3 things that mark the arrival of Economic Depression

MG News | June 20, 2019 at 03:16 PM GMT+05:00

June 20, 2019 (MLN): While the past few months have been no less than an abyss for Pakistan, an overview of the economic predicament within the international arena provides an unfortunate solace as it implies that the rest of the World doesn’t seem to be doing that well either.

Of all sorts of depression that Pakistan has come face to face with lately, a Global Economic Depression is the most foul and unwelcomed one, given the ordeal times that are already inhabiting all of the nation’s attention and fortitude.

Although a global synopsis signals towards the arrival of global depression, it also means that Pakistan’s government is probably not responsible for everything that is going wrong within the country, as the international ordeals surface to share the blame.

Here are 3 things underscored by AKD Research that hint towards arrival of the next Global Economic Depression:

- Trade Slowdown:

In World Trade Organization (WTO)’s latest global trade outlook, it was estimated that the World trade will continue to face strong headwinds in 2019 and 2020 after growing more slowly than expected in 2018 due to rising trade tensions and increased economic uncertainty.

According to WTO economists, merchandise trade volume growth is expected to fall to 2.6% in 2019 — down from 3.0% in 2018. Trade growth could then rebound to 3.0% in 2020; however, this is dependent on an easing of trade tensions.

A research note by AKD Research has pointed out that WTO’s global trade outlook has fallen to in CY10 lows “amidst other global freight indicators marking clear deceleration in global trade volumes.

- Crumpling Manufacturing Activity:

The leading indicators of global manufacturing activity which includes JP Morgan Global PMI and OECD’s composite leading indicator for advanced and emerging economies, have collapsed to the levels that were witnessed in the global recession 2008-09, says AKD note.

According to them, this sets hints towards significant compression over medium term.

- Falling prices and shrunken demand:

International price of crude has fallen by around 11-12% over the month, that of coal trades at a three-year low whereas cotton prices have plunged by 4.2% MoM.

AKD’s research highlights that the international cotton prices toppled due to weak consumption data for the upcoming year, with benchmark Cotlook index moving down 8.1% MoM.

“Looking ahead, the direction of cotton prices hinges upon the outcome of ongoing trade spat between China and the US,” analysts at AKD believe.

Similarly, the US-China trade war has a deep impact on coal prices as well. This coupled with the oversupply is maintaining a solid pressure on prices which have come down by 11% and are traded at a three year low of $62 per ton.

“Commodity linked domestic industries reliant on global sourcing of raw materials are likely to undergo a period of significant demand compressions, where our interactions with industrial importers reveal a dissuasive approach, with lower inventory levels preferred and remittance payments delayed, in expectation of PKR stability,” informed AKD.

Copyright Mettis Link News

Related News

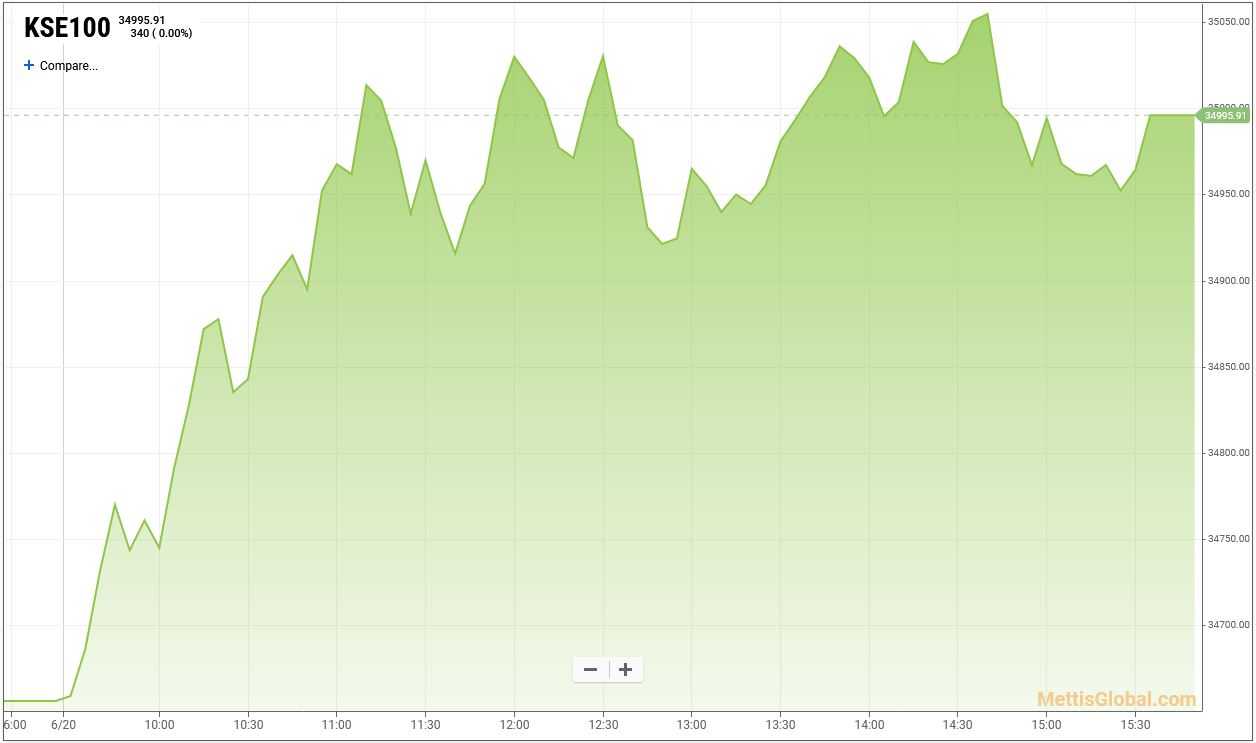

| Name | Price/Vol | %Chg/NChg |

|---|---|---|

| KSE100 | 134,299.77 290.06M |

0.39% 517.42 |

| ALLSHR | 84,018.16 764.12M |

0.48% 402.35 |

| KSE30 | 40,814.29 132.59M |

0.33% 132.52 |

| KMI30 | 192,589.16 116.24M |

0.49% 948.28 |

| KMIALLSHR | 56,072.25 387.69M |

0.32% 180.74 |

| BKTi | 36,971.75 19.46M |

-0.05% -16.94 |

| OGTi | 28,240.28 6.19M |

0.21% 58.78 |

| Symbol | Bid/Ask | High/Low |

|---|

| Name | Last | High/Low | Chg/%Chg |

|---|---|---|---|

| BITCOIN FUTURES | 118,140.00 | 119,450.00 115,635.00 |

4270.00 3.75% |

| BRENT CRUDE | 70.63 | 70.71 68.55 |

1.99 2.90% |

| RICHARDS BAY COAL MONTHLY | 97.50 | 0.00 0.00 |

1.10 1.14% |

| ROTTERDAM COAL MONTHLY | 108.75 | 108.75 108.75 |

0.40 0.37% |

| USD RBD PALM OLEIN | 998.50 | 998.50 998.50 |

0.00 0.00% |

| CRUDE OIL - WTI | 68.75 | 68.77 66.50 |

2.18 3.27% |

| SUGAR #11 WORLD | 16.56 | 16.60 16.20 |

0.30 1.85% |

Chart of the Day

Latest News

Top 5 things to watch in this week

Pakistan Stock Movers

| Name | Last | Chg/%Chg |

|---|

| Name | Last | Chg/%Chg |

|---|

MTB Auction

MTB Auction