APTMA urges restoration of zero-rating, uniform sales tax on yarn imports

MG News | February 10, 2025 at 11:28 AM GMT+05:00

February 10, 2025 (MLN): All Pakistan Textile Mills Association (APTMA) has demanded the restoration of zero-rating on local supplies under the Export Facilitation Scheme (EFS) or the imposition of the same sales tax regime on yarn imports.

A record 32 million kg of yarn was imported in January 2025 due to an unfair sales tax regime that continues to devastate the domestic cotton, spinning, and weaving industries.

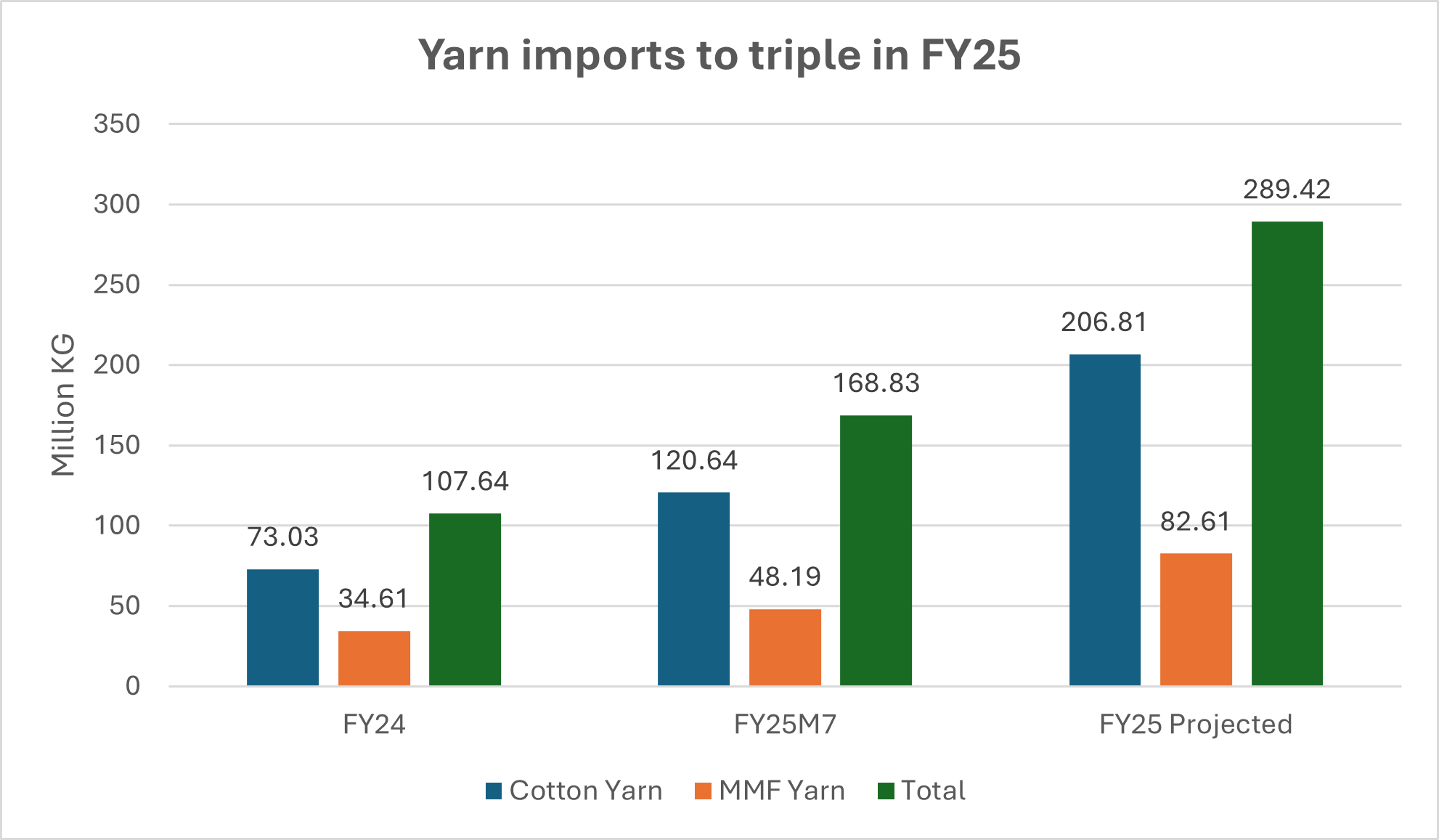

Yarn imports are set to triple in FY25, reaching a projected 289.42mn kg compared to 107.64mn kg in FY24.

In the first seven months of FY25 alone, imports had already surged to 168.83mn kg, with cotton yarn reaching 120.64mn kg and MMF (man-made fiber) yarn rising to 48.19mn kg.

In FY24, total yarn imports stood at 107.64mn kg, with cotton yarn accounting for 73.03mn kg and MMF yarn making up 34.61mn kg.

Industry stakeholders warn that local suppliers face an 18% sales tax on exports, while imports remain sales tax-free, according to All Pakistan Textile Mills Association (APTMA).

Nearly 40% of spinning units have shut down, while the remaining are operating below 50% capacity.

This decline has resulted in thousands of job losses, millions of dollars lost to imports, and billions of dollars in investment sunk.

The collapse of the spinning sector is also crippling domestic value addition in exports, with dire consequences for the broader textile industry.

Without a robust spinning industry, there will be no demand for Pakistani cotton, further exacerbating the crisis.

Industry representatives are calling for immediate policy corrections to prevent further damage.

Ensuring a level playing field for domestic cotton and industry is crucial for sustaining employment, improving the balance of payments, and reducing reliance on costly foreign loans.

Competitive industries require fair policies, APTMA further added.

Copyright Mettis Link News

Related News

| Name | Price/Vol | %Chg/NChg |

|---|---|---|

| KSE100 | 146,795.12 323.78M | -6.79% -10700.98 |

| ALLSHR | 88,495.82 491.27M | -6.08% -5731.19 |

| KSE30 | 45,108.67 136.27M | -6.67% -3221.53 |

| KMI30 | 210,115.63 111.33M | -6.49% -14571.70 |

| KMIALLSHR | 57,275.28 310.11M | -5.86% -3563.81 |

| BKTi | 42,586.22 57.25M | -6.38% -2903.74 |

| OGTi | 31,242.32 16.42M | -2.62% -841.15 |

| Symbol | Bid/Ask | High/Low |

|---|

| Name | Last | High/Low | Chg/%Chg |

|---|---|---|---|

| BITCOIN FUTURES | 67,450.00 | 68,215.00 65,685.00 | -845.00 -1.24% |

| BRENT CRUDE | 106.84 | 119.50 99.00 | 14.15 15.27% |

| RICHARDS BAY COAL MONTHLY | 99.40 | 0.00 0.00 | -11.85 -10.65% |

| ROTTERDAM COAL MONTHLY | 127.00 | 0.00 0.00 | 0.05 0.04% |

| USD RBD PALM OLEIN | 1,083.50 | 1,083.50 1,083.50 | 0.00 0.00% |

| CRUDE OIL - WTI | 102.23 | 119.48 98.00 | 11.33 12.46% |

| SUGAR #11 WORLD | 14.09 | 14.17 13.69 | 0.37 2.70% |

Chart of the Day

Latest News

Top 5 things to watch in this week

Pakistan Stock Movers

| Name | Last | Chg/%Chg |

|---|

| Name | Last | Chg/%Chg |

|---|

.png?width=280&height=140&format=Webp)