PSX still reasonably valued despite record rally

MG News | October 08, 2025 at 10:07 AM GMT+05:00

October 8, 2025 (MLN): Despite one of the strongest rallies in its history, the Pakistan Stock Market remains within a “comfort zone” of reasonable valuations, according to a recent analysis by NBP Funds.

The report titled “Is the Pakistan Stock Market Expensive?” by Dr. Amjad Waheed, CFA, Chief Executive Officer of NBP Funds, highlights that since July 2023, the benchmark KSE-100 Index has surged nearly fourfold, up 89% in FY24, 60% in FY25, and projected to rise 32% in 1QFY26.

This performance, the report attributes, stems from IMF-backed stabilization measures, improved macro fundamentals, political continuity, and a sharp decline in interest rates from 22% to 11%.

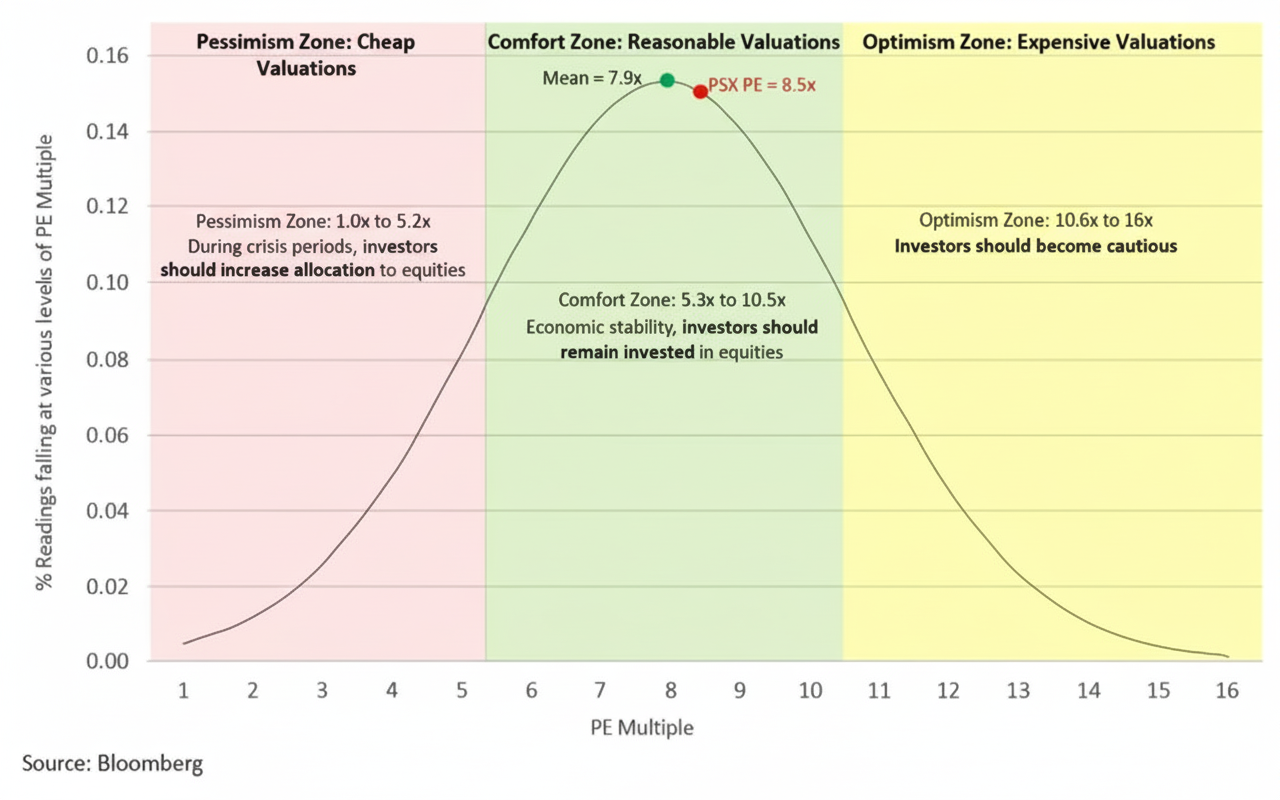

Citing Bloomberg’s data on the KSE-100 Index’s price-to-earnings (P/E) ratios since 2006, the study shows that the market’s long-term average P/E stands at 7.9x, with the current level around 8.5x, positioning it well within the “comfort zone” (5.3x–10.5x).

This range reflects reasonable valuations supported by economic stability and improving liquidity conditions.

“Pakistan’s market is not overheated. At a P/E of 8.5x today, it still stands comfortably below the ‘optimism zone’ where valuations typically become expensive,” Dr. Waheed noted.

The report divides market valuations into three zones:

-

Pessimism Zone (1.0x–5.2x): Seen during macroeconomic crises, where equities trade at distressed levels, often the best time to build exposure.

-

Comfort Zone (5.3x–10.5x): Characterized by stability and improving fundamentals, where equities remain attractively valued.

-

Optimism Zone (10.6x–16x): Where markets tend to overheat, often preceding corrections.

NBP Funds concludes that Pakistan’s equities remain “reasonably valued,” backed by strong dividends of 5–6%, abundant liquidity, and improving macro fundamentals, offering both income and growth potential as fixed-income returns moderate into single digits.

Copyright Mettis Link News

Related News

| Name | Price/Vol | %Chg/NChg |

|---|---|---|

| KSE100 | 151,973.00 479.70M | -9.57% -16089.17 |

| ALLSHR | 91,178.86 800.22M | -9.20% -9239.97 |

| KSE30 | 46,326.47 200.60M | -9.73% -4995.92 |

| KMI30 | 212,170.17 176.87M | -9.84% -23154.95 |

| KMIALLSHR | 58,382.38 455.91M | -9.19% -5909.79 |

| BKTi | 44,306.03 79.95M | -9.79% -4809.39 |

| OGTi | 29,106.80 28.46M | -9.93% -3209.99 |

| Symbol | Bid/Ask | High/Low |

|---|

| Name | Last | High/Low | Chg/%Chg |

|---|---|---|---|

| BITCOIN FUTURES | 66,185.00 | 67,760.00 64,325.00 | -1640.00 -2.42% |

| BRENT CRUDE | 71.88 | 71.96 70.69 | 0.12 0.17% |

| RICHARDS BAY COAL MONTHLY | 96.00 | 0.00 0.00 | -3.50 -3.52% |

| ROTTERDAM COAL MONTHLY | 107.95 | 107.95 107.95 | 0.30 0.28% |

| USD RBD PALM OLEIN | 1,071.50 | 1,071.50 1,071.50 | 0.00 0.00% |

| CRUDE OIL - WTI | 66.60 | 66.67 65.38 | 0.12 0.18% |

| SUGAR #11 WORLD | 14.05 | 14.10 13.78 | 0.18 1.30% |

Chart of the Day

Latest News

Top 5 things to watch in this week

Pakistan Stock Movers

| Name | Last | Chg/%Chg |

|---|

| Name | Last | Chg/%Chg |

|---|

Trade Balance

Trade Balance