Weekly Market Roundup

Nilam Bano | February 16, 2025 at 09:13 PM GMT+05:00

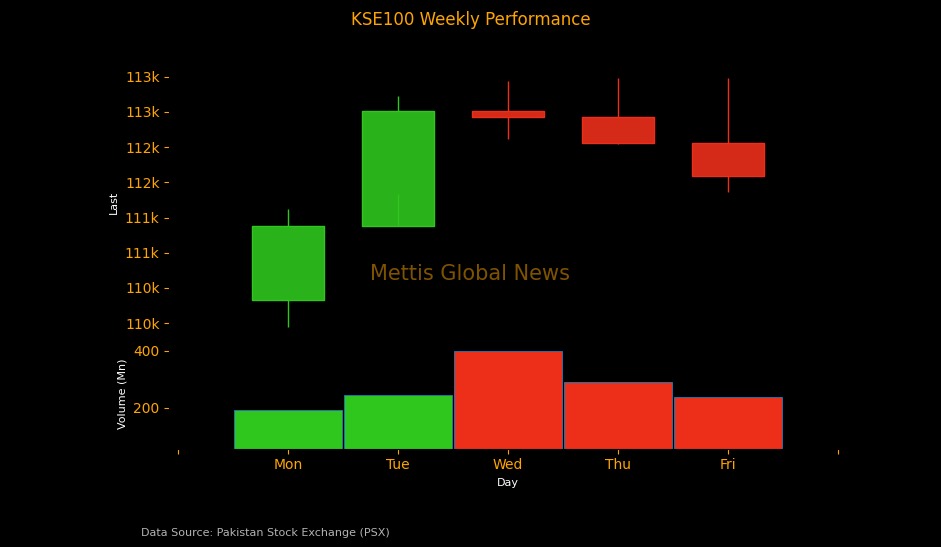

February 16, 2025 (MLN): Owing to the IMF factor, earnings season, and improved economic activity, Pakistan equities started the week on a positive note but later succumbed to selling pressure.

During the week, the benchmark KSE-100 index gained 1,762.36 points, up by 1.6% to close at 112,085.29 compared to the previous week’s close of 11,0322.93.

Intraday swings were significant, with the index reached a high of 113,482.12 (+1,396.83 points) and a low of 109,948.57 (-2,136.72 points).

KSE-100 Drawdown

The last close of the KSE-100 Index witnessed a 4.68% drawdown from its recent peak of 117,586.98 points on January 3, 2025.

Earlier, on January 17, 2023, the index experienced its most prominent drawdown, recorded at 20.3%.

Market cap

The KSE-100 market capitalization stood at Rs3.44 trillion, up 1.45% from the previous week’s Rs3.39tr. In USD terms, the market cap was recorded at $12.34 billion, compared to $12.17bn in the prior week, reflecting a surge of $169.3 million or 1.4%.

This week, the index return in USD terms turned positive 1.53%, compared to last week’s negative return of -3.47%.

During the week, a three-member mission from the International Monetary Fund (IMF) has arrived in Pakistan to conduct a Governance and Corruption Diagnostic Assessment (GCDA) under the Extended Fund Facility (EFF) 2024 program.

In addition, MSCI Inc. (NYSE: MSCI) disclosed the results of its February 2025 Index Review for the MSCI Equity Indexes wherein Abbott Laboratories (Pakistan) Limited, Searle Pakistan Limited, BF Biosciences Limited, Biafo Industries Limited, and Power Cement Limited joined the Index.

Deletions include Air Link Communication Limited, Askari Bank Limited, and Attock Refinery Limited.

Meanwhile, the State Bank of Pakistan (SBP) conducted an auction on Wednesday in which it sold Pakistan Investment Bonds (PIBs) worth Rs476.36 billion against the target of Rs350bn.

The sales of cars, including LCVs, vans, and jeeps, in Pakistan, increased by 61.4% in January 2025, clocking in at 17,010 units compared to 10,536 units recorded in the same month of last year,

The foreign exchange reserves held by SBP decreased by $251.7 million or 2.20% WoW to $11.17 billion during the week ended on February 07, 2025. The decrease in SBP reserves is attributed to the external debt repayments.

The positive economic cues helped stabilize investor sentiment, pushing the KSE-100 index’s fiscal year-to-date returns to 42.88%. However, on CYTD return stood at -2.64%.

Top Index Movers

During the week, Cement, Fertilizer, Oil & Gas Exploration Companies and Power Generation & Distribution contributed 571.97, 346.83, 339.21, and 154.56 points to the index.

On the flip side, Textile Composite & Oil & Gas Marketing Companies dented the index by -50.05, and -38.39 points, respectively.

Among individual stocks, LUCK added 448.75 points to the index while FFC, MARI, and HUBC contributed to the index by 217.11, 189.61, and 141.50, respectively.

Conversely, SYS, and PSO, eroded 58.08 and 44.49 points, respectively.

FIPI/LIPI

This week, Foreign Investors remained net sellers, offloading the equities worth $7.13m.

Among them, Foreign Corporates led the selling activity worth $6.5m while Overseas Pakistanis sold securities worth $0.6m.

On the other hand, this week, local Investors were net buyers, purchasing equities worth $7.13m.

Banks and Insurance Companies bought securities worth $9.66m and $4.49m, respectively.

However, Mutual Funds sold securities worth $8.26m.

Copyright Mettis Link News

Related News

| Name | Price/Vol | %Chg/NChg |

|---|---|---|

| KSE100 | 148,617.78 624.60M | 0.86% 1274.27 |

| ALLSHR | 91,685.08 1,340.28M | 0.74% 669.39 |

| KSE30 | 45,247.79 197.43M | 0.83% 370.74 |

| KMI30 | 212,370.79 224.51M | 1.05% 2209.48 |

| KMIALLSHR | 61,227.89 711.87M | 1.18% 715.56 |

| BKTi | 41,264.02 160.39M | 0.54% 221.73 |

| OGTi | 30,019.10 23.63M | 0.64% 190.41 |

| Symbol | Bid/Ask | High/Low |

|---|

| Name | Last | High/Low | Chg/%Chg |

|---|---|---|---|

| BITCOIN FUTURES | 108,265.00 | 0.00 0.00 | -510.00 -0.47% |

| BRENT CRUDE | 67.46 | 67.94 67.29 | -0.52 -0.76% |

| RICHARDS BAY COAL MONTHLY | 88.70 | 88.70 88.70 | -0.75 -0.84% |

| ROTTERDAM COAL MONTHLY | 96.15 | 96.75 96.00 | -0.40 -0.41% |

| USD RBD PALM OLEIN | 1,106.50 | 1,106.50 1,106.50 | 0.00 0.00% |

| CRUDE OIL - WTI | 64.01 | 0.00 0.00 | 0.00 0.00% |

| SUGAR #11 WORLD | 16.34 | 16.52 16.33 | -0.14 -0.85% |

Chart of the Day

Latest News

Top 5 things to watch in this week

Pakistan Stock Movers

| Name | Last | Chg/%Chg |

|---|

| Name | Last | Chg/%Chg |

|---|

.jpeg)

.jpeg)

.jpeg)

SPI

SPI