 stock performance

MG News | October 08, 2025 at 10:46 AM GMT+05:00

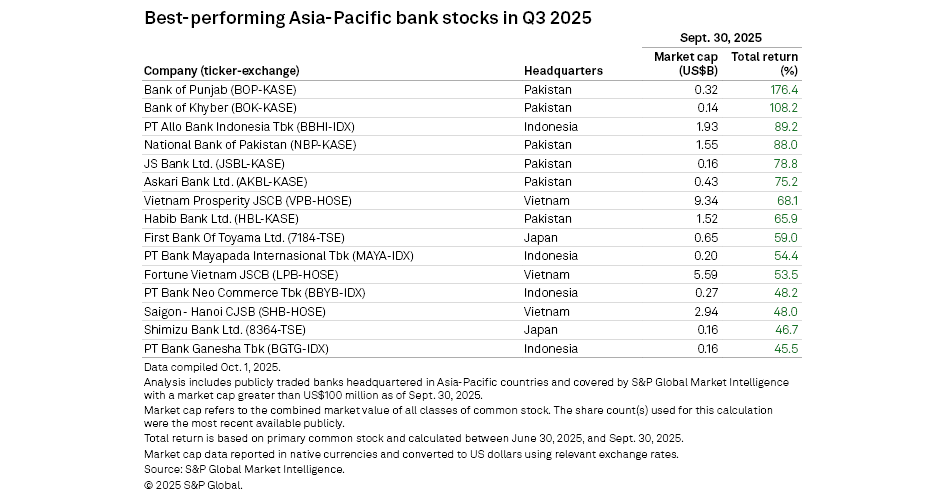

October 08, 2025 (MLN): Pakistan-based

banks led the Asia-Pacific region in stock performance during the third

quarter, supported by a rally in the local equities market and improving

investor sentiment.

The Bank of Punjab topped the list of

publicly traded banks in the region with market capitalizations above $100

million, according to S&P Global.

The Lahore-based lender, valued at about $320m

as of September 30, recorded a total return of 176.4% in the third quarter.

The Bank of Khyber ranked second with

a total return of 108.2%. Other Pakistan-based lenders that appeared among the

top 15 included National Bank of Pakistan, JS Bank Ltd., Askari Bank Ltd., and

Habib Bank Ltd.

The strong performance of these banks coincided with a broader uptrend in Pakistan’s stock market.

The benchmark KSE-100 index gained for five

consecutive months, reflecting improving confidence following the resolution of

a military conflict with India in May and stronger diplomatic engagement with

the United States, including several meetings between Pakistani leaders and

U.S. President Donald Trump.

The index advanced 11% in July and

11.4% in September, Market Intelligence data showed.

Several Indonesia-based banks also

featured in the top-performing list. PT Allo Bank Indonesia Tbk ranked third

with a total return of 89.2%, followed by PT Bank Mayapada Internasional Tbk,

PT Bank Neo Commerce Tbk, and PT Bank Ganesha Tbk.

Three Vietnamese lenders were also

among the top 15 Vietnam Prosperity Joint Stock Commercial Bank, which had the

highest market capitalization among the group at $9.34 billion, achieved a

total return of 68.1%, while Fortune Vietnam Joint Stock Commercial Bank and

Saigon - Hanoi Commercial Joint Stock Bank also made the list.

Vietnam’s VN-Index rose 37.2% between

May and August, boosting investor sentiment.

In contrast, Chinese and Indian

lenders dominated the ranks of the region’s worst-performing bank stocks in the

third quarter.

Seven of the 15 weakest performers were mid-tier Chinese banks, led by Bank of Jiujiang Co. Ltd., which posted a total return of negative 18.2%.

Other underperformers included China

Everbright Bank Co. Ltd., Bank of Beijing Co. Ltd., Hua Xia Bank Co. Ltd., Bank

of Shanghai Co. Ltd., Industrial Bank Co. Ltd., and Bank of Jiangsu Co. Ltd.

Chinese banks continue to face margin pressures and subdued loan demand, which

have dampened earnings growth.

Five Indian banks also appeared among

the laggards, including Aavas Financiers Ltd., Dhanlaxmi Bank Ltd., IndusInd

Bank Ltd., Equitas Small Finance Bank Ltd., and Bajaj Holdings & Investment

Ltd. PT Bank Nationalnobu Tbk of Indonesia was the poorest performer overall,

with a total return of negative 31.9%.

Bangladesh-based Midland Bank PLC, which was the best-performing Asia-Pacific bank stock in the previous quarter, ranked as the third-worst performer this time with a total return of negative 20.9%, while South Korea’s KakaoBank Corp. recorded a negative 20.8% return.

Related News

| Name | Price/Vol | %Chg/NChg |

|---|---|---|

| KSE100 | 167,085.58 225.68M | 0.48% 802.03 |

| ALLSHR | 101,220.72 685.91M | 0.47% 477.65 |

| KSE30 | 50,772.02 134.57M | 0.57% 290.16 |

| KMI30 | 239,923.35 145.03M | 0.77% 1831.31 |

| KMIALLSHR | 66,042.80 345.76M | 0.65% 425.34 |

| BKTi | 45,106.39 29.18M | 0.06% 24.91 |

| OGTi | 33,583.05 26.44M | 1.52% 502.39 |

| Symbol | Bid/Ask | High/Low |

|---|

| Name | Last | High/Low | Chg/%Chg |

|---|---|---|---|

| BITCOIN FUTURES | 89,425.00 | 0.00 0.00 | -175.00 -0.20% |

| BRENT CRUDE | 63.86 | 64.09 63.06 | 0.60 0.95% |

| RICHARDS BAY COAL MONTHLY | 91.00 | 0.00 0.00 | 0.10 0.11% |

| ROTTERDAM COAL MONTHLY | 97.25 | 97.25 97.25 | 0.05 0.05% |

| USD RBD PALM OLEIN | 1,016.00 | 1,016.00 1,016.00 | 0.00 0.00% |

| CRUDE OIL - WTI | 60.14 | 0.00 0.00 | 0.06 0.10% |

| SUGAR #11 WORLD | 14.82 | 15.02 14.73 | -0.06 -0.40% |

Chart of the Day

Latest News

Top 5 things to watch in this week

Pakistan Stock Movers

| Name | Last | Chg/%Chg |

|---|

| Name | Last | Chg/%Chg |

|---|

Savings Mobilized by National Savings Schemes

Savings Mobilized by National Savings Schemes