Weekly Market Roundup

Abdur Rahman | October 25, 2024 at 08:26 PM GMT+05:00

October 25, 2024 (MLN): Pakistan stocks soared to new heights this week as improving macroeconomic indicators and expectations of further reduction in the policy rate continued to boost sentiment.

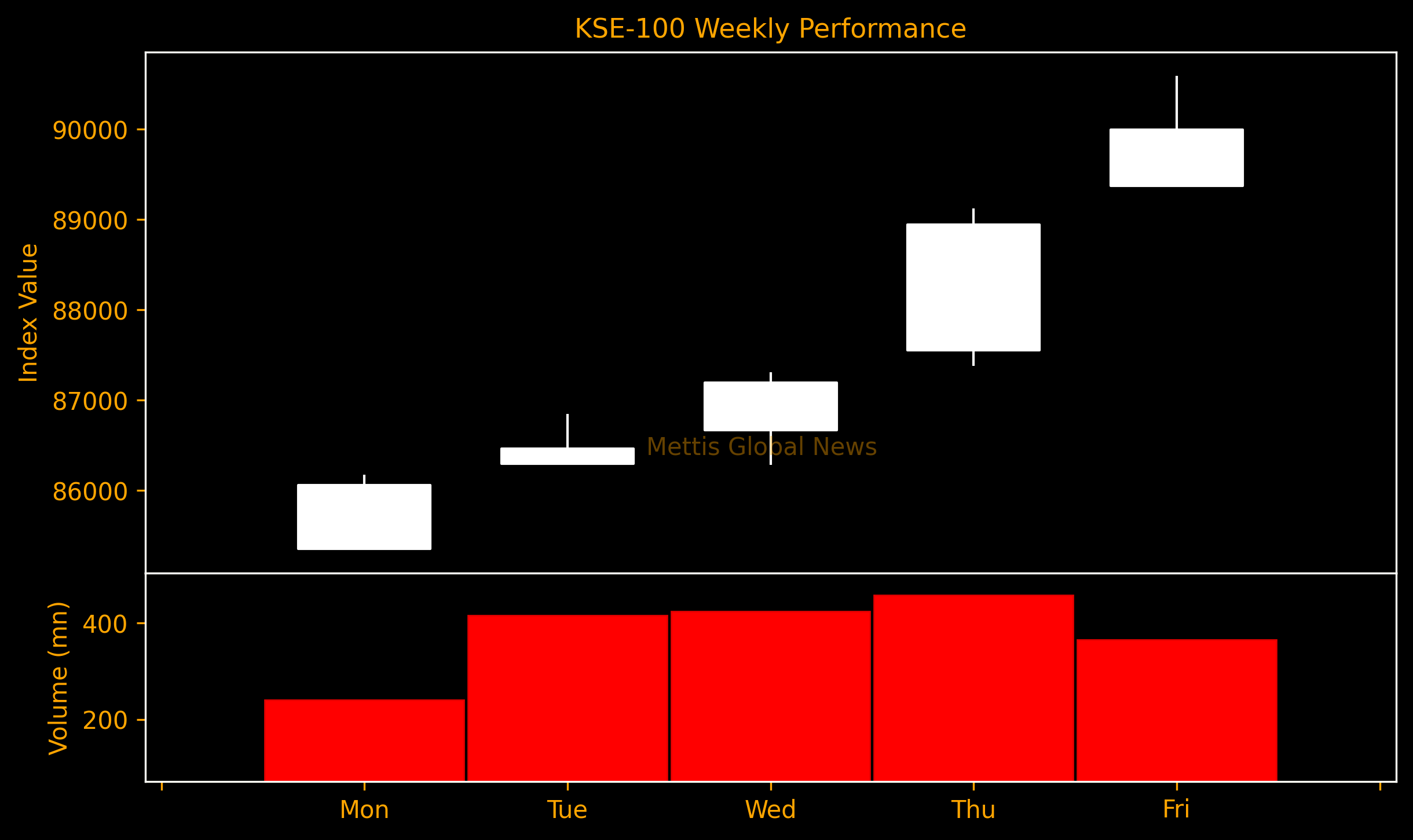

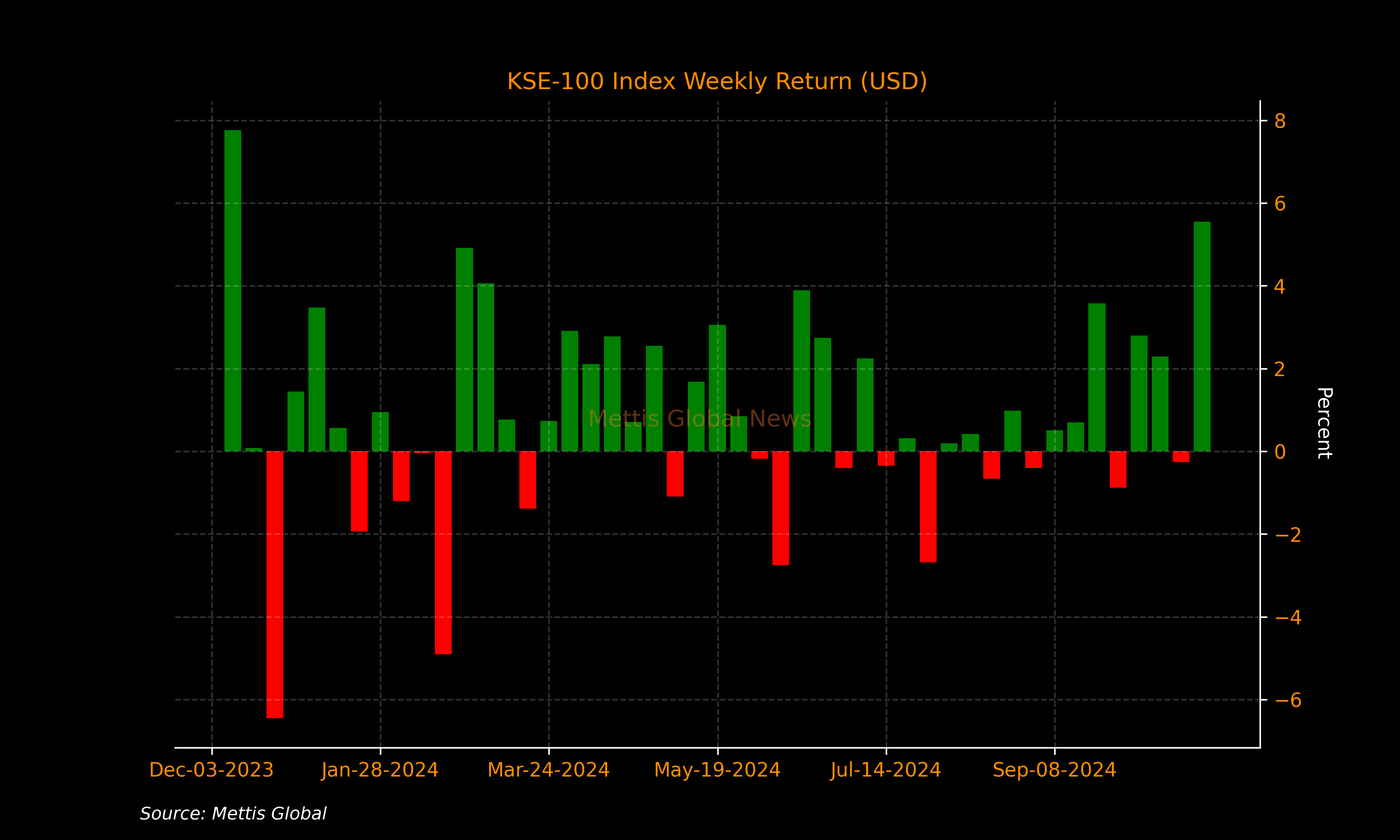

The benchmark KSE-100 Index surged 4,744 points or 5.6% in both PKR and USD terms to close at an all-time high of 89,994.

That was the biggest weekly jump since December last year.

Throughout the week, KSE-100 traded in a wide range of 5,244 points, between a high of 90,594 (+5,344) and a low of 85,349 (+99) points.

Pakistan stock market's average traded volume increased 51.5% WoW to 669.93 million shares. Traded value also rose 29.6% WoW to Rs29.09 billion.

Market capitalization increased by $1.84bn or 4.6% to $42.1bn over the week. In PKR terms, market capitalization stood at Rs11.69 trillion.

The State Bank of Pakistan has cut interest rate by 450 basis points since June and is scheduled to review monetary policy again on November 04.

Most analysts believe the central bank will reduce its policy rate by another 200 bps in its upcoming meeting amid a decline in inflation, and a low current account deficit.

Top Index Movers

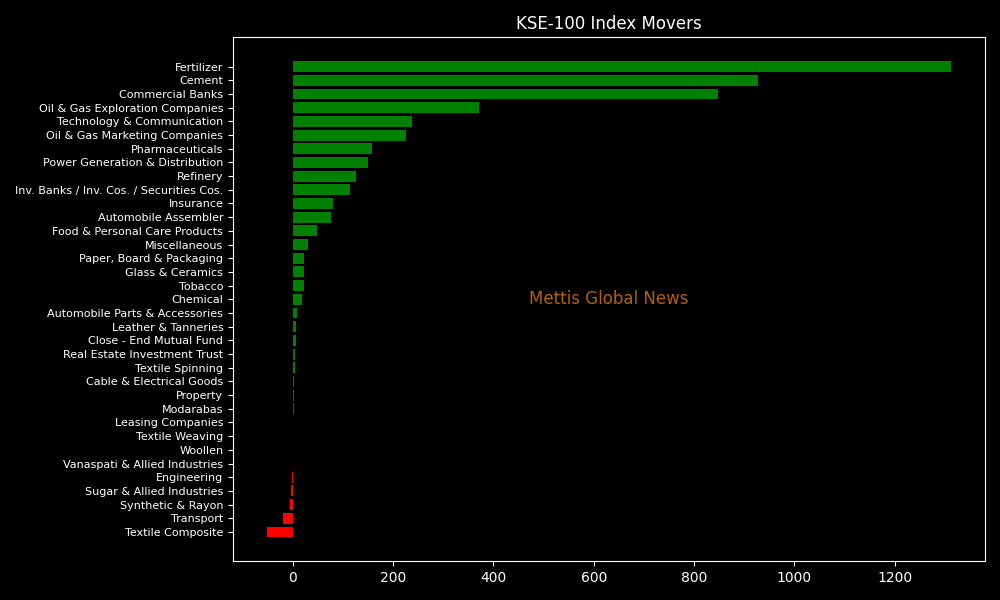

Sector-wise, top positive contributors were Fertilizer (+1,312pts), Cement (+929pts), Commercial Banks (+847pts), Oil & Gas Exploration Companies (+371pts), and Technology & Communication (+238pts).

Contrary to that, negative contributions came from Textile Composite (-51pts), Transport (-19pts), Synthetic & Rayon (-7pts), Sugar & Allied Industries (-4pts), and Engineering (-2pts).

The best-performing stocks during the week were FFC (+852pts), UBL (+374pts), EFERT (+235pts), OGDC (+206pts), and LUCK (+203pts).

Whereas, the worst-performing were ILP (-87pts), POL (-41pts), INDU (-24pts), PIBTL (-19pts), and BAFL (-18pts).

FIPI/LIPI

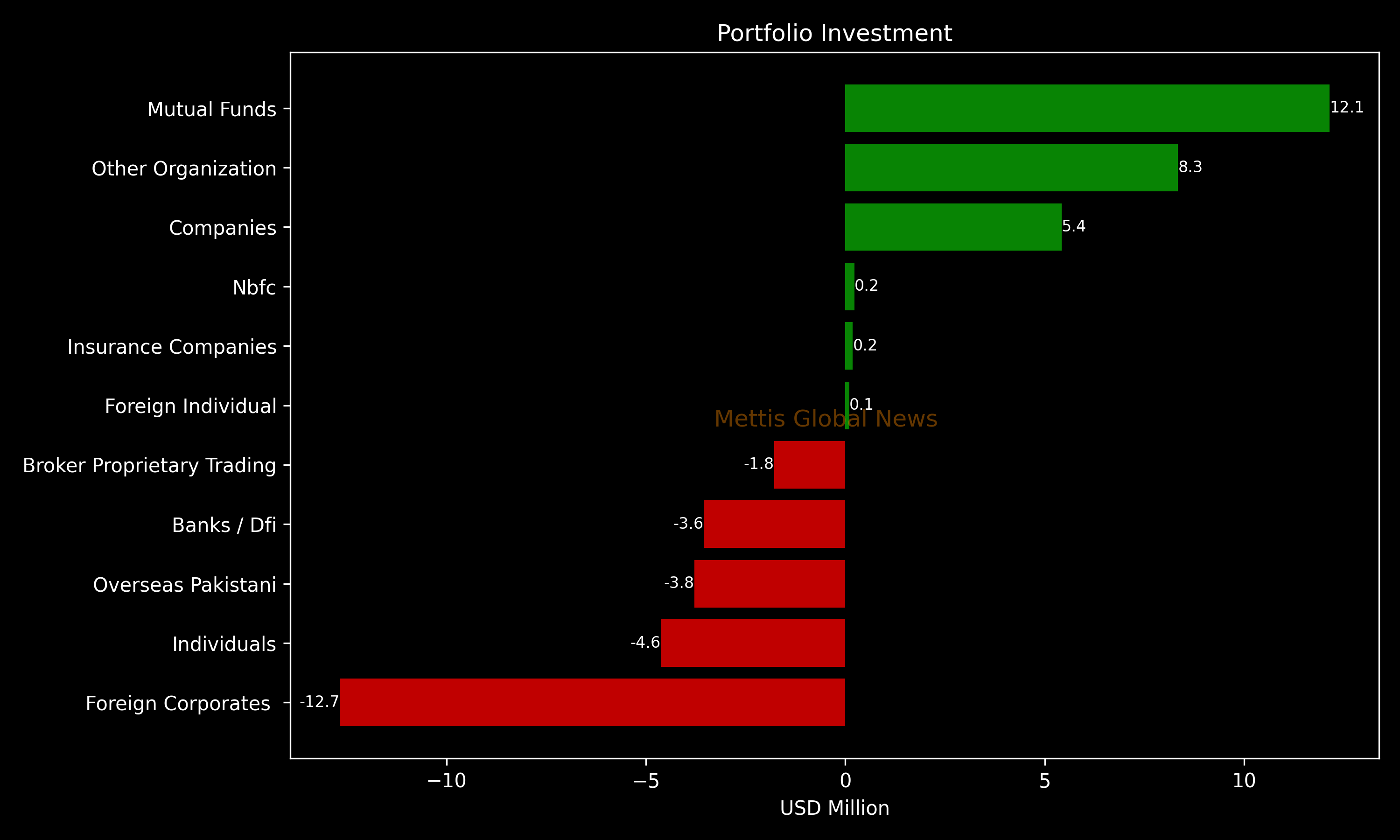

Foreign investors remained net sellers for the eighth consecutive week, dumping $16.4m worth of equities, led by foreign corporates with $12.7m.

Flow-wise, Mutual funds were the dominant buyers, with a net investment of $12.1m.

They allocated the majority of their capital, $5.0m, to Power Generation and Distribution, while divesting from the All other Sectors sector, amounting to $1.1m in sales.

Copyright Mettis Link News

Related News

| Name | Price/Vol | %Chg/NChg |

|---|---|---|

| KSE100 | 148,617.78 624.60M | 0.86% 1274.27 |

| ALLSHR | 91,685.08 1,340.28M | 0.74% 669.39 |

| KSE30 | 45,247.79 197.43M | 0.83% 370.74 |

| KMI30 | 212,370.79 224.51M | 1.05% 2209.48 |

| KMIALLSHR | 61,227.89 711.87M | 1.18% 715.56 |

| BKTi | 41,264.02 160.39M | 0.54% 221.73 |

| OGTi | 30,019.10 23.63M | 0.64% 190.41 |

| Symbol | Bid/Ask | High/Low |

|---|

| Name | Last | High/Low | Chg/%Chg |

|---|---|---|---|

| BITCOIN FUTURES | 108,265.00 | 113,390.00 108,020.00 | -4475.00 -3.97% |

| BRENT CRUDE | 67.46 | 67.94 67.29 | -0.52 -0.76% |

| RICHARDS BAY COAL MONTHLY | 88.70 | 88.70 88.70 | -0.75 -0.84% |

| ROTTERDAM COAL MONTHLY | 96.15 | 96.75 96.00 | -0.40 -0.41% |

| USD RBD PALM OLEIN | 1,106.50 | 1,106.50 1,106.50 | 0.00 0.00% |

| CRUDE OIL - WTI | 64.01 | 64.55 63.88 | -0.59 -0.91% |

| SUGAR #11 WORLD | 16.34 | 16.52 16.33 | -0.14 -0.85% |

Chart of the Day

Latest News

Top 5 things to watch in this week

Pakistan Stock Movers

| Name | Last | Chg/%Chg |

|---|

| Name | Last | Chg/%Chg |

|---|

SPI

SPI