Bank deposit rate falls to 5.28% in September

.png?width=950&height=450&format=Webp)

MG News | October 20, 2025 at 07:15 PM GMT+05:00

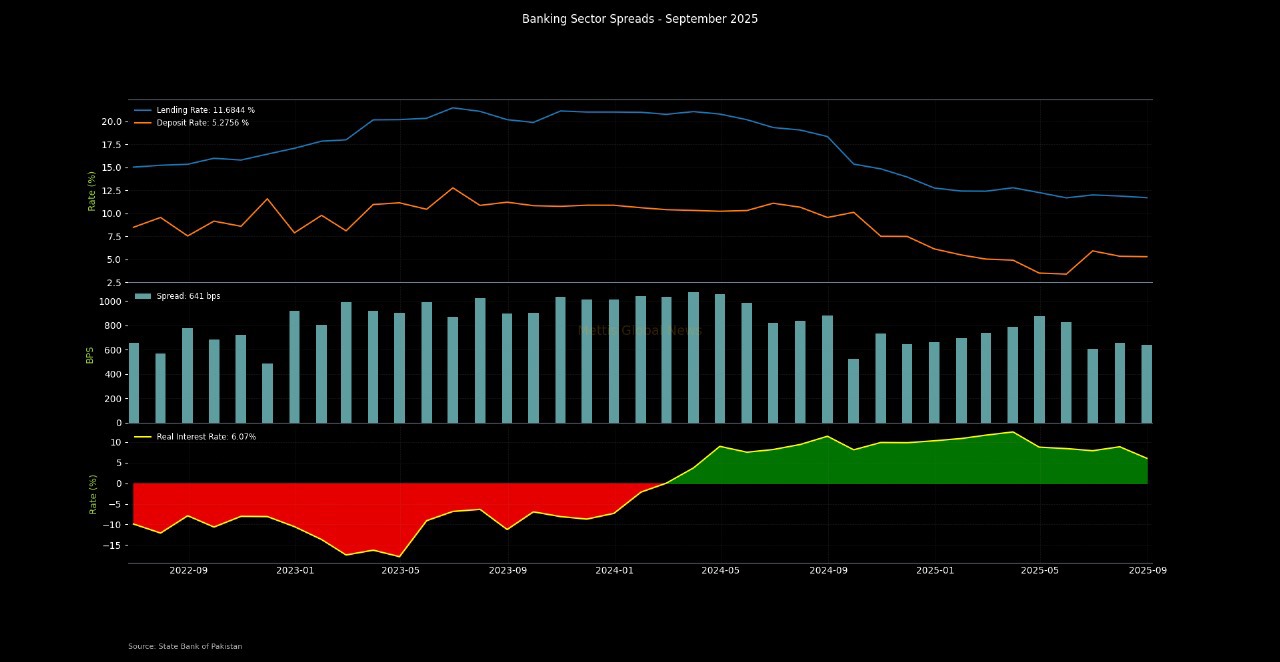

October 20, 2025 (MLN): The return on bank deposits fell by 5 basis points (bps) to 5.28% in September 2025, compared to 5.32% in August, as per the latest data released by the State Bank of Pakistan (SBP).

On a yearly basis, the weighted average return on deposits plunged by a sharp 1,290bps from 18.18% recorded in the same month last year, reflecting the lagged impact of the monetary easing cycle that began earlier this year following the sharp decline in inflation.

Meanwhile, the average lending rate for all scheduled banks dropped by 19bps to 11.68% in September from 11.87% in August.

Year-on-year, the lending rate fell by 665bps from 18.33%, marking one of the steepest declines since the post-COVID monetary loosening in 2020.

As a result, the banking sector spread narrowed by 14bps to 6.40 percentage points, indicating a compression in banks’ interest margins amid a lower policy rate environment.

In real terms, both rates remained positive, with the real deposit rate at 1.94% and the real lending rate at 8.34%, as headline inflation stood 5.6% YoY in September.

Although the pickup in inflation slightly reduced real returns compared to the previous month, depositors are still earning more than the inflation rate, and borrowing remains relatively expensive.

This suggests that monetary policy continues to be tight in real terms, helping to keep inflationary pressures in check despite recent cuts in nominal rates.

Historical trend analysis (2018–2025) shows that deposit and lending rates peaked in 2023, with lending rates hitting over 21% and deposit rates above 12%, mirroring the tight monetary stance adopted to curb record-high inflation above 35%.

The subsequent decline through 2024–25 reflects a pronounced monetary normalization phase, as inflation fell from double digits to low single digits.

Despite the easing, real interest rates have turned positive for the first time since early 2021, signaling improved purchasing power for savers and a possible revival in real investment activity.

The current spread level of 6.4% remains below the historical average of around 500–700bps, indicating a gradual rebalancing of credit and deposit markets in line with stable macroeconomic conditions.

The sustained moderation in both nominal and real rates suggests that Pakistan’s financial system is transitioning from a phase of aggressive monetary tightening to relative stability.

This shift is expected to pave the way for lower borrowing costs, improved liquidity, and potentially higher credit off-take in the coming quarters.

Copyright Mettis Link News

Related News

| Name | Price/Vol | %Chg/NChg |

|---|---|---|

| KSE100 | 167,085.58 225.68M | 0.48% 802.03 |

| ALLSHR | 101,220.72 685.91M | 0.47% 477.65 |

| KSE30 | 50,772.02 134.57M | 0.57% 290.16 |

| KMI30 | 239,923.35 145.03M | 0.77% 1831.31 |

| KMIALLSHR | 66,042.80 345.76M | 0.65% 425.34 |

| BKTi | 45,106.39 29.18M | 0.06% 24.91 |

| OGTi | 33,583.05 26.44M | 1.52% 502.39 |

| Symbol | Bid/Ask | High/Low |

|---|

| Name | Last | High/Low | Chg/%Chg |

|---|---|---|---|

| BITCOIN FUTURES | 89,425.00 | 92,995.00 88,405.00 | -3415.00 -3.68% |

| BRENT CRUDE | 63.86 | 64.09 63.06 | 0.60 0.95% |

| RICHARDS BAY COAL MONTHLY | 91.00 | 0.00 0.00 | 0.10 0.11% |

| ROTTERDAM COAL MONTHLY | 97.25 | 97.25 97.25 | 0.05 0.05% |

| USD RBD PALM OLEIN | 1,016.00 | 1,016.00 1,016.00 | 0.00 0.00% |

| CRUDE OIL - WTI | 60.14 | 60.50 59.42 | 0.47 0.79% |

| SUGAR #11 WORLD | 14.82 | 15.02 14.73 | -0.06 -0.40% |

Chart of the Day

Latest News

Top 5 things to watch in this week

Pakistan Stock Movers

| Name | Last | Chg/%Chg |

|---|

| Name | Last | Chg/%Chg |

|---|

Savings Mobilized by National Savings Schemes

Savings Mobilized by National Savings Schemes