Weekly Market Roundup

Abdur Rahman | November 22, 2024 at 08:19 PM GMT+05:00

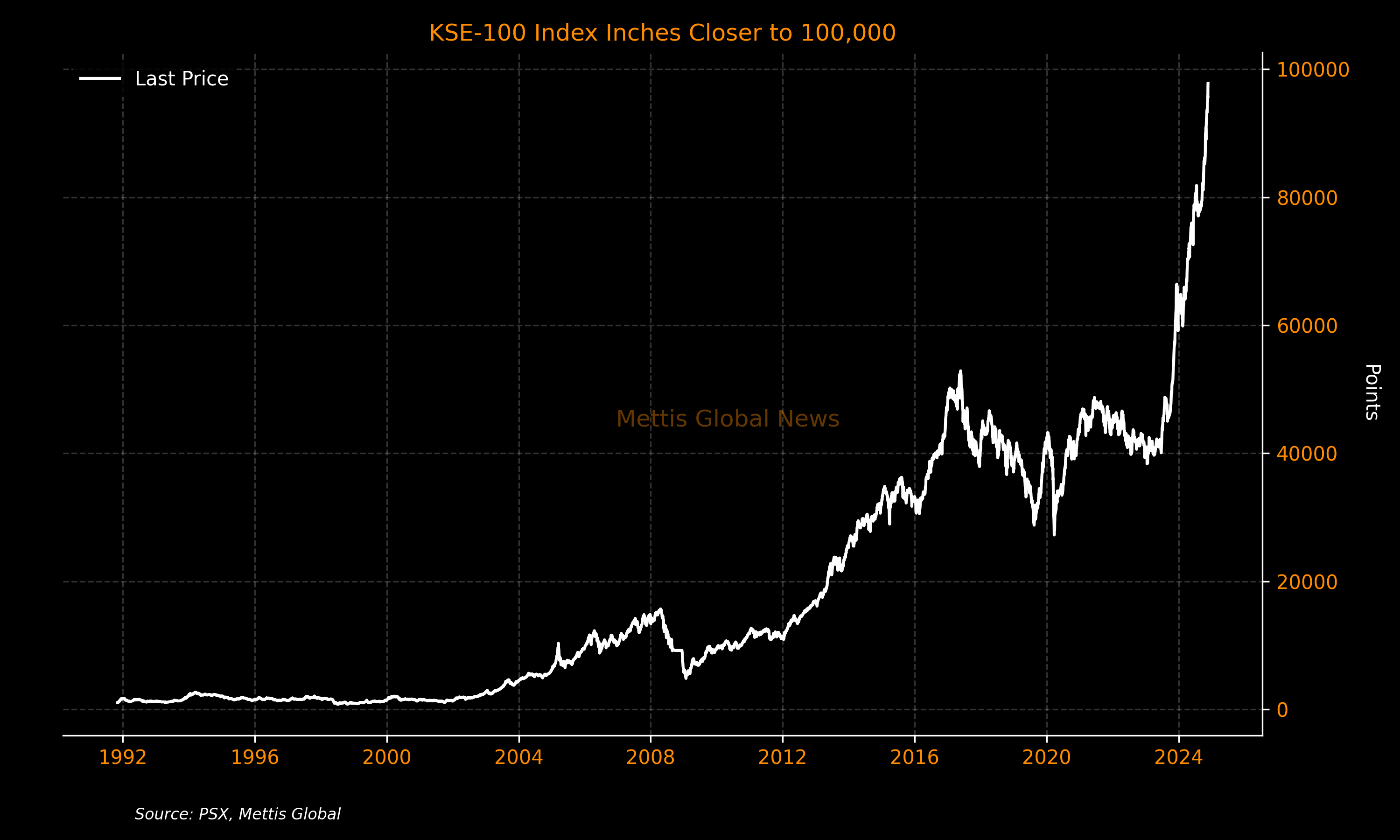

November 22, 2024 (MLN): Pakistan stocks extended their record-breaking run to close in on the historic 100,000 mark, buoyed by improving economic conditions and falling bond yields.

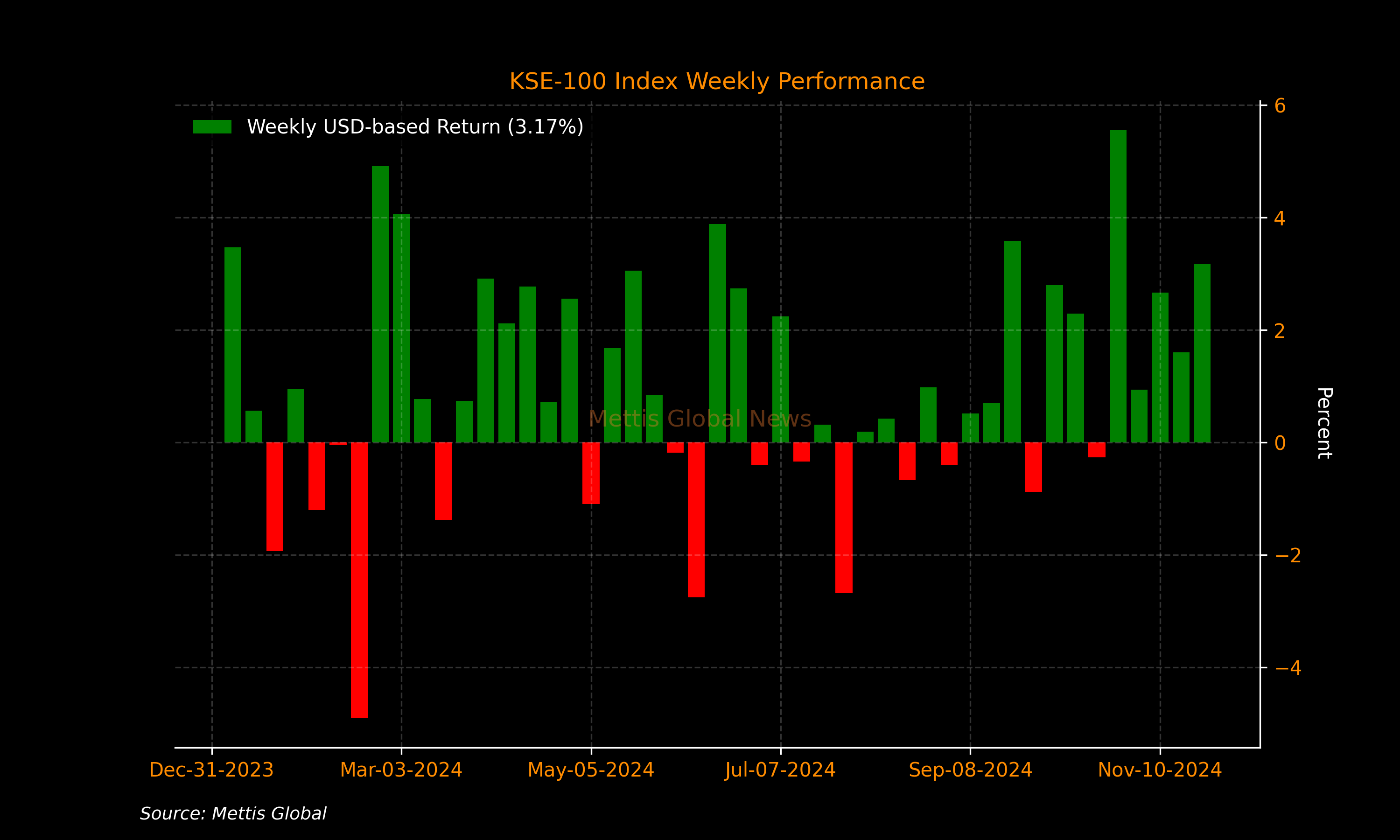

The stock benchmark KSE-100 Index advanced 3,035 points or 3.2% to 97,798 and notched its fifth consecutive weekly gain, the longest winning streak since April.

The gauge has handed more than 56% returns to investors this year, aided by mutual funds’ net purchases of $136.5 million in Pakistani stocks, the highest since 2017, according to data compiled by MG Research.

Mutual funds are piling into local shares at a record pace on signs of improvement in the nation’s economy, declining interest rates, and a stable rupee.

Pakistan’s economy has stabilized with inflation easing significantly from a record 38% in May 2023 to 7.2% in October. That has allowed the central bank to reduce interest rates by 700bps since June in four consecutive cuts.

Consumer price gains are expected to ease further to below 5% in November, according to MG Research calculations

Despite the stock market's record-breaking rally, the KSE-100 is still traded at 5.8 times future earnings, a multiple that’s 29% lower than its 10-year average.

Throughout the week, KSE-100 traded in a wide range of 5,003 points, between a high of 99,623 (+4,859) and a low of 94,620 (-143) points.

Pakistan stock market's average traded volume rose 12.8% WoW to 990.71 million shares. Traded value also increased 5.4% WoW to Rs34.41 billion.

Market capitalization jumped by $1.11bn or 2.5% to $45.07bn over the week. In PKR terms, market capitalization stood at Rs12.52 trillion.

Top Index Movers

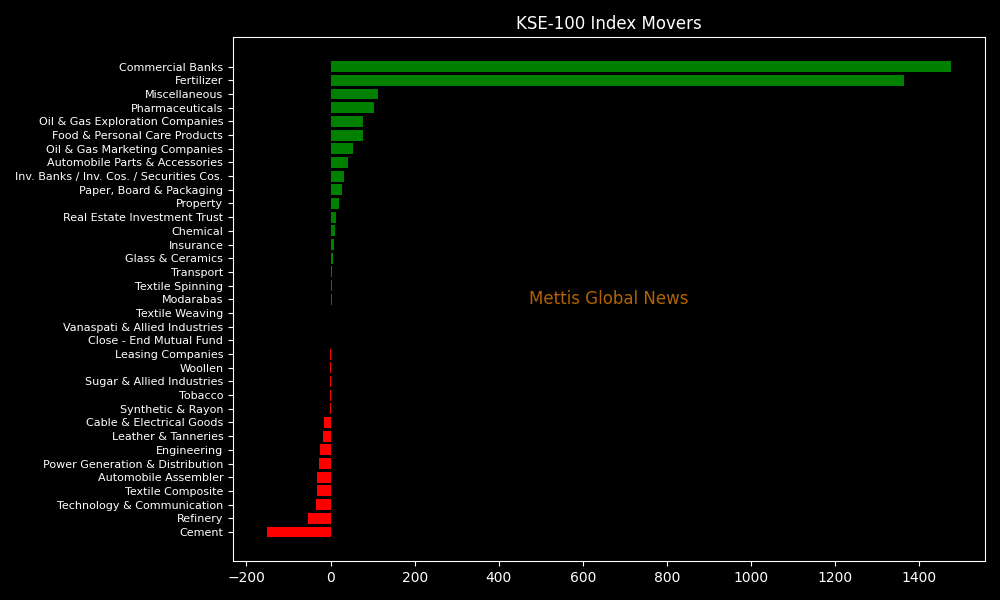

Sector-wise, top positive contributors were Commercial Banks (+1,475pts), Fertilizer (+1,364pts), Miscellaneous (+112pts), Pharmaceuticals (+103pts), and Oil & Gas Exploration Companies (+78pts).

Contrary to that, negative contributions came from Cement (-151pts), Refinery (-54pts), Technology & Communication (-35pts), Textile Composite (-31pts), and Automobile Assembler (-31pts).

The best-performing stocks during the week were FFC (+979pts), MEBL (+393pts), BAHL (+254pts), HBL (+207pts), and MCB (+180pts).

Whereas, the worst-performing were HUBC (-91pts), SEARL (-59pts), TRG (-56pts), LUCK (-52pts), and ATRL (-48pts).

FIPI/LIPI

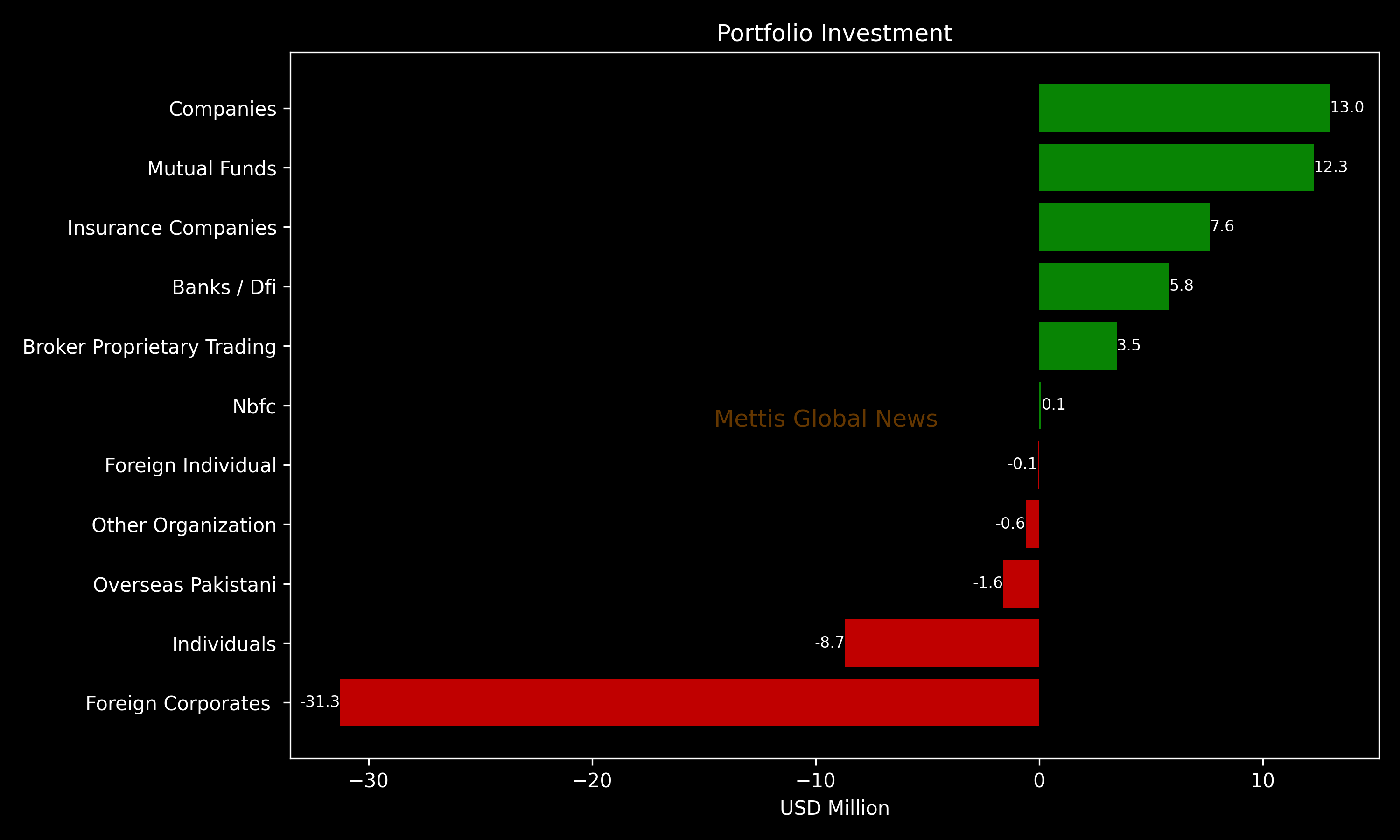

Foreign investors were net sellers during the week, dumping a significant $33m worth of equities.

Flow-wise, the leading sellers were Foreign Corporates with a net sale of $31.3m. Their most substantial sales activity was in Commercial Banks, amounting to $22.2m.

On the other hand, Companies were the dominant buyers, with a net investment of $13.0m. They allocated the majority of their capital, $9.7m, to Commercial Banks.

Copyright Mettis Link News

Related News

| Name | Price/Vol | %Chg/NChg |

|---|---|---|

| KSE100 | 168,062.17 222.44M | -0.49% -830.92 |

| ALLSHR | 100,418.83 533.18M | -0.47% -469.95 |

| KSE30 | 51,322.39 95.56M | -0.78% -400.92 |

| KMI30 | 235,325.12 71.27M | -0.62% -1468.03 |

| KMIALLSHR | 64,292.17 192.91M | -0.54% -350.28 |

| BKTi | 49,115.42 49.83M | -0.78% -388.38 |

| OGTi | 32,316.78 8.08M | -1.33% -436.77 |

| Symbol | Bid/Ask | High/Low |

|---|

| Name | Last | High/Low | Chg/%Chg |

|---|---|---|---|

| BITCOIN FUTURES | 66,185.00 | 67,760.00 64,325.00 | -1640.00 -2.42% |

| BRENT CRUDE | 71.88 | 71.96 70.69 | 0.12 0.17% |

| RICHARDS BAY COAL MONTHLY | 96.00 | 0.00 0.00 | -3.50 -3.52% |

| ROTTERDAM COAL MONTHLY | 107.95 | 107.95 107.95 | 0.30 0.28% |

| USD RBD PALM OLEIN | 1,071.50 | 1,071.50 1,071.50 | 0.00 0.00% |

| CRUDE OIL - WTI | 66.60 | 66.67 65.38 | 0.12 0.18% |

| SUGAR #11 WORLD | 14.05 | 14.10 13.78 | 0.18 1.30% |

Chart of the Day

Latest News

Top 5 things to watch in this week

Pakistan Stock Movers

| Name | Last | Chg/%Chg |

|---|

| Name | Last | Chg/%Chg |

|---|

Monetary Aggregates (M3) - Monthly Profile

Monetary Aggregates (M3) - Monthly Profile