Weekly Market Roundup

Abdur Rahman | October 11, 2024 at 10:26 PM GMT+05:00

October 11, 2024 (MLN): Pakistan stocks extended their blistering rally this week, largely led by gains in banking and E&P stocks.

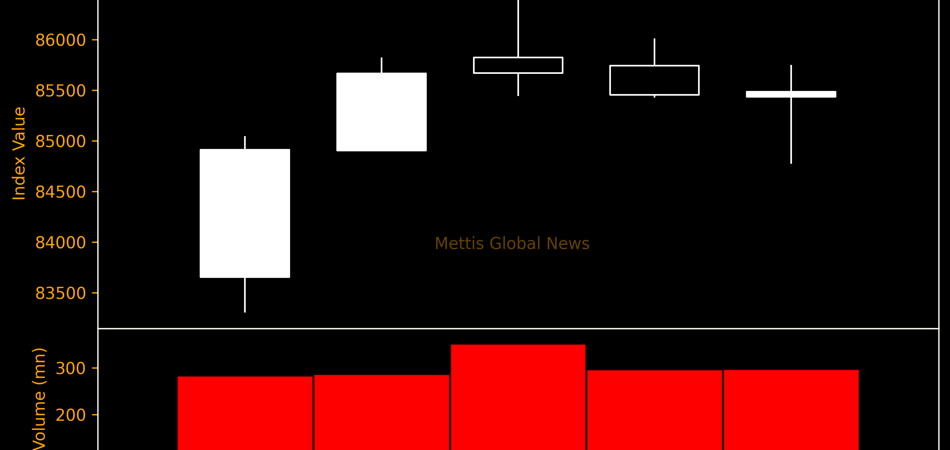

The benchmark KSE-100 Index rose 1,951 points or 2.3% from last week in both PKR and USD terms to close at 85,483.

According to an MG Research report, the October-December quarter has historically been the best period for stock market. Since 1992, KSE-100 has climbed an average 6.6% in the final three months of the year.

Throughout the week, KSE-100 traded in a range of 3,148 points, between a high of 86,451 (+2,919) and a low of 83,304 (-228) points.

Pakistan stock market's average daily traded volume surged 52.2% WoW to 523.32 million shares. Traded value also soared 77.8% WoW to Rs29.72 billion.

The market capitalization increased by $981.5 million or 2.5% to $40.18bn over the week. In PKR terms, market capitalization stood at Rs11.16 trillion.

Top Index Movers

Sector-wise, top positive contributors were Commercial Banks (+1,015pts), Oil & Gas Exploration Companies (+628pts), Oil & Gas Marketing Companies (+288pts), Fertilizer (+286pts), and Pharmaceuticals (+120pts).

Contrary to that, negative contributions came from Power Generation & Distribution (-570pts), Cement (-58pts), Automobile Parts & Accessories (-15pts), Textile Composite (-14pts), and Insurance (-11pts).

Power sector sank this week following the government’s termination of power purchase contracts with some Independent Power Producers (IPPs).

The best-performing stocks during the week were OGDC (+308pts), PPL (+281pts), BAHL (+208pts), PSO (+204pts), and MCB (+175pts).

Whereas, the worst-performing were HUBC (-574pts), LUCK (-245pts), MARI (-83pts), AIRLINK (-34pts), and MEHT (-32pts).

The IPP and index heavyweight Hub Power (PSX: HUBC) said it has decided to initiate a Negotiated Settlement Agreement regarding the accelerated expiry of its 1,292 MW power plant, effective October 01, 2024.

These agreements were originally scheduled to expire in March 2027. According to the terms of the agreement, the Government of Pakistan (GoP) and the Central Power Purchasing Agency-Guarantee (CPPAG) have agreed to settle the company's outstanding receivables up till October 01, 2024.

Read: Early termination of IPP contracts saves Pakistan Rs411bn: Leghari

FIPI/LIPI

Foreign investors remained net sellers for the sixth week in a row, dumping another $22.63m worth of equities. The persistent selling is due to FTSE rebalancing, which demoted Pakistan from Secondary Emerging to Frontier Market in July.

The leading sellers were Foreign Corporates, with a net sale of $20.62m.

Their most substantial sales activity was in Food and Personal Care Products, amounting to $18.2m, while they acquired $7.82m of equities in the Technology and Communication.

This selling pressure was largely absorbed by Mutual funds, as they bought $18.91m shares on a net basis.

Mutual funds allocated the majority of their capital, $9.87m, to Oil and Gas Exploration Companies, while divesting from the Power Generation and Distribution sector, amounting to $2.84m in sales.

Copyright Mettis Link News

Related News

| Name | Price/Vol | %Chg/NChg |

|---|---|---|

| KSE100 | 158,509.44 84.83M | -1.68% -2701.24 |

| ALLSHR | 94,864.87 153.53M | -1.28% -1232.42 |

| KSE30 | 48,607.34 41.22M | -2.36% -1174.41 |

| KMI30 | 225,937.55 49.05M | -2.02% -4659.56 |

| KMIALLSHR | 61,291.66 88.03M | -1.43% -891.61 |

| BKTi | 45,760.54 7.50M | -1.64% -762.67 |

| OGTi | 32,219.99 6.64M | -1.40% -458.23 |

| Symbol | Bid/Ask | High/Low |

|---|

| Name | Last | High/Low | Chg/%Chg |

|---|---|---|---|

| BITCOIN FUTURES | 70,810.00 | 71,645.00 70,500.00 | -720.00 -1.01% |

| BRENT CRUDE | 84.51 | 84.66 83.16 | -0.90 -1.05% |

| RICHARDS BAY COAL MONTHLY | 99.40 | 0.00 0.00 | -9.60 -8.81% |

| ROTTERDAM COAL MONTHLY | 125.00 | 125.00 125.00 | 3.50 2.88% |

| USD RBD PALM OLEIN | 1,083.50 | 1,083.50 1,083.50 | 0.00 0.00% |

| CRUDE OIL - WTI | 80.00 | 80.17 78.24 | -1.01 -1.25% |

| SUGAR #11 WORLD | 13.71 | 13.82 13.61 | -0.02 -0.15% |

Chart of the Day

Latest News

Top 5 things to watch in this week

Pakistan Stock Movers

| Name | Last | Chg/%Chg |

|---|

| Name | Last | Chg/%Chg |

|---|

Savings Mobilized by National Savings Schemes

Savings Mobilized by National Savings Schemes