Weekly Market Roundup

Abdur Rahman | July 26, 2024 at 08:26 PM GMT+05:00

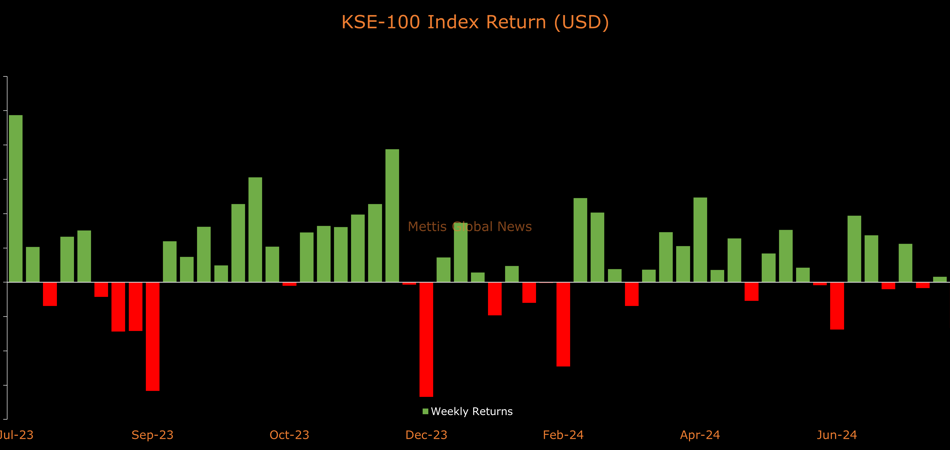

July 26, 2024 (MLN): Bears dominated the Pakistan stock market throughout the week, with the benchmark KSE-100 Index slumping 2,088 points or 2.6% to close at 78,030.

On the currency front, the Pakistani Rupee recorded a decline of 0.08% WoW. In USD terms, the KSE-100 index lost 2.7% this week.

Throughout the week, KSE-100 traded in a range of 2,164 points, between a high of 80,086 (-32) and a low of 77,921 (-2,196) points.

PSX average traded volume was recorded at 336.89 million shares worth Rs15.65 billion, marking a decrease of 27.3% WoW in the number of shares and 41.6% WoW in traded value.

Meanwhile, the PSX market capitalization decreased by $1.01bn or 2.6% to $37.32bn over the week. In PKR terms, market capitalization stood at Rs10.39 trillion.

Investors are closely monitoring the monetary policy meeting scheduled for Monday, where the central bank is expected to ease the policy rate further.

Top Index Movers

Sector-wise, top negative contributors were Commercial Banks with (-504pts), Power Generation & Distribution (-333pts), Oil & Gas Exploration Companies (-243pts), Cement (-161pts), and Fertilizer (-145pts).

Contrary to that, the positive contributions came from Tobacco (+15pts), Automobile Assembler (+7pts), Property (+4pts), Real Estate Investment Trust (+3pts), and Textile Spinning (+1pts).

The worst-performing stocks during the week were HUBC (-219pts), DAWH (-120pts), BAHL (-105pts), OGDC (-101pts), and SYS (-97pts).

Whereas, PAKT, FFBL, BAFL, INDU, and LCI added 15, 11, 8, 7, and 7 points to the index respectively.

FIPI/LIPI

Foreign investors were net buyers during the week, acquiring $4.58m worth of equities.

Flow-wise, Insurance Companies were the dominant buyers, with a net investment of $4.07m.

They allocated the majority of their capital, $2.44m, to Commercial Banks.

On the other hand, the leading sellers were Mutual Funds, with a net sale of $5.55m.

Their most substantial sales activity was in Commercial Banks, amounting to $1.77m.

Copyright Mettis Link News

Related News

| Name | Price/Vol | %Chg/NChg |

|---|---|---|

| KSE100 | 171,404.49 326.40M | -0.32% -556.16 |

| ALLSHR | 103,442.24 795.99M | -0.21% -217.04 |

| KSE30 | 52,413.79 113.03M | -0.27% -143.72 |

| KMI30 | 244,645.84 109.10M | -0.15% -378.05 |

| KMIALLSHR | 67,050.27 450.39M | -0.02% -14.08 |

| BKTi | 47,413.54 37.21M | -0.37% -176.81 |

| OGTi | 33,419.75 8.88M | -0.20% -67.52 |

| Symbol | Bid/Ask | High/Low |

|---|

| Name | Last | High/Low | Chg/%Chg |

|---|---|---|---|

| BITCOIN FUTURES | 87,895.00 | 0.00 0.00 | -165.00 -0.19% |

| BRENT CRUDE | 60.55 | 60.65 59.40 | 0.73 1.22% |

| RICHARDS BAY COAL MONTHLY | 91.00 | 0.00 0.00 | 2.30 2.59% |

| ROTTERDAM COAL MONTHLY | 96.90 | 96.90 96.90 | 0.50 0.52% |

| USD RBD PALM OLEIN | 1,016.00 | 1,016.00 1,016.00 | 0.00 0.00% |

| CRUDE OIL - WTI | 56.54 | 0.00 0.00 | 0.02 0.04% |

| SUGAR #11 WORLD | 14.85 | 14.87 14.45 | 0.37 2.56% |

Chart of the Day

Latest News

Top 5 things to watch in this week

Pakistan Stock Movers

| Name | Last | Chg/%Chg |

|---|

| Name | Last | Chg/%Chg |

|---|

Large Scale Manufacturing (LSM)

Large Scale Manufacturing (LSM)