Weekly Market Roundup

Abdur Rahman | October 20, 2024 at 04:07 PM GMT+05:00

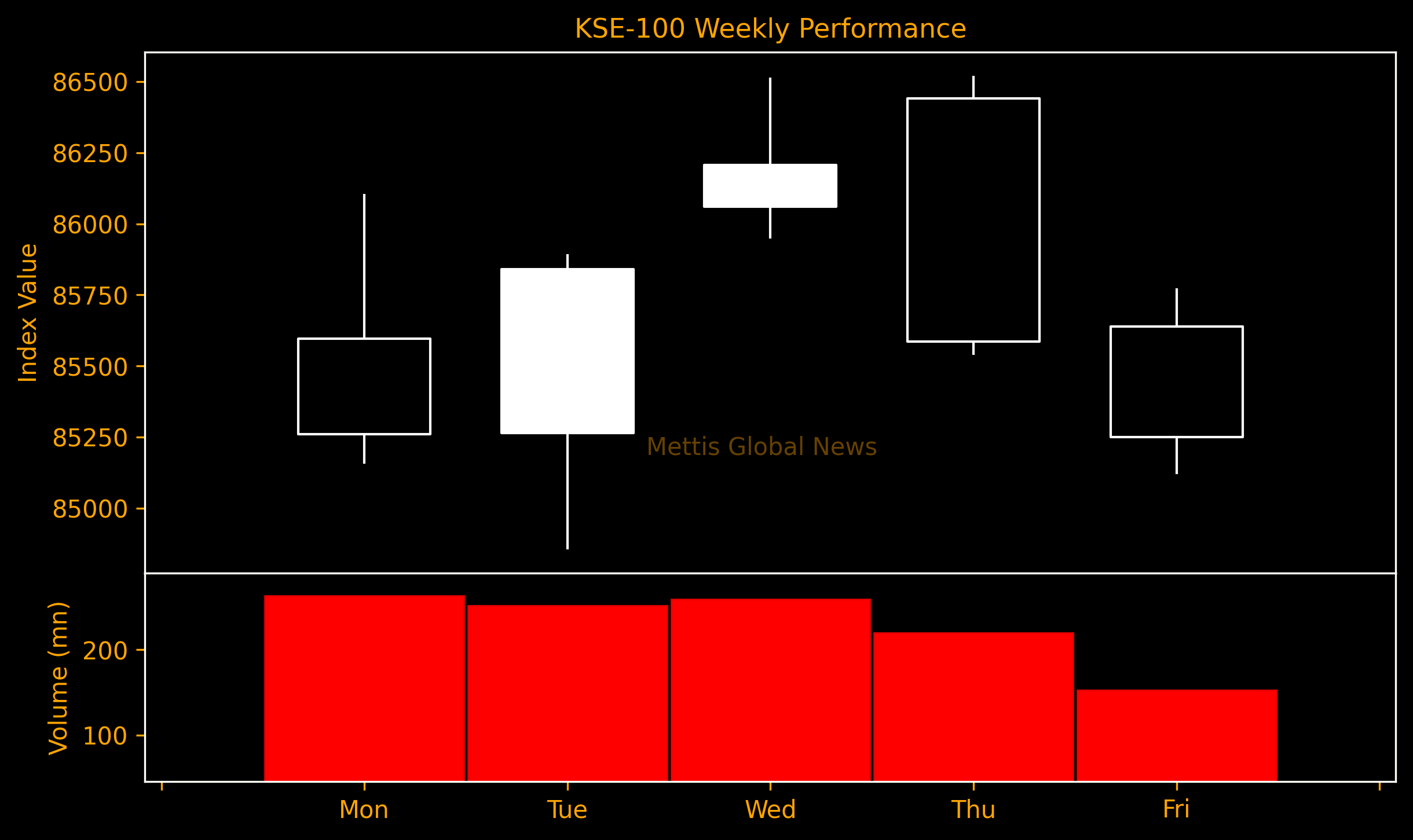

October 20, 2024 (MLN): Pakistan stocks ended the week slightly in red after hitting a fresh record mid-week.

The equity benchmark KSE-100 Index closed at 85,250, a decrease of 233 points or 0.3% from last week in both PKR and USD terms.

The key highlight of the week was the 23rd meeting of the Council of Heads of Government (CHG) of the Shanghai Cooperation Organization (SCO), which concluded with a significant advancement in collaboration among member states.

Catch all SCO-related developments here: SCO Summit 2024

Meanwhile, after the termination of five IPP contracts, the govt is now proposing to halt payments to 18 other IPPs with a total capacity of 4,267MW, brokerage house JS Global noted.

Throughout the week, KSE-100 traded in a range of 1,664 points, between a high of 86,520 (+1,037) and a low of 84,856 (-627) points.

Pakistan stock market's average traded volume dipped 15.5% WoW to 442.26 million shares. The traded value fell 24.5% WoW to Rs22.44 billion.

Market capitalization increased by $77.32m or 0.2% to $40.26bn over the week. In PKR terms, market capitalization stood at Rs11.18 trillion.

In economic news, the large-scale manufacturing (LSM) sector of Pakistan recorded a decline of 2.65% in August 2024 compared to last year. Cumulatively in the two months of fiscal year 2024-25, the LSM showed a contraction of 0.19% year-on-year.

Meanwhile, the State Bank of Pakistan's (SBP) reserves jumped further by $214.7 million or 1.99% WoW above $11 billion mark.

The government conducted four auctions during the week, picking up Rs716bn through T-bills at relatively stable yields, Rs197bn through fixed rate PIBs at lower yields, Rs409bn through floating rate PIBs, and Rs251bn through Ijara Sukuk auction.

Fixed rate Pakistan Investment Bonds (PIBs) auction witnessed a fall in cutoff rates across all tenors, with the decline going as much as 74bps.

Top Index Movers

Sector-wise, the largest drags on the index were Commercial Banks (-293pts), Power Generation & Distribution (-131pts), Fertilizer (-71pts), Cement (-65pts), and Paper, Board & Packaging (-28pts).

Contrary to that, the positive contributions came from Refinery (+93pts), Tobacco (+82pts), Engineering (+65pts), Pharmaceuticals (+49pts), and Automobile Assembler (+34pts).

The worst-performing stocks during the week were POL (-180pts), HUBC (-142pts), MCB (-134pts), UBL (-119pts), and ENGRO (-108pts).

Whereas, the best-performing were MARI (+173pts), ATRL (+101pts), PAKT (+82pts), FFC (+65pts), and INDU (+58pts).

FIPI/LIPI

Foreign investors remained net sellers for the seventh consecutive week, dumping $11.6m worth of equities, led by foreign corporates with $10.4m.

Significant selling was witnessed in All other Sectors worth $7.4m, followed by fertilizer at $1.6m.

On the local front, companies were the dominant buyers, with a net investment of $25.8m. They allocated the majority of their capital, $21.5m, to All other Sectors.

On the other hand, the leading sellers were Banks / Dfi, with a net sale of $16.6m. Their most substantial sales activity was in All other Sectors, amounting to $12.5m.

Copyright Mettis Link News

Related News

| Name | Price/Vol | %Chg/NChg |

|---|---|---|

| KSE100 | 138,597.36 256.32M | -0.05% -68.14 |

| ALLSHR | 85,286.16 608.38M | -0.48% -413.35 |

| KSE30 | 42,340.81 77.13M | -0.03% -12.33 |

| KMI30 | 193,554.51 76.19M | -0.83% -1627.52 |

| KMIALLSHR | 55,946.05 305.11M | -0.79% -443.10 |

| BKTi | 38,197.97 16.53M | -0.59% -225.01 |

| OGTi | 27,457.35 6.73M | -0.94% -260.91 |

| Symbol | Bid/Ask | High/Low |

|---|

| Name | Last | High/Low | Chg/%Chg |

|---|---|---|---|

| BITCOIN FUTURES | 117,670.00 | 121,165.00 117,035.00 | -1620.00 -1.36% |

| BRENT CRUDE | 69.23 | 70.77 69.14 | -0.29 -0.42% |

| RICHARDS BAY COAL MONTHLY | 96.50 | 0.00 0.00 | 2.20 2.33% |

| ROTTERDAM COAL MONTHLY | 104.50 | 104.50 104.50 | -0.30 -0.29% |

| USD RBD PALM OLEIN | 998.50 | 998.50 998.50 | 0.00 0.00% |

| CRUDE OIL - WTI | 66.03 | 67.54 65.93 | -0.20 -0.30% |

| SUGAR #11 WORLD | 16.79 | 17.02 16.71 | 0.05 0.30% |

Chart of the Day

Latest News

Top 5 things to watch in this week

Pakistan Stock Movers

| Name | Last | Chg/%Chg |

|---|

| Name | Last | Chg/%Chg |

|---|

Weekly Forex Reserves

Weekly Forex Reserves