Weekly Market Roundup

By Nilam Bano | March 02, 2025 at 11:40 AM GMT+05:00

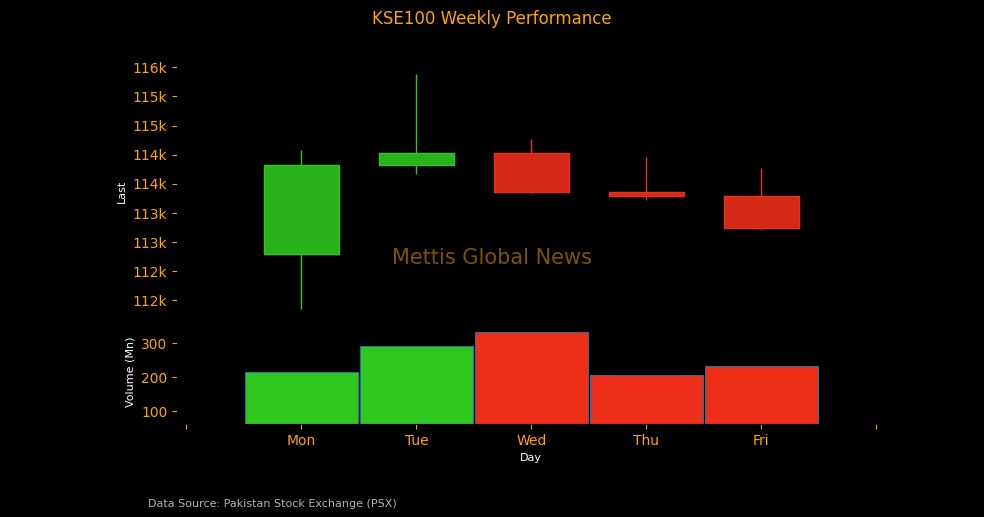

March 03, 2025 (MLN): The local bourse started the week on a positive note on the back of positive developments on the economic side but after two sessions profit taking activity was witnessed.

However, compared to the previous week, the benchmark KSE-100 index gained 450.73 points, up by 0.40% to close at 113,251.66 compared to the previous week’s close of 112,800.93.

Intraday swings were significant, with the index reached a high of 115,889.6 (+2,637.94 points) and a low of 111,857.33 (-1,394.33 points).

Market cap

The KSE-100 market capitalization stood at Rs3.48 trillion, up 0.38% from the previous week’s Rs3.46tr. In USD terms, the market cap was recorded at $12.45 billion, compared to $12.41bn in the prior week, reflecting a surge of $43.25 million or 0.35%.

This week, the index return in USD terms remained positive 0.36%, compared to last week’s return of 0.51%.

Investor sentiments received a significant boost as a technical delegation from the International Monetary Fund (IMF)began discussions on Monday regarding Pakistan’s request for more than $1 billion in additional funding to enhance climate resilience.

Following the initial talks, a policy review is set to take place early next week to evaluate the government’s performance under the existing $7 billion Extended Fund Facility (EFF). The government is expecting to receive between $1 billion and $1.5 billion in additional funding.

In addition, Pakistan and Iran signed a Memorandum of Understanding (MoU) to boost bilateral trade, setting a target of $10 billion.

The Consumer Price Index (CPI) for February 2025 is estimated at 1.9% YoY, compared to 2.4% YoY recorded in January 2025. On a sequential basis, inflation is expected to decrease by 0.5% compared to the previous month's decline of 0.2%.

The total money supply circulating within the economy till January 2025 has been recorded at Rs40.13 trillion. The money circulating within the economy until December 2024 was Rs40.21tr whereas, in January of last year, the figure was Rs35.58tr.

Furthermore, The foreign exchange reserves held by the State Bank of Pakistan (SBP) increased by $20.9 million or 0.19% WoW to $11.22bn during the week ended on February 21, 2025.

The positive economic cues helped stabilize investor sentiment, pushing the KSE-100 index’s fiscal year-to-date returns to 43.37%. However, on CYTD return stood at -1.62%.

Top Index Movers

During the week, Commercial Banks, Glass & Ceramics, and Power Generation & Distribution contributed 493.89, 82.99, and 78.06 points to the index.

On the flip side, Inv. Banks, Technology & Communication, and Engineering dented the index by - 221.25, -109.18, and -23.24 points, respectively.

Among individual stocks, OGDC added 206.39 points to the index while MCB, BAHL, and MEBL contributed to the index by 203.07, 176.30, and 118.77, respectively.

Conversely, UBL, MARI, and ABOT, eroded -215.87, -136.07, and - 106.49 points, respectively.

FIPI/LIPI

This week, Foreign Investors remained net sellers, offloading the equities worth $5.98m.

Among them, Foreign Corporates led the selling activity worth $4.55m while Overseas Pakistanis sold securities worth $1.44m.

On the other hand, this week, local Investors were net buyers, purchasing equities worth $5.98m.

Mutual Funds bought securities worth $31.62m whereas Individuals sold securities worth $18.52m.

Copyright Mettis Link News

Related News

| Name | Price/Vol | %Chg/NChg |

|---|---|---|

| KSE100 | 129,910.15 182.24M |

1.33% 1710.72 |

| ALLSHR | 80,837.96 498.46M |

1.32% 1050.34 |

| KSE30 | 39,773.34 73.66M |

1.71% 668.35 |

| KMI30 | 189,224.75 64.51M |

1.24% 2309.14 |

| KMIALLSHR | 54,695.79 234.10M |

0.91% 493.91 |

| BKTi | 34,687.44 33.07M |

3.62% 1210.76 |

| OGTi | 28,318.16 7.41M |

1.27% 355.58 |

| Symbol | Bid/Ask | High/Low |

|---|

| Name | Last | High/Low | Chg/%Chg |

|---|---|---|---|

| BITCOIN FUTURES | 107,290.00 | 107,290.00 105,440.00 |

1540.00 1.46% |

| BRENT CRUDE | 67.04 | 67.29 66.98 |

-0.07 -0.10% |

| RICHARDS BAY COAL MONTHLY | 97.50 | 97.50 97.50 |

0.70 0.72% |

| ROTTERDAM COAL MONTHLY | 103.80 | 0.00 0.00 |

-3.70 -3.44% |

| USD RBD PALM OLEIN | 998.50 | 998.50 998.50 |

0.00 0.00% |

| CRUDE OIL - WTI | 65.32 | 65.65 65.26 |

-0.13 -0.20% |

| SUGAR #11 WORLD | 15.70 | 16.21 15.55 |

-0.50 -3.09% |

Chart of the Day

Latest News

Top 5 things to watch in this week

Pakistan Stock Movers

| Name | Last | Chg/%Chg |

|---|

| Name | Last | Chg/%Chg |

|---|

.jpeg)

.jpeg)

.jpeg)

.jpeg)

.jpeg)

CPI

CPI