Auto financing in Pakistan rises to Rs328bn in January

MG News | February 16, 2026 at 04:56 PM GMT+05:00

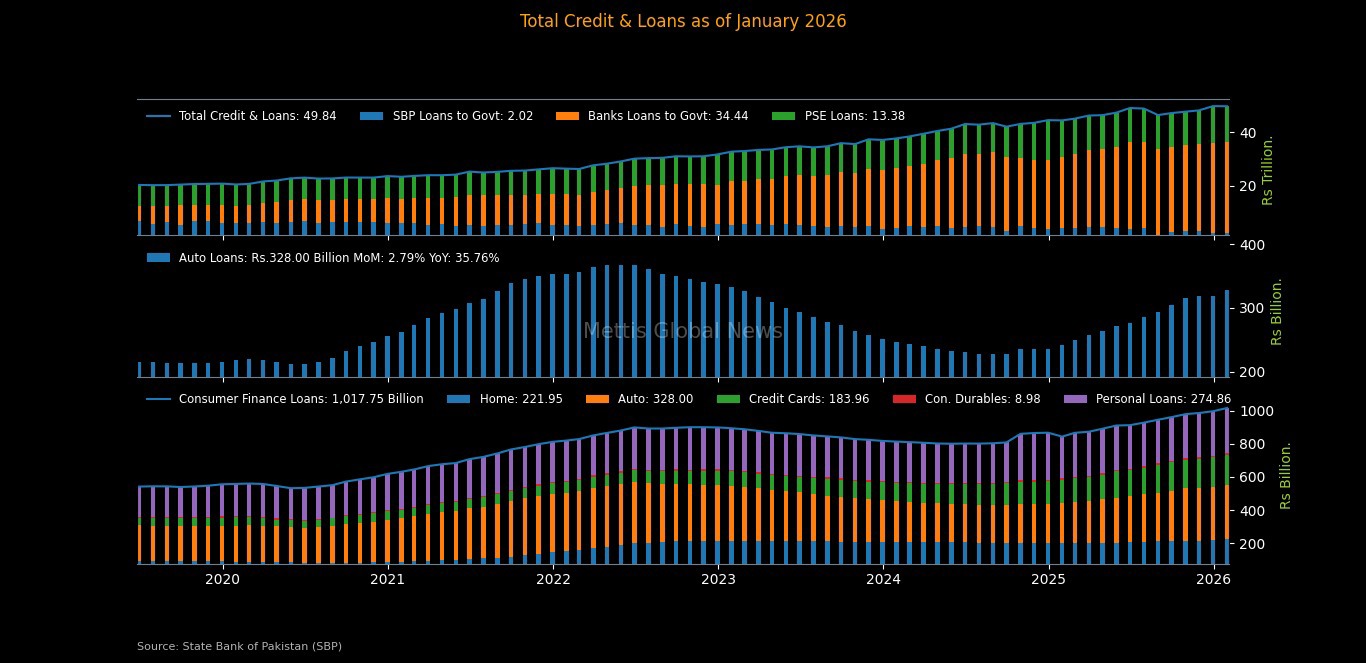

February 16, 2026 (MLN): Automobile financing in Pakistan increased to Rs328bn in January 2026, up 2.79% month-on-month (MoM) from Rs319.08bn in December 2025, according to the latest data released by the State Bank of Pakistan (SBP).

On a year-on-year (YoY) basis, car financing surged by 35.76%, compared with Rs241.6bn in the same period last year.

According to SBP data, consumer financing for house building stood at Rs221.95bn by the end of January 2026, up 11.02% YoY. On a monthly basis, housing finance inched up 0.75% from Rs220.31bn in the previous month.

Meanwhile, financing for personal use reached Rs274.86bn, reflecting an increase of 8.66% YoY and 2.56% MoM.

As a result, overall credit disbursed to consumers rose 20.55% YoY to Rs1.02tr. Compared with Rs997.94bn in the previous month, consumer financing posted a 1.99% MoM increase.

The central bank’s data further showed that outstanding credit to the private sector grew 6.56% YoY to Rs10.34tr in January 2026. However, on a sequential basis, private sector loans declined 3.09% MoM from Rs10.67tr in December.

Within private sector credit, loans to the manufacturing sector stood at Rs5.64tr during the review period, down 0.8% YoY and 3.74% MoM.

Borrowing by the construction sector amounted to Rs215.81bn in January, rising 1.54% YoY but falling 1.61% MoM.

The data also showed that loans to the agriculture, forestry, and fishing sectors increased to Rs601.35bn in the month under review, up 36.25% YoY, while declining 2.68% MoM on a sequential basis.

Copyright Mettis Link News

Related News

| Name | Price/Vol | %Chg/NChg |

|---|---|---|

| KSE100 | 154,421.43 202.93M | -0.92% -1437.05 |

| ALLSHR | 92,487.78 401.80M | -0.96% -898.05 |

| KSE30 | 47,322.74 112.52M | -1.11% -528.79 |

| KMI30 | 221,927.00 101.40M | -0.80% -1792.09 |

| KMIALLSHR | 59,889.41 199.88M | -1.08% -652.12 |

| BKTi | 44,127.70 34.85M | -1.99% -894.82 |

| OGTi | 31,715.42 8.74M | -2.31% -748.93 |

| Symbol | Bid/Ask | High/Low |

|---|

| Name | Last | High/Low | Chg/%Chg |

|---|---|---|---|

| BITCOIN FUTURES | 70,495.00 | 71,145.00 69,345.00 | -330.00 -0.47% |

| BRENT CRUDE | 99.81 | 101.59 95.20 | 7.83 8.51% |

| RICHARDS BAY COAL MONTHLY | 99.40 | 0.00 0.00 | -10.20 -9.31% |

| ROTTERDAM COAL MONTHLY | 124.50 | 124.60 123.85 | 3.10 2.55% |

| USD RBD PALM OLEIN | 1,083.50 | 1,083.50 1,083.50 | 0.00 0.00% |

| CRUDE OIL - WTI | 95.39 | 97.19 88.61 | 8.14 9.33% |

| SUGAR #11 WORLD | 14.41 | 14.49 14.12 | 0.16 1.12% |

Chart of the Day

Latest News

Top 5 things to watch in this week

Pakistan Stock Movers

| Name | Last | Chg/%Chg |

|---|

| Name | Last | Chg/%Chg |

|---|

_20260101112329999_0153db_20260209062258909_9180ec.webp?width=280&height=140&format=Webp)

Auto Numbers

Auto Numbers