Weekly Market Roundup

.jpeg)

MG News | January 11, 2025 at 10:20 PM GMT+05:00

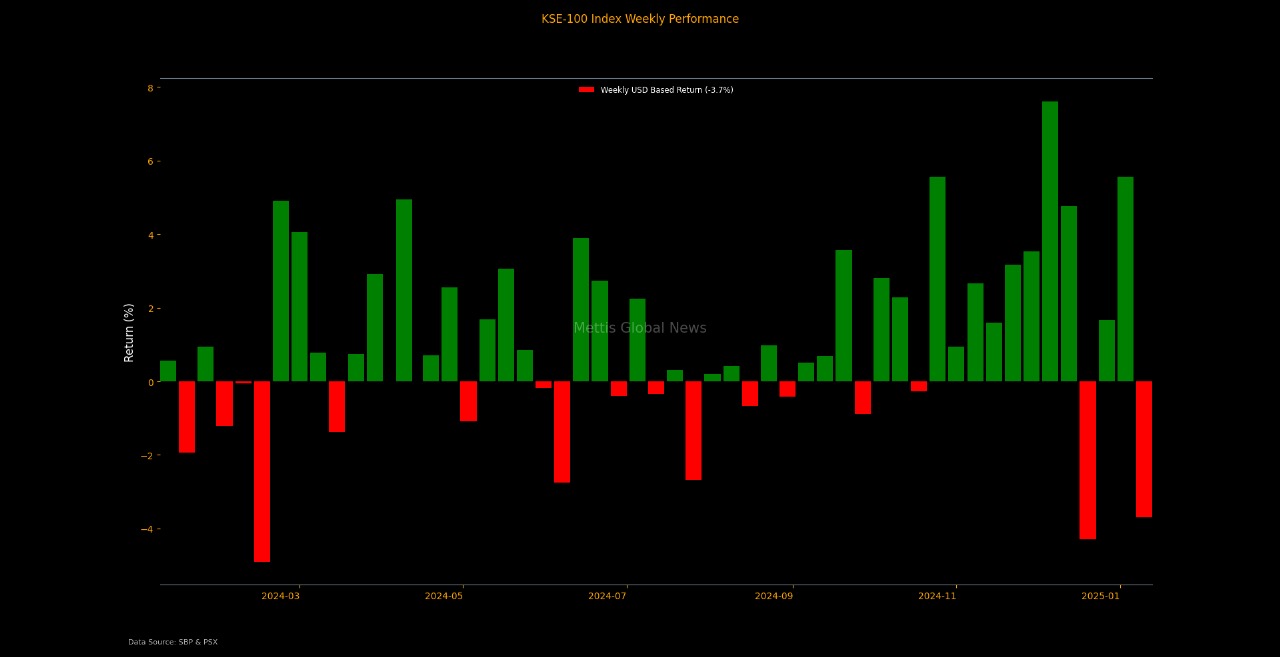

January 11, 2025 (MLN): Profit-taking dominated the Pakistan Stock Exchange (PSX) last week as the benchmark KSE-100 index nosedived by 4,339.7 points (-3.7%) to close at 113,247.29.

Intraday swings were significant, with the index reaching a high of 118,735.1 (+5,487.81 points) and a low of 112,013.59 (-1,233.7points).

Reversing last week’s 5.56% climb, the index took a 3.69% dip this week in USD terms.

On the economic front, the UAE extended its $2 billion loan to Pakistan, while ADB revised Pakistan's FY25 growth target slightly upward from 2.8% to 3%.

Remittances remained strong in December 2024 as it reached $3.1bn, witnessing a 29% YoY increase.

In the T-bill auction, cut-off yields fell by up to 50bps. Meanwhile, PSX held a GIS auction where the government raised Rs138bn, mainly through 10-year VRR Sukuk.

On the external front, SBP reserves declined by $15 million WoW to $11.7bn.

Despite the volatility, positive economic cues helped stabilize investor sentiment, pushing the KSE-100 index’s fiscal year-to-date returns to 44.36%.

Top Index Movers

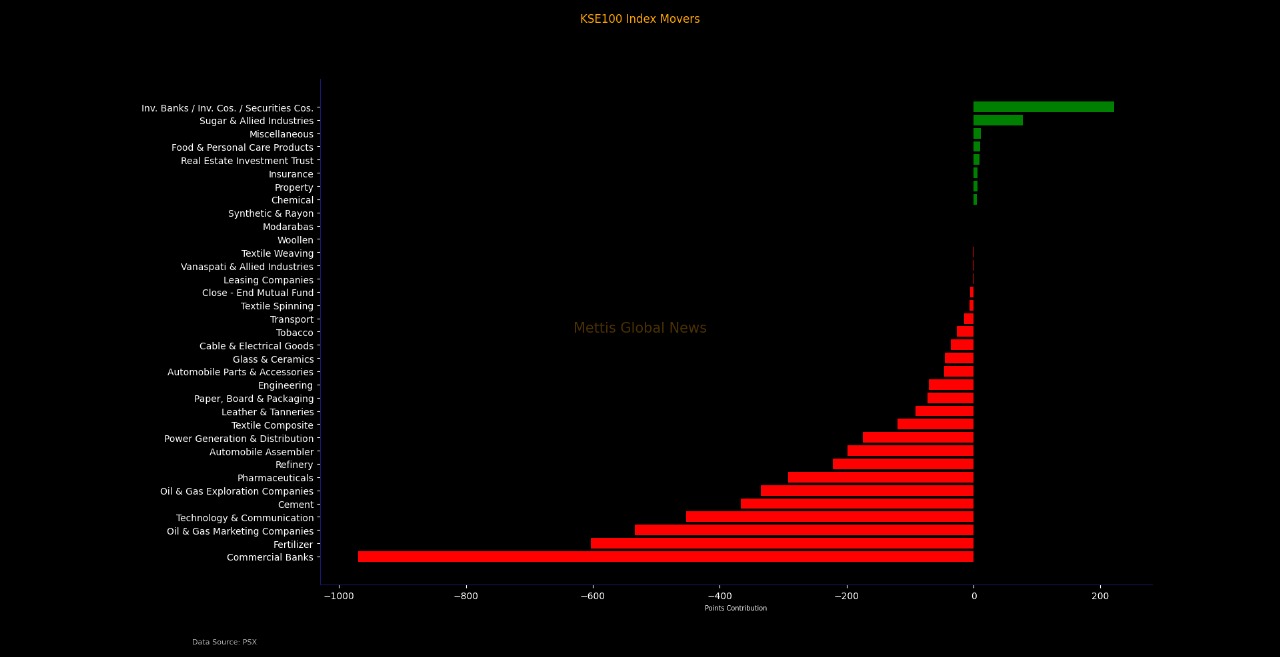

Sector-wise, Commercial Banks, Fertilizer, Oil & Gas Marketing Companies, Technology & Cement dented the index by 970.02, 603.20, 533.93, 453.25 and 367.21 points, respectively.

Contrary to that, Inv. Banks and Sugar & Allied Industries contributed 221.93 and 77.33 points, respectively.

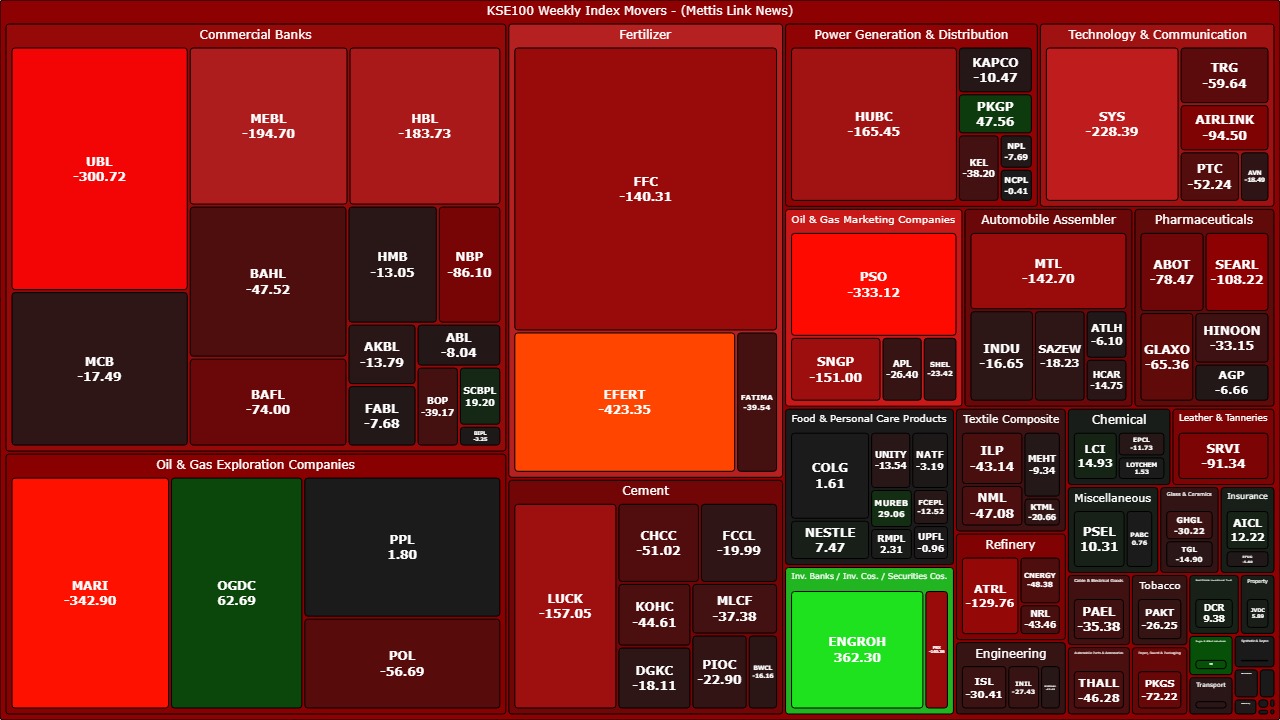

EFERT emerged as the worst-performing stock of the week, eroding the index by 423.35 points. It was followed by MARI, PSO, and UBL, losing 342.89, 333.11, and 300.71 points, respectively.

Conversely, ENGROH replacing ENGRO and DAWH started trading on Monday and had a major positive contribution of 362.29 points in the index during the week.

FIPI/LIPI

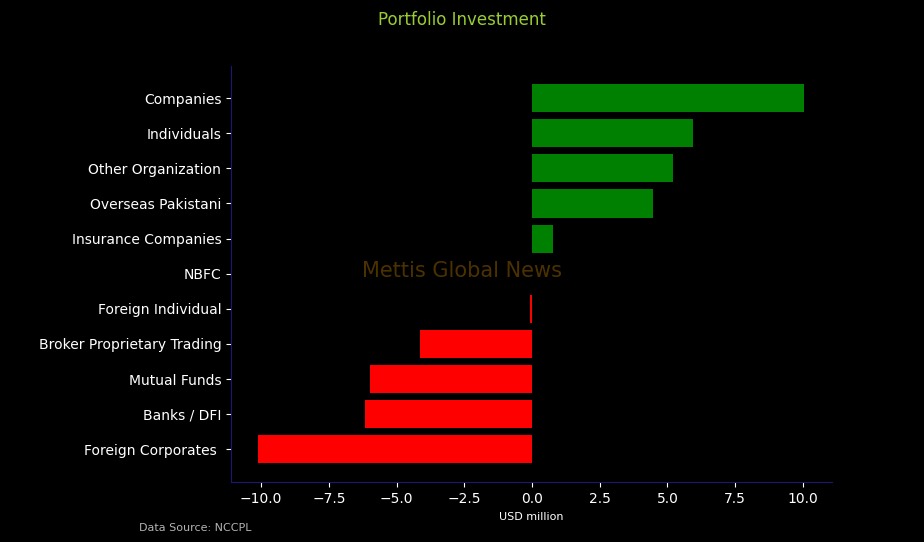

This week, foreign investors were net sellers, offloading equities worth $5.69m.

Among them, foreign corporates led the selling spree with $10.1m, while foreign individuals sold securities worth $76.58thousand.

On the other hand, overseas Pakistanis purchased securities amounting to $4.48m.

Meanwhile, local investors emerged as net buyers this week, recording an investment of $5.69m.

Among them, companies led the buying activity with a net purchase of $5.93m while mutual funds sold securities worth $5.96m.

Copyright Mettis Link News

Related News

| Name | Price/Vol | %Chg/NChg |

|---|---|---|

| KSE100 | 134,299.77 290.06M |

0.39% 517.42 |

| ALLSHR | 84,018.16 764.12M |

0.48% 402.35 |

| KSE30 | 40,814.29 132.59M |

0.33% 132.52 |

| KMI30 | 192,589.16 116.24M |

0.49% 948.28 |

| KMIALLSHR | 56,072.25 387.69M |

0.32% 180.74 |

| BKTi | 36,971.75 19.46M |

-0.05% -16.94 |

| OGTi | 28,240.28 6.19M |

0.21% 58.78 |

| Symbol | Bid/Ask | High/Low |

|---|

| Name | Last | High/Low | Chg/%Chg |

|---|---|---|---|

| BITCOIN FUTURES | 118,140.00 | 119,450.00 115,635.00 |

4270.00 3.75% |

| BRENT CRUDE | 70.63 | 70.71 68.55 |

1.99 2.90% |

| RICHARDS BAY COAL MONTHLY | 97.50 | 0.00 0.00 |

1.10 1.14% |

| ROTTERDAM COAL MONTHLY | 108.75 | 108.75 108.75 |

0.40 0.37% |

| USD RBD PALM OLEIN | 998.50 | 998.50 998.50 |

0.00 0.00% |

| CRUDE OIL - WTI | 68.75 | 68.77 66.50 |

2.18 3.27% |

| SUGAR #11 WORLD | 16.56 | 16.60 16.20 |

0.30 1.85% |

Chart of the Day

Latest News

Top 5 things to watch in this week

Pakistan Stock Movers

| Name | Last | Chg/%Chg |

|---|

| Name | Last | Chg/%Chg |

|---|

MTB Auction

MTB Auction