Big industry output grows 8% YoY in October

MG News | December 19, 2025 at 02:22 PM GMT+05:00

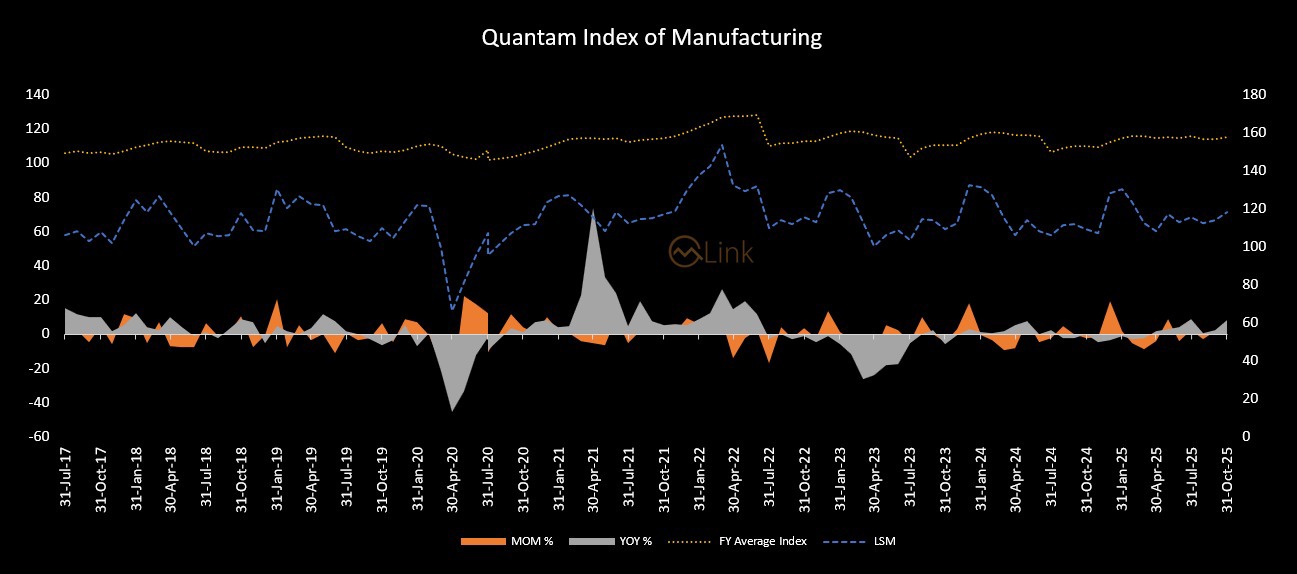

December 19, 2025 (MLN): Pakistan’s large-scale manufacturing sector showed a notable recovery in October 2025, with the Quantum Index of Manufacturing (QIM) rising to 118.43, reflecting improved industrial momentum amid strong performances in automobiles, cement and petroleum products.

According to provisional data with base year 2015-16, Large Scale Manufacturing Industries (LSMI) output grew 8.33% year-on-year (YoY) in October 2025, while posting a 3.75% month-on-month (MoM) increase compared to September 2025.

On a cumulative basis, the sector recorded a 5.02% growth during July–October FY26, with the QIM averaging 115.16, up from 109.65 in the same period last year.

The strongest growth in October came from automobiles, which surged 65% YoY, followed by petroleum products (48.97%), cement (12.73%), and garments (10.99%).

On the cumulative front, automobiles expanded sharply by 78.89%, while cement output rose 14.58% during July–October FY26.

However, some sectors remained under pressure, notably iron & steel, chemicals, pharmaceuticals, and machinery & equipment, weighing on overall growth.

Growth of Major Manufacturing Items

| Manufacturing Sector | Weight (%) | % Change Oct-25 | % Change Jul–Oct FY26 |

|---|---|---|---|

| Cotton Yarn | 8.88 | 1.05 | 2.23 |

| Cotton Cloth | 7.29 | 0.19 | 0.26 |

| Garments | 6.08 | 10.99 | 4.69 |

| Petroleum Products | 6.66 | 48.97 | 12.25 |

| Fertilizers | 3.93 | 3.89 | 0.24 |

| Cement | 4.65 | 12.73 | 14.58 |

| Iron & Steel | 3.45 | (2.40) | (3.25) |

| Automobile | 3.10 | 65.00 | 78.89 |

The 5.02% cumulative growth during July–October FY26 was primarily driven by automobiles (1.82 percentage points), petroleum products (0.89 pp), cement (0.83 pp), garments (0.83 pp) and food (0.66 pp).

In contrast, pharmaceuticals (-0.43 pp), chemicals (-0.16 pp), iron & steel (-0.15 pp) and furniture (-0.26 pp) exerted downward pressure.

Sectoral Trend

Overall, production increased during July–October FY26 in food, beverages, tobacco, textiles, wearing apparel, petroleum products, cement, automobiles and transport equipment, signaling a broad-based but uneven recovery.

Meanwhile, output declined in wood products, chemicals, pharmaceuticals, iron & steel, machinery and furniture, indicating lingering challenges in selected industrial segments.

The October data indicate improving industrial sentiment, with sustained momentum in construction-linked and consumer-driven sectors likely to remain key for LSMI growth going forward.

Copyright Mettis Link News

Related News

| Name | Price/Vol | %Chg/NChg |

|---|---|---|

| KSE100 | 146,480.15 378.01M | -6.99% -11015.95 |

| ALLSHR | 88,401.15 613.63M | -6.18% -5825.86 |

| KSE30 | 44,996.51 162.61M | -6.90% -3333.70 |

| KMI30 | 210,039.41 136.40M | -6.52% -14647.92 |

| KMIALLSHR | 57,315.72 369.31M | -5.79% -3523.37 |

| BKTi | 42,364.50 67.24M | -6.87% -3125.46 |

| OGTi | 31,480.49 21.12M | -1.88% -602.98 |

| Symbol | Bid/Ask | High/Low |

|---|

| Name | Last | High/Low | Chg/%Chg |

|---|---|---|---|

| BITCOIN FUTURES | 68,020.00 | 68,215.00 65,685.00 | -275.00 -0.40% |

| BRENT CRUDE | 106.69 | 119.50 99.00 | 14.00 15.10% |

| RICHARDS BAY COAL MONTHLY | 99.40 | 0.00 0.00 | -11.85 -10.65% |

| ROTTERDAM COAL MONTHLY | 127.00 | 0.00 0.00 | 0.05 0.04% |

| USD RBD PALM OLEIN | 1,083.50 | 1,083.50 1,083.50 | 0.00 0.00% |

| CRUDE OIL - WTI | 103.27 | 119.48 98.00 | 12.37 13.61% |

| SUGAR #11 WORLD | 14.43 | 14.43 14.25 | 0.33 2.34% |

Chart of the Day

Latest News

Top 5 things to watch in this week

Pakistan Stock Movers

| Name | Last | Chg/%Chg |

|---|

| Name | Last | Chg/%Chg |

|---|