Weekly Update: Early losses erased by later gains

By MG News | June 23, 2017 at 11:43 AM GMT+05:00

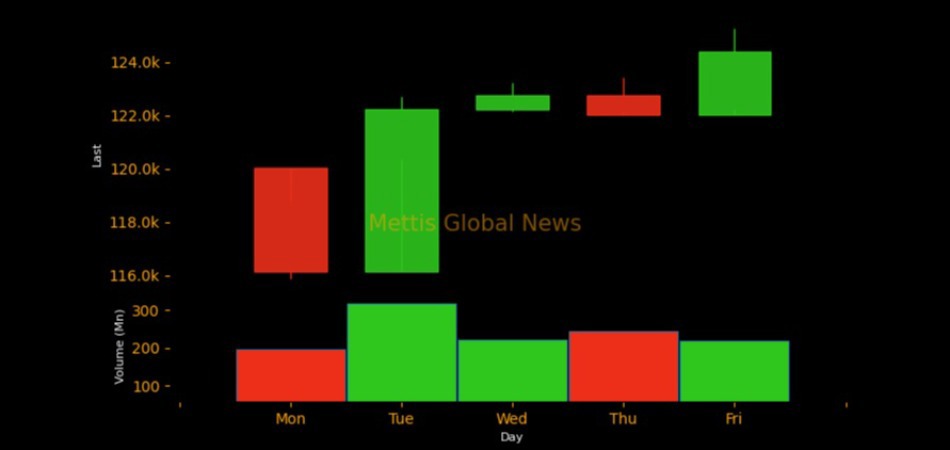

The market activity was equally split in two parts of up and down. The markets began with a turbulent two days when the markets fell to a year-to-date low of 44914 points low. The new lows paved way for seasoned investors to buy it cheap from the market, which helped the market gain some healthy momentum on Wednesday and Thursday. The downs and ups resulted in a close of week at -1.1%. The index lost almost 2,000 points in the first two days and then pared around 1,400 of those points to end the week with losses of a little over 500 points. Sectors that had been suffering in the last few weeks as the markets continued to fall were the ones who picked up in the last two days. Apart from the ongoing political uncertainity, declining oil prices have also taken a heavy toll on the market. Oil prices in the market have hit their ten months low in the ongoing week as the glut worries due to excessive supply form the Shale production has negated any desired effects prompted by the OPEC led cuts.

Volume leaders with the highest average daily traded shares during the week were: 1) KEL (124.1mn shares), 2) TRG (58.8mn shares), 3) BOP (43.3mn shares) and 4) EPCL (38.5mn shares). Top performers during the week were: 1) NM (+7.96%WoW), 2) HUBC (+3.86%WoW), 3) AKBL (+3.74%WoW), 4) EPCL (+3.01%WoW), whereas stocks leading declines were: 1) INDU (-6.80%WoW), 2) FFBL (-6.07%WoW), 3) LOTCHEM (-5.77%WoW) and 4) HASCOl (-5.17%WoW).

Key Announcements

- Central Directorate of National Savings (CDNS) has achieved Rs 188 billion savings till mid of last months of final quarter of current fiscal year, from July 1 to June 13, 2016-17.

- Government releases over Rs2b for petroleum ministry under PSDP

- IMF lauds Pakistans economy with favorable outlook

- PSX Falls Below 46000, touches a 6 month low

- China Offers To Make Diamer-Bhasha Dam Project Part of CPEC

- Nepra Approves Reduction in Power Tariff Under Fuel Price Adjustment

- Modifications made in Margin Financing System by NCCPL

- US to provide additional Rs 19bln to create economic opportunities in Pakistan

- Sugar price down rs 14 per kg to rs 56 during this Ramzan

- President KCCI demands immediate settlement of refunds claims

- Pakistan, Iran to sign free trade pact: Dastgir

- July - May FDI clocks in at USD 2.028 Billion

- Pakistan and France sign Credit Facility Agreement for Sustainable Energy Sector Reform Program

- Pakistan becomes full signatory of 'Washington Accord'

- France provides 100mn soft loan for sustainable energy sector reform program

- SECP notifies forms for reporting beneficial ownership

- Current account deficit crosses government estimate reaches USD 8.9 Billion

- Asian Development Bank to provide US$ 300 million for Public Sector Enterprises Reform Program

- Pakistan's Liquid FX Reserves at USD 20.361 Billion

- Ministry of Industries and Production has allowed KIA-Lucky Motors Pakistan Ltd, Nishat Group and United Motors Pvt Ltd to setup plants for assembling of vehicles worth US$372mn

Monday

After losing a total of 2,668 points in the previous week, the stock market started the incumbent week on a negative tone again. The close below 47,000 during the last week was first in last two months. The session witnessed a cumulative decline of 265.22 points or a 0.57 percent. The index touched an intra-day high of 47083.26 and a low of 46312.95 points, and closed at a tally of 46593.34 points. The net gainers during today's session were; Jubilee Life Insurance Corporation Limited JLICL +2.84%, Otsuka Pakistan Limited OTSU +5.00%, Pakistan Oilfields Limited POL +2.40%, Sazgar Engineering Works Limited SAZEW +5.00% and Attock Cement Pakistan Limited ACPL +3.15%.

The net decliners during the session were; Bata Pakistan Limited BATA -4.29%, Wyeth Pakistan Limited WYETH -5.00%, Indus Motor Company Limited INDU -4.72%, Hinopak Motors Limited HINO -5.00% and Service Industries Pakistan Limited SRVI -4.76%.

Tuesday

PSX witnessed a six month low today as it shed more than 1500 points, falling below the 45000 point for first time in the last six months. The session witnessed a cumulative decline of 1678.9 points or a 3.60 percent. The index touched an intra-day high of 44,777.33 and a low of 44,823.56 points, and closed at a tally of 44,914.44 points.

The net gainers during today's session were; Highnoon Laboratories Limited HINOON +4.38%, Abbott Laboratories ABOT +1.66%, Otsuka Pakistan Limited OTSU +5.00%, Sazgar Engineering Works Limited SAZEW +5.00% and Biafo Industries Limited BIFO 3.50%.

The net decliners during the session were; Unilever Pakistan Foods Limited UPFL -5.00%, Bata Pakistan Limited BATA -4.45%, Sanofi-Aventis Pakistan Limited SAPL -5.00%, Indus Motor Company Limited INDU -5.00% and Hinopak Motors Limited HINO -5.00%.

Wednesday

Activity at the bourse exhibited an epic battle between the bulls and bears, as evident by the intraday index curve drawing out 7 major inflection points and covering a span of almost 7,000pts in both directions. The market ended its recent run of negative finishes to close Wednesday's trading session with a 560 point gain. The session witnessed extreme volatility as the market swung between positive and negative before finally closing in the green. Market participation rose further as volumes gained 17% to 346mn.sh, while traded value rose 27% to Rs16.6bn/US$159mn.

The trading range was 1,938 points or 4.32 % of previous close as the index touched an intraday high of 45,765.35 (+850.90 points or 1.89%) and a low of 43,826.67 (-1,087 points or -2.42%).

Gainers were led by Service Ind. Ltd +49.00, followed by Millat tractors +46.00, Pak Suzuki +32.79, Honda Atlas Cars +31.97 and Indus Motors +23.10

Decliners were Pak Services -47.50, Wyeth Pak -42.25, Hinopak Motor -32.50, Siemens Pak -26.99 and Ghandhara Ind. -21.77.

Thursday

After a start of week with bruises and bloodshed, the markets finally picked up on the positive momentum instigated by the institutional buyers. The market ended the session at a positive number.

After falling at a six month low on Tuesday, the markets ended its negative session runs on Wednesday (yesterday) as the markets picked up due to institutional investors taking advantage of the low priced stocks. The session witnessed a cumulative incline of 857.85 points or a 1.89 percent. The index touched an intra-day high of 46464.38 and a low of 45474.46 points, and closed at a tally of 46332.44 points.

The net gainers during today's session were; Millat Tractors MTL +4.07%, Hinopak Motors Limited HINO +4.22%, Exide Pakistan EXIDE +4.09%, Mari Petroleum Company MARI +2.54% and Atlas Battery ATBA +4.33%.

The net decliners during the session were; Rafhan Maize Products Limited RMPL -3.52%, Wyeth Pakistan WYETH -2.83%, Honda Atlas Cars HCAR -5.00%, JDW Sugar Mills JDWS -4.25% and Thal Limited THALL -2.28%.

Related News

| Name | Price/Vol | %Chg/NChg |

|---|---|---|

| KSE100 | 125,627.31 258.99M |

1.00% 1248.25 |

| ALLSHR | 78,584.71 1,142.41M |

1.16% 904.89 |

| KSE30 | 38,153.79 69.25M |

0.63% 238.06 |

| KMI30 | 184,886.50 91.38M |

0.01% 13.72 |

| KMIALLSHR | 53,763.81 554.57M |

0.54% 290.61 |

| BKTi | 31,921.68 33.15M |

1.78% 557.94 |

| OGTi | 27,773.98 9.65M |

-0.40% -112.21 |

| Symbol | Bid/Ask | High/Low |

|---|

| Name | Last | High/Low | Chg/%Chg |

|---|---|---|---|

| BITCOIN FUTURES | 108,120.00 | 109,565.00 107,195.00 |

635.00 0.59% |

| BRENT CRUDE | 66.68 | 67.20 65.92 |

-0.12 -0.18% |

| RICHARDS BAY COAL MONTHLY | 97.00 | 97.00 97.00 |

1.05 1.09% |

| ROTTERDAM COAL MONTHLY | 107.65 | 107.65 105.85 |

1.25 1.17% |

| USD RBD PALM OLEIN | 998.50 | 998.50 998.50 |

0.00 0.00% |

| CRUDE OIL - WTI | 65.06 | 65.82 64.50 |

-0.46 -0.70% |

| SUGAR #11 WORLD | 16.19 | 16.74 16.14 |

-0.52 -3.11% |

Chart of the Day

Latest News

Top 5 things to watch in this week

Pakistan Stock Movers

| Name | Last | Chg/%Chg |

|---|

| Name | Last | Chg/%Chg |

|---|