Weekly Market Roundup

MG News | February 09, 2020 at 04:47 PM GMT+05:00

February 9, 2020 (MLN): The State Bank of Pakistan’s attempts to preempt the inflation numbers by introducing a plethora of incentives to boost exports during its MPS press conference seems to have done little to offset the market’s shock at higher than expected inflation numbers.

Subsequent firefighting by the Finance minister and the SBP to assure the market that inflation had peaked has not calmed investor sentiment with only foreign investors in Government securities cheering higher interest rates and a stable currency.

Further panic was created following news of shortfall in tax revenue and proposals for additional tax measures to be introduced in a mini or the upcoming budget.

Equity Market Roundup

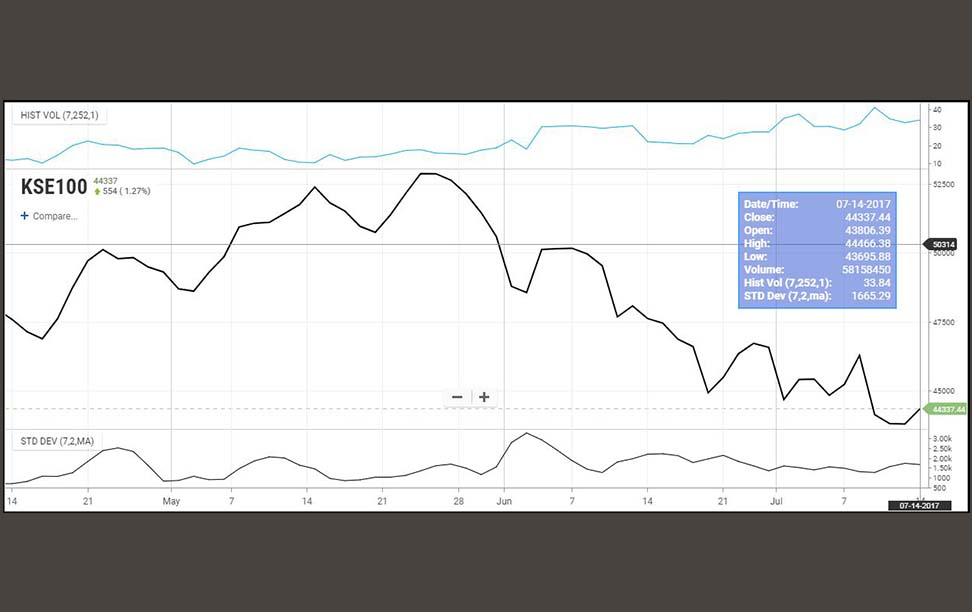

The KSE-100 index lost nearly 1,487 points during the week, and closed at 40,143 level, i.e. lower by 3.57 percent in comparison to the previous week's closing of 41,630 points.

According to a research report by Arif Habib Limited, aggravated inflationary pressure and turmoil in global markets following the outbreak of the Corona Virus were the primary reasons behind the continuation of the selling spree in the stock market.

During the week, E&P Companies snatched around 525 points from the benchmark index, followed by Commercial Banks and Cement sector as the took away 240 points and 125 points respectively. Company-wise, the scrips of MCB (-125), PPL (-158), OGDC (-125), HBL (-104) AND PSO (-74) endured the highest losses.

Likewise, the All-Share Market Index declined by a whopping $1.7 billion before settling at $49.06 billion.

Foreign investors were the net sellers during the week, with the total sale of securities being recorded at $14.1 million. Amongst these, Foreign Corporates emerged as the largest group of buyers as they sold securities worth $15.6 million.

On the contrary, local investors were the net buyers, with Insurance Companies making the largest sale at $13.6 million, followed by Induvial Investors who sold securities amounting to $7.7 million.

Forex Roundup

The dollar traded in a range of 22 Paisa against PKR during the week, being quoted at a low of 154.35 (ask) and a high of 154.57 (bid), and closing at 154.40, a decline of 8 paisa over the shortened week.

The Pak Rupee has now extended its gains to the sixth successive week and closed at a 7 month high, having appreciated by Rs.5.65 or 3.53 percent since the start of FY20.

10 Day volatility increased from 0.50 percent in the previous week to 0.57 percent.

Fixed Income Roundup

While in the initial reaction to the inflation numbers being much higher than expectations was relatively muted, the interest rate shot up after the PIB auction in which cut off yields went up by 30, 20 and 10 basis points for 3, 5 and 10 years and markets fears of monetary easing being delayed were realized.

Secondary market yields were up by 37, 36 and 14 basis points for 3, 5 and 10 years while the short-term yields for 3 months increased by 7 bps while 6 and 12 months were up by 12 bps.

Copyright Mettis Link News

Related News

| Name | Price/Vol | %Chg/NChg |

|---|---|---|

| KSE100 | 138,597.36 256.32M | -0.05% -68.14 |

| ALLSHR | 85,286.16 608.38M | -0.48% -413.35 |

| KSE30 | 42,340.81 77.13M | -0.03% -12.33 |

| KMI30 | 193,554.51 76.19M | -0.83% -1627.52 |

| KMIALLSHR | 55,946.05 305.11M | -0.79% -443.10 |

| BKTi | 38,197.97 16.53M | -0.59% -225.01 |

| OGTi | 27,457.35 6.73M | -0.94% -260.91 |

| Symbol | Bid/Ask | High/Low |

|---|

| Name | Last | High/Low | Chg/%Chg |

|---|---|---|---|

| BITCOIN FUTURES | 117,670.00 | 121,165.00 117,035.00 | -1620.00 -1.36% |

| BRENT CRUDE | 69.23 | 70.77 69.14 | -0.29 -0.42% |

| RICHARDS BAY COAL MONTHLY | 96.50 | 0.00 0.00 | 2.20 2.33% |

| ROTTERDAM COAL MONTHLY | 104.50 | 104.50 104.50 | -0.30 -0.29% |

| USD RBD PALM OLEIN | 998.50 | 998.50 998.50 | 0.00 0.00% |

| CRUDE OIL - WTI | 66.03 | 67.54 65.93 | -0.20 -0.30% |

| SUGAR #11 WORLD | 16.79 | 17.02 16.71 | 0.05 0.30% |

Chart of the Day

Latest News

Top 5 things to watch in this week

Pakistan Stock Movers

| Name | Last | Chg/%Chg |

|---|

| Name | Last | Chg/%Chg |

|---|

Weekly Forex Reserves

Weekly Forex Reserves