Euro zone bonds rally after Fed, supply deluge

By MG News | June 11, 2020 at 03:57 PM GMT+05:00

June 11, 2020: Euro zone government bonds rallied on Thursday after the U.S. Federal Reserve signalled it plans years of extraordinary support to counter the economic fallout from the coronavirus pandemic and markets digested a deluge of issuance from lower-rated states.

All 17 current Fed policymakers see the federal funds rate -unchanged on Wednesday - remaining near zero through next year, and 15 of them see no change through 2022. That contrasts with the 2008/09 global financial crisis, when some policymakers raised a cautionary flag about the need for higher interest rates to guard against inflation.

"We are not even thinking about thinking about raising rates," Fed Chair Jerome Powell said.

Germany's 10-year benchmark fell to an eight-day low at -0.38%, falling 5 basis points on the day. German Bunds followed U.S. Treasuries, which rallied on the Fed meeting and are down around 13 bps over the last two sessions .

"Clearly, central bank intervention supresses rates but I don’t think this is enough to explain the rally," said Antoine Bouvet, senior rates strategist at ING, referring to higher-rated sovereign bonds like Germany's, whose 10-year yield is down 11 bps this week.

"There has been a deterioration in sentiment since last week as the focus shifted from upside surprises in U.S. data to risk of a second wave," Bouvet added.

Better-than-expected U.S. employment numbers boosted markets last Friday, but new infections in the country are rising slightly after five weeks of declines, according to a Reuters analysis, only part of which is attributed to more testing.

Southern European bonds also rallied after yields rose sharply this week. Euro zone sovereigns raised 24 billion euros via syndicated bond sales this week, according to Refinitiv IFR data, half of that coming from Spain, which caused a sell-off as markets struggled to digest the supply.

Spanish 10-year yields fell 5 bps to 0.64% after touching a 15-day high on Wednesday.

Italy's 10-year yield was down 6 bps to 1.46% as it sold 9.5 billion euros of three, seven and 15-year bonds in an auction, paying the lowest yield level since February on the three and 15-year bonds.

Investors' focus is also on the euro zone finance ministers' meeting later in the session for any updates on the European Union's 750 billion euro recovery fund proposal.

The European Central Bank will do anything possible to ensure that the current crisis is not made worse by a credit crunch, chief economist Philip Lane said.

Reuters

Related News

| Name | Price/Vol | %Chg/NChg |

|---|---|---|

| KSE100 | 120,531.99 16.19M |

3.76% 4364.51 |

| ALLSHR | 75,088.72 38.82M |

3.54% 2568.27 |

| KSE30 | 36,820.42 10.11M |

3.99% 1413.08 |

| KMI30 | 178,488.12 10.25M |

5.03% 8546.56 |

| KMIALLSHR | 51,575.08 26.00M |

4.25% 2101.95 |

| BKTi | 30,588.20 1.60M |

2.86% 849.83 |

| OGTi | 27,162.67 0.77M |

5.20% 1342.61 |

| Symbol | Bid/Ask | High/Low |

|---|

| Name | Last | High/Low | Chg/%Chg |

|---|---|---|---|

| BITCOIN FUTURES | 105,090.00 | 106,185.00 103,850.00 |

1795.00 1.74% |

| BRENT CRUDE | 69.74 | 70.20 68.23 |

-1.74 -2.43% |

| RICHARDS BAY COAL MONTHLY | 88.00 | 0.00 0.00 |

-3.35 -3.67% |

| ROTTERDAM COAL MONTHLY | 103.85 | 0.00 0.00 |

0.10 0.10% |

| USD RBD PALM OLEIN | 998.50 | 998.50 998.50 |

0.00 0.00% |

| CRUDE OIL - WTI | 66.82 | 67.83 64.38 |

-1.69 -2.47% |

| SUGAR #11 WORLD | 16.52 | 16.78 16.49 |

-0.05 -0.30% |

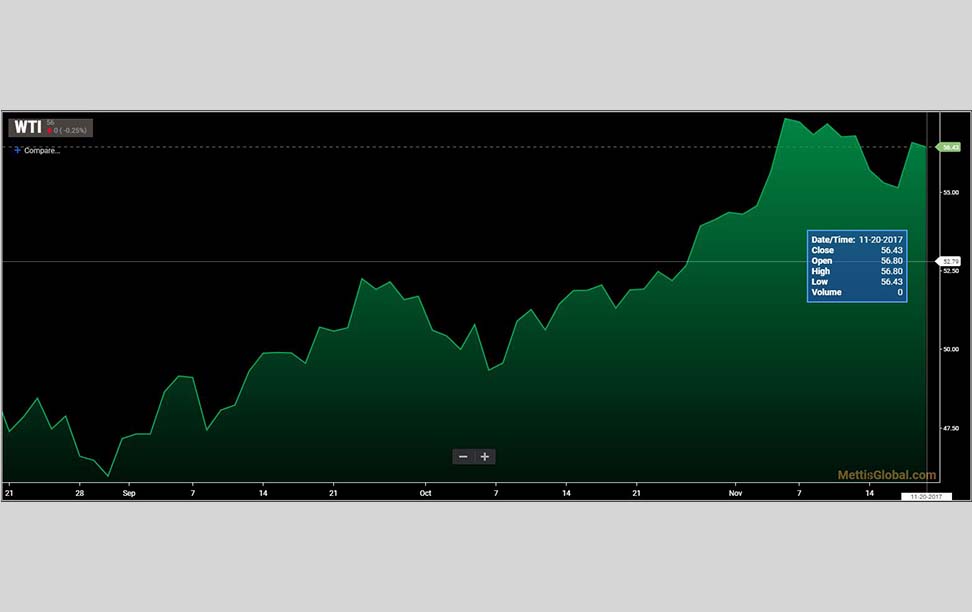

Chart of the Day

Latest News

Top 5 things to watch in this week

Pakistan Stock Movers

| Name | Last | Chg/%Chg |

|---|

| Name | Last | Chg/%Chg |

|---|

.jpg)